As the electric vehicle (EV) stocks continue to struggle due to waning consumer interest and subdued demand, the allure of quick profits from the rapid growth in the EV sector has drastically declined. However, amidst the downward spiral, a compelling opportunity has arisen for shrewd investors to delve into the mire and scout for potential diamonds in the rough. At the spotlight is the embattled EV manufacturer, Lucid Group (NASDAQ: LCID), whose stock has plummeted a staggering 95% from its peak. With the ongoing expansion of its manufacturing capabilities, promising growth projections, and an expanding line of vehicles, I stand resolutely bullish on LCID.

An Inside Look at Lucid Group

Lucid Group, straddling the realms of technology and automotive sectors, specializes in the niche of luxury electric vehicles. The company’s flagship product, the Lucid Air, is an elite battery-powered luxury sedan that boasts the longest range and fastest charging capability in the market, with an estimated range of 516 miles on a single charge.

With a retail network for direct consumer sales, online distribution, and a growing number of studios and service centers, Lucid Group has been solidifying its presence in North America, Europe, and the Middle East. Moreover, the company operates a comprehensive vehicle service network inclusive of in-house service centers, mobile service vehicles, and authorized collision repair shops.

Charting the Expansion Trajectory

Lucid Group has embarked on a trajectory of ambitious expansion endeavors, aimed at enhancing its market footprint. The company has already commenced work on the design and engineering of the Lucid Gravity, a luxury sports utility vehicle anticipated to make its debut this year. Simultaneously, Lucid is also pivoting towards scaling its manufacturing prowess to cater to higher-volume vehicle segments.

The manufacturing of the Lucid Air takes place at the company’s groundbreaking electric vehicle manufacturing facility in Casa Grande, Arizona, with plans for full completion by the end of this year. It is projected to have an annual output capacity of 90,000 vehicles, a significant increase from its 2022 capacity of 34,000 vehicles. Not stopping there, Lucid is also in the process of constructing an EV manufacturing facility in Saudi Arabia, with an ambitious target of shipping 155,000 units annually, firmly planting its roots in the Middle East.

Performance Evaluation for Lucid in 2023

Amidst the rumbles of production and delivery, Lucid Motors succeeded in manufacturing 8,428 vehicles and delivering 6,001 vehicles in 2023. Though this marked a shortfall from the initial production target of 12,000 vehicles, the figures underscore a tangible progress for the company. In the third quarter alone, Lucid Group generated $137.8 million in sales, offset by capital expenditures totaling $192.5 million.

Yet, the company grappled with significant net losses, tallying over $2 billion in the last three quarters due to elevated cash burn rates. The resultant belt-tightening measures included an 18% reduction in workforce and the departure of the company’s CFO, Sherry House.

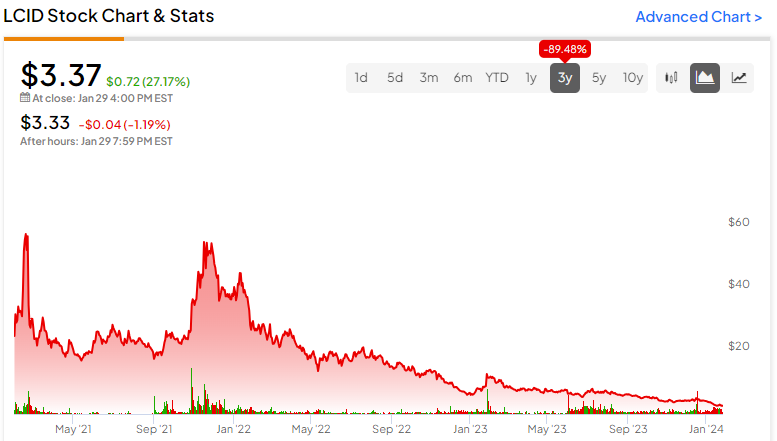

Lucid Group Stock: The Trail of Volatility

The roadmap for any company in the automobile manufacturing domain is thickly dotted with capital-intensive milestones. Lucid Motors is no exception and faces the arduous task of rapidly scaling up its manufacturing capabilities to attain economies of scale and consistent profit margins. Articulating the scale, Tesla reported its initial quarter of positive operating income in Q3 2018, closing the year with 245,200 vehicle deliveries, eclipsing the starkly lower deliveries by Lucid Motors in 2023, which delineates the significant resource allocation required for sustained profitability.

Additionally, Lucid Group contends with stiff competition from both established and burgeoning EV manufacturers, such as NIO, Ford, and General Motors. The company, sitting on $5.5 billion in total liquidity at the end of Q3, is poised to face multiple rounds of capital raising over the next decade, portending potential shareholder dilution on equity issuance and balance sheet strain through debt obligations.

Given this backdrop, a tumultuous journey lies ahead for investors eyeing Lucid stock in the ongoing year and beyond.

The Price Projection for LCID Stock

Presently, out of the nine analysts scrutinizing LCID stock, none advocate a Buy recommendation, with eight suggesting a Hold, and one deeming it a Sell, culminating in a Hold consensus rating. The average LCID stock price target stands at $5.09, signifying a substantial 51% surge from the current price.

The Final Takeaway

Lucid Group represents a captivating, albeit perilous, investment proposition. The company faces an uphill climb to boost production and deliveries, augment profit margins, and navigate through the tumultuous macroeconomic landscape to regain the trust of investors. Despite these setbacks, with its stock trading at a noteworthy discount to consensus estimates, and buoyed by multiple secular tailwinds poised to materialize over the next two decades, Lucid remains a worthy contender for investor scrutiny.