While many investors have their eye on Nvidia as the premier artificial intelligence (AI) investment, it’s time to shake off the blinders and refocus on a more sustainable long-term contender. Drawing your attention away from Nvidia, I present to you a compelling case for Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), parent company of Google, as the more prudent investment option in the AI landscape.

Alphabet’s Recurring Revenue Model

Unlike Nvidia’s hardware-centric approach, Alphabet has embraced a subscription-based model for its AI-related products and services. By leveraging its Nvidia GPUs in a subscription model through Google Cloud, Alphabet provides clients with scalable computing power, ensuring a recurring revenue stream. Furthermore, Alphabet’s generative AI model, Gemini, promises to unlock additional revenue streams, making its business model more robust and sustainable.

Timing and Market Position

While Nvidia has already capitalized on the initial surge in AI demand, Alphabet is poised at the precipice, waiting to harness the full potential of cloud computing and generative AI. This positions Alphabet as a more intriguing prospect for investment, avoiding the pitfalls of inflated expectations that often accompany companies already entrenched in a demand rush.

Valuation and Diversification

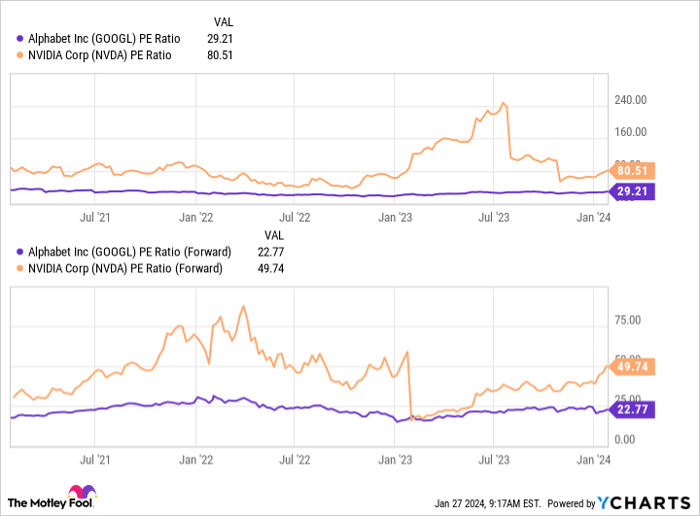

Nvidia’s exorbitant price-to-earnings (P/E) ratio renders it a high-stakes gamble, laden with lofty investor expectations. Meanwhile, Alphabet’s stock remains relatively affordable, trading at levels comparable to the broader S&P 500. In addition, Alphabet’s revenue stream isn’t reliant solely on AI, boasting a diversified income base with advertising services contributing heavily, rendering it more resilient in the face of potential AI downturns.

Resilience Beyond AI

Alphabet’s diversified revenue streams, particularly its reliance on advertising services, provide a safety net should the AI market fail to meet expectations. This balanced revenue portfolio shields Alphabet from over-reliance on AI, in stark contrast to Nvidia, where an AI downturn would have a profound and detrimental impact.

If you fancy a wild roller-coaster ride with Nvidia, it may hold appeal. However, for a steady, market-beating journey, I firmly advocate for Alphabet. After all, investing isn’t about flashy thrills but the sustained, reliable journey to prosperity.

Before you eagerly plunge into Alphabet stock, consider this: The Motley Fool Stock Advisor analyst team has handpicked what they believe are the 10 best stocks for investors to buy now. Interestingly, Alphabet did not make the cut, hinting at perhaps untapped potential. However, the Stock Advisor service has a history of tripling the returns of the S&P 500, offering a compelling opportunity for growth-oriented investors.

*Stock Advisor returns as of January 22, 2024.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool has a disclosure policy.