An Awe-Inspiring Retail Boom

The retail sector, encompassing traditional brick-and-mortar stores and e-commerce behemoths, is poised for a resurgence. Fueled by anticipated increases in consumer expenditure amid abating inflationary constraints and the potential for impending interest rate cuts, the retail realm is flashing a beacon of promise. To unearth the creme de la creme of retail stocks for your investment portfolio, the much-touted TipRanks Stock Screener has been invoked.

Premium Picks

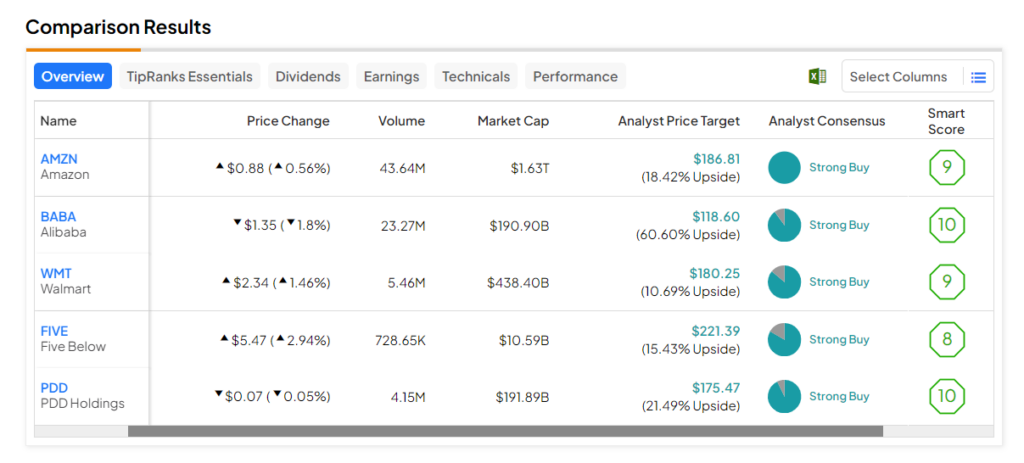

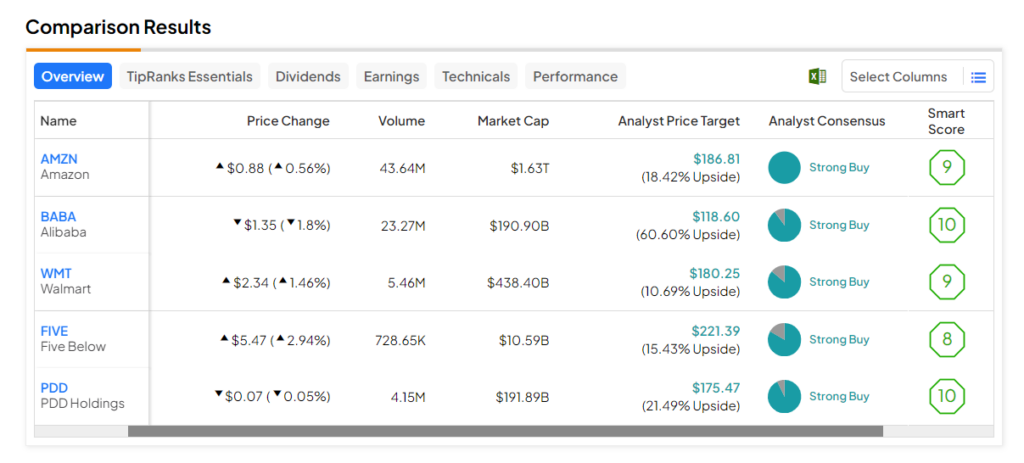

These select stocks have garnered a resounding Strong Buy endorsement from analysts and are fortified with an Outperform Smart Score (8, 9, or 10) on TipRanks, heralding their potential to outshine the broader market. Moreover, the price projections by analysts denote a robust upside potential exceeding 10%.

Leading Lights in Retail Stocks

- Five Below (NASDAQ:FIVE) – Five Below, a specialty discount retailer, proffers an array of top-tier products, predominantly priced below $5, tailored to the teenage and pre-teen demographic. The average price target for FIVE stock suggests an upbeat potential of 15.4%. Moreover, its Smart Score of eight augurs well for future performance.

- PDD Holdings (NASDAQ:PDD) – This Chinese e-commerce platform facilitates a direct link between consumers and manufacturers/agricultural producers. PDD stock’s price prognosis of $175.47 hints at a vast upside potential of 21.5%. Additionally, it boasts a stellar outperforming Smart Score of “Perfect 10.”

- Alibaba (NYSE:BABA) – A Chinese multinational conglomerate specializing in e-commerce, retail, and technology, Alibaba elicits optimism with its stock’s average price target projecting a whopping 57.7% upside potential. Furthermore, it flaunts a Smart Score of “Perfect 10.”

- Walmart (NYSE:WMT) – A global retail juggernaut renowned for its extensive network of hypermarkets, discount department stores, and supermarkets, WMT stock carries an average price target of $180.25, implying a healthy 10.7% upside potential from current levels. It also boasts a Smart Score of nine.

- Amazon (NASDAQ:AMZN) – The multinational technology and e-commerce titan, revered for its online retail platform, cloud computing services, and diverse tech portfolio, foretells an 18.4% analyst consensus upside for AMZN stock. Additionally, it wields a robust Smart Score of nine. At the cusp of its Q4 outcomes slated for February 1, eight analysts have doffed their hats and hailed the stock a Buy.