OpenAI launched its current version of ChatGPT in late 2022 and sparked fervent investor interest in all things artificial intelligence (AI). This surge in fascination saw the emergence of Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) as AI trailblazers, shaping the category and its applications. Microsoft’s close partnership with OpenAI led to the rise of Bing Chat, while Alphabet swiftly unveiled Bard in response to ChatGPT’s release.

Almost a year after the debut of Bing Chat and Bard, both companies reported earnings for the October-to-December quarter. Investors reacted by selling off both stocks, signaling that the AI stock boom may have been overdone. However, despite this, both companies delivered robust financial results.

Image source: Getty Images.

Microsoft’s Robust Growth

Microsoft recently dethroned Apple as the world’s most valuable company, and its earnings validate the ascent. To be fair, the enterprise software company’s acquisition of Activision Blizzard in October contributed slightly to its results from a year ago.

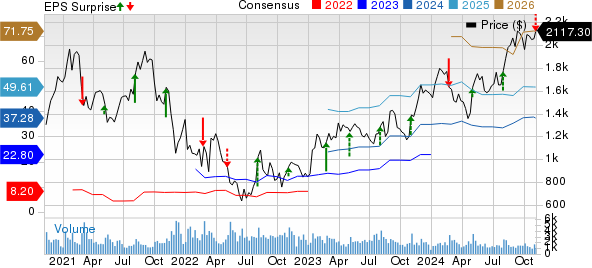

Microsoft’s fiscal 2024 second-quarter revenue surged by 18% year over year to $62 billion, surpassing analyst estimates of $61.14 billion. Operating income soared 33% year over year, or 25% on a non-GAAP basis. Additionally, earnings per share (EPS) grew by 33% year over year, or 26% on a non-GAAP basis, reaching $2.93. These figures exceeded expectations.

Microsoft’s cloud segment remained a bright spot as its intelligent cloud division saw a 20% year-over-year growth, with Azure revenue increasing by 30%. However, search and news advertising revenue growth, at 8% year over year, hinted that Bing Chat may not have gained the traction the company had anticipated.

Microsoft concluded the after-hours session down 0.3%.

Alphabet’s Shortfall in a Pivotal Metric

Alphabet presented a strong fiscal 2023 fourth-quarter report overall, signaling ongoing recovery from the digital ad market slowdown. Revenue rose by 13% year over year to $86.3 billion, surpassing the consensus at $85.3 billion. However, ad revenue of $65.5 billion slightly trailed expectations, leading to a 6% decline in the stock price during after-hours trading.

The lower-than-expected ad revenue growth suggested that Alphabet might be losing ad-market share to competitors or that AI has yet to significantly impact ad spending.

On the bottom line, EPS surged from $1.05 to $1.64, propelled by a $2 billion improvement in equity securities. Operating income surged by 30% to $23.7 billion.

Ad revenue grew by 11% to $65.5 billion, partly due to persistent weakness in Google Network, which again saw a decline in revenue. On the other hand, the Google Cloud segment, closely watched by investors, achieved a 26% growth, reaching $9.2 billion, and reported an operating income of $864 million, a stark improvement from the loss of $186 million a year earlier.

The Showdown

Both Microsoft and Alphabet enjoyed robust stock-price appreciation last year, with both companies reporting similar growth in the recent quarter. The disparity lies in their AI strategies, where Microsoft seems to hold the upper hand.

Microsoft integrated its AI-powered Copilot across a range of products, including the Office 365 suite, Github, Azure, and Bing. Management revealed that AI propelled a 6% growth in Azure’s revenue, escalating it from 24% to 30%, a significant advancement that is likely to continue.

Moreover, compared to Alphabet, Microsoft seemed better equipped for the AI revolution through acquisitions like Github, which complements its AI Copilot tools, and its pivotal investment in OpenAI.

On the other hand, Alphabet acquired the AI research lab DeepMind several years ago but did not integrate it with Google Brain until last year. While possessing the technology to introduce its chatbot, Alphabet allowed OpenAI and ChatGPT to lead the narrative in AI chat.

Why Microsoft Reigns as the Superior AI Stock

Alphabet is no novice in AI, but the company lacks the strategy and applications to fully harness the potential of generative AI, a strength that Microsoft confidently wields.

Microsoft, on the contrary, had orchestrated preparations for this pivotal moment and took calculated risks, including its alliance with OpenAI. It also boasts a significantly more diversified product range compared to Alphabet, which heavily relies on ad revenue, a domain that has not evidently benefited from AI.

Although Microsoft’s stock comes at a steeper price than Alphabet’s, it emerges as the more compelling AI investment. Its long-term prospects in the realm of new technology appear decidedly more promising.

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market. They just revealed what they believe are the ten best stocks for investors to buy right now, and Microsoft made the list — but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of January 29, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Apple, and Microsoft. The Motley Fool has a disclosure policy.