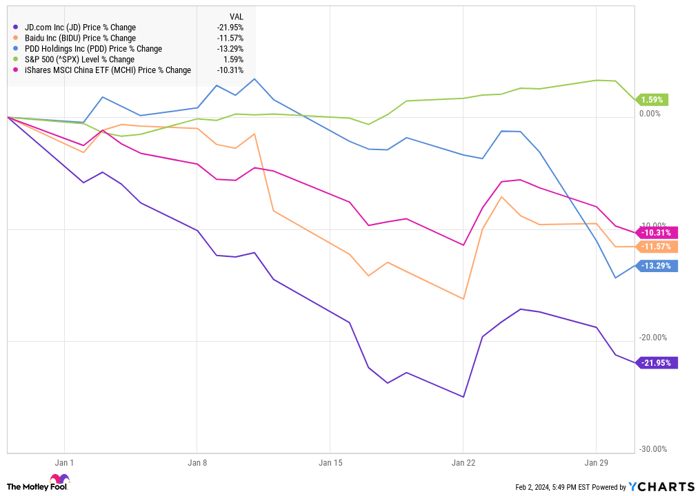

Given the onslaught of negative news that battered China’s stock market in January, it is hardly surprising that JD.com (NASDAQ: JD), PDD Holdings (NASDAQ: PDD), and Baidu (NASDAQ: BIDU) experienced a collective plunge, shedding 22%, 13.3%, and 11.6% respectively by month’s end, as per S&P Global Market Intelligence data. The grim performance of the iShares MSCI China ETF (NASDAQ: MCHI), which tumbled 10.3%, reflected the broader downtrend in Chinese stocks.

A Bleak Start for Chinese Stocks

China’s financial woes at the onset of the year stemmed from discouraging GDP data, with the country reporting a mere 5.2% growth for 2023, marking its slowest expansion in three decades. Economic anxiety amplified with a mere 4.1% fourth-quarter GDP growth and ongoing apprehensions are rife about a parallel slowdown in 2024.

Adding to the misery was Beijing’s unwelcome intervention, dissuading investors from shedding Chinese stocks amidst a capital shift from China to Japan. Mid-month, the complete unraveling of China Evergrande Group, once a titan in real estate development, exacerbated the sector’s frailty.

As if that weren’t enough, JD.com, PDD Holdings, and Baidu faced their own set of tribulations.

Poor company-specific performance saw JD.com emerge as the weakest link over the past three months, despite scarce news impacting it directly. The company grappled with nearly stagnant growth through 2023, yielding market share to PDD Holdings’ Pinduoduo, the latter harnessing rapid advancements via its social commerce model flaunting cut-rate prices for group purchasers.

Founder Richard Liu’s plea for JD.com to enhance competitiveness underscored the urgency in December, echoing a similar narrative from Alibaba maven Jack Ma.

PDD Holdings, initially resilient, succumbed to a late-month downturn tied to analysts’ skepticism around the zenith of its Temu e-commerce app’s global traction. Although Temu’s triumph steered a 94% revenue surge in the third quarter, it’s palpable that sustaining such meteoric expansion, particularly with the company edging toward a $40 billion revenue run rate, poses a formidable challenge.

Meanwhile, a mid-month article implicating Baidu’s Ernie AI platform in military research chiseled away at Baidu’s stock value, triggering apprehensions of U.S. government reprisals, given Washington’s prevailing restrictions on chip exports to China. Despite Baidu’s denial of the report, recovery prospects for the stock appeared bleak.

Image source: Getty Images.

Can China Stocks Stage a Comeback?

The current climate offers scant hope of reprieve for China’s tech sector, underscored by Apple’s recent China sales slump, further affirming the country’s economic fragility. While PDD’s rapid growth shines as a silver lining, the overall outlook for the Chinese economy paints a notably challenging picture.

For prospective investors eyeing Chinese stocks, PDD appears to be the most viable option, given its meteoric rise. Baidu’s AI chatbot also presents promise, albeit with a note of caution as the broader economic malaise in China is poised to persist.

Before diving into PDD Holdings stock, it’s prudent to consider that although it didn’t make The Motley Fool Stock Advisor‘s 10 best stock picks, the service has substantially outperformed the S&P 500 since 2002, promising investors guidance, portfolio building strategies, and two fresh stock picks each month.

*Stock Advisor returns as of January 29, 2024