Last year witnessed an explosion in the artificial intelligence (AI) market, and the momentum shows no signs of waning. The release of OpenAI’s ChatGPT revitalized interest in AI, prompting numerous tech companies to reorient their operations around AI. Consequently, Nvidia‘s (NASDAQ: NVDA) stock surged by over 200% year over year, while Advanced Micro Devices (NASDAQ: AMD) saw a 100% climb.

Battle of AI Titans: Nvidia vs. AMD

Battle of AI Titans: Nvidia vs. AMD

The Reign of Nvidia

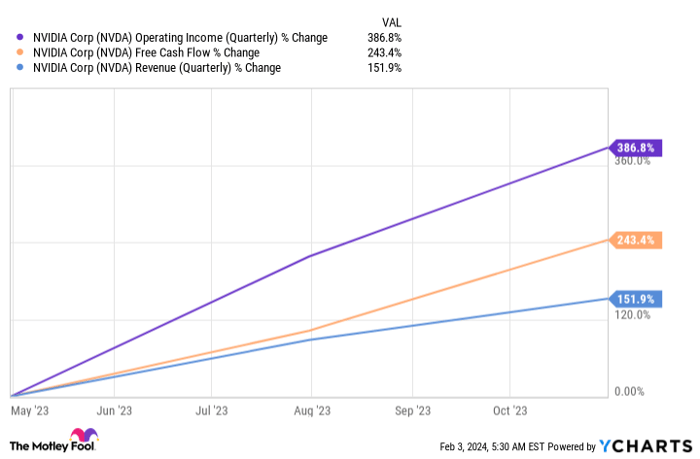

Nvidia became the darling of Wall Street as its graphics processing units (GPUs) emerged as the go-to choice for AI developers worldwide. The heightened demand for AI services led to a rapid depletion of Nvidia’s chips, driving its earnings to unprecedented levels. The chart below illustrates its extraordinary ascent, with revenue, operating income, and free cash flow soaring over the past 12 months.

Data by YCharts

Nvidia’s longstanding dominance in GPUs provided it with a head start in AI, leaving competitors like AMD and Intel scrambling to catch up. The company’s increasing earnings have further solidified its position, equipping it with substantial cash reserves to sustain its technological investments and maintain its market leadership.

Nevertheless, other chipmakers might still pose a challenge. With the AI market projected to grow at a compound annual growth rate (CAGR) of 37% through 2030, nearing a value of nearly $2 trillion by the decade’s end, there seems to be ample space for Nvidia to retain its dominant market share and accommodate new entrants.

Moreover, Nvidia’s dedicated AI investments are yielding significant progress in China, where demand for the technology is soaring. Statista anticipates an 18% CAGR for the Chinese AI market until at least 2030. To meet the growing demand and comply with expanded U.S. export restrictions on high-end chips to China, Nvidia developed the H20, an AI GPU. According to Reuters, Nvidia is set to commence H20 shipments in the first quarter of 2024 and scale up production in the following quarter. Thus, Nvidia remains at the forefront of AI chip development and represents an appealing investment avenue within the burgeoning sector.

The Challenge of AMD

AMD stands as Nvidia’s primary rival, long nipping at its heels with the second-largest share of the GPU market. Despite being less prepared than Nvidia in 2023 to swiftly cater to the influx of AI developers in need of high-computing power, AMD introduced a new AI GPU last December, positioning itself for a lucrative role in the industry.

AMD’s MI300X AI GPU is anticipated to compete fiercely with similar offerings from Nvidia and has already garnered the attention of major AI players. In November 2023, Microsoft announced that Azure would be the first cloud platform to adopt AMD’s new GPU to optimize its AI capabilities. Given Microsoft’s close partnership with OpenAI, this collaboration renders Microsoft a potent ally for AMD.

AMD released its fourth-quarter 2023 earnings on Jan. 30, with the company’s revenue climbing 10% year over year to $6 billion, surpassing analysts’ estimates by $60 million. Robust growth emanated from its AI-focused data center segment, registering a 38% revenue increase. Despite surpassing overall expectations, AMD fell short on guidance. The company anticipates achieving $5.4 billion in sales in Q1 2024, plus or minus $300 million, while Wall Street estimates project $5.7 billion. The transitioning market trends have led to a decrease in demand for central processing units (CPUs) and a concomitant rise in GPU demand, signaling a transitional phase for AMD.

While AMD may not be as advanced in its AI journey as Nvidia, it would be unwise to underestimate its potential. As it commences the shipment of its AI chips and expands into other facets of the market, such as AI-powered PCs, AMD’s growth prospects appear promising.

Nvidia or AMD: The Superior AI Stock?

Nvidia and AMD find themselves at markedly different stages in their AI expansions, with one firmly entrenched in the chip segment of the market, and the other just hitting its stride.

Consequently, the choice between these company stocks may hinge on whether one is swayed by Nvidia’s validated AI success or is inclined to bet on AMD’s long-term potential in the sector.

Data by YCharts

Regardless of the direction one leans towards, comparing the valuations of these companies is sensible. Nvidia’s forward price-to-earnings and price-to-free-cash-flow ratios are notably lower than those of AMD, albeit neither stock being inexpensive. Nvidia’s lower metrics suggest that it provides greater value than AMD, given its more established role in AI and the promising expansion in China. Consequently, Nvidia emerges as the less risky and superior stock to invest in for AI at present.

The Reign of Nvidia

Nvidia became the darling of Wall Street as its graphics processing units (GPUs) emerged as the go-to choice for AI developers worldwide. The heightened demand for AI services led to a rapid depletion of Nvidia’s chips, driving its earnings to unprecedented levels. The chart below illustrates its extraordinary ascent, with revenue, operating income, and free cash flow soaring over the past 12 months.

Data by YCharts

Nvidia’s longstanding dominance in GPUs provided it with a head start in AI, leaving competitors like AMD and Intel scrambling to catch up. The company’s increasing earnings have further solidified its position, equipping it with substantial cash reserves to sustain its technological investments and maintain its market leadership.

Nevertheless, other chipmakers might still pose a challenge. With the AI market projected to grow at a compound annual growth rate (CAGR) of 37% through 2030, nearing a value of nearly $2 trillion by the decade’s end, there seems to be ample space for Nvidia to retain its dominant market share and accommodate new entrants.

Moreover, Nvidia’s dedicated AI investments are yielding significant progress in China, where demand for the technology is soaring. Statista anticipates an 18% CAGR for the Chinese AI market until at least 2030. To meet the growing demand and comply with expanded U.S. export restrictions on high-end chips to China, Nvidia developed the H20, an AI GPU. According to Reuters, Nvidia is set to commence H20 shipments in the first quarter of 2024 and scale up production in the following quarter. Thus, Nvidia remains at the forefront of AI chip development and represents an appealing investment avenue within the burgeoning sector.

The Challenge of AMD

AMD stands as Nvidia’s primary rival, long nipping at its heels with the second-largest share of the GPU market. Despite being less prepared than Nvidia in 2023 to swiftly cater to the influx of AI developers in need of high-computing power, AMD introduced a new AI GPU last December, positioning itself for a lucrative role in the industry.

AMD’s MI300X AI GPU is anticipated to compete fiercely with similar offerings from Nvidia and has already garnered the attention of major AI players. In November 2023, Microsoft announced that Azure would be the first cloud platform to adopt AMD’s new GPU to optimize its AI capabilities. Given Microsoft’s close partnership with OpenAI, this collaboration renders Microsoft a potent ally for AMD.

AMD released its fourth-quarter 2023 earnings on Jan. 30, with the company’s revenue climbing 10% year over year to $6 billion, surpassing analysts’ estimates by $60 million. Robust growth emanated from its AI-focused data center segment, registering a 38% revenue increase. Despite surpassing overall expectations, AMD fell short on guidance. The company anticipates achieving $5.4 billion in sales in Q1 2024, plus or minus $300 million, while Wall Street estimates project $5.7 billion. The transitioning market trends have led to a decrease in demand for central processing units (CPUs) and a concomitant rise in GPU demand, signaling a transitional phase for AMD.

While AMD may not be as advanced in its AI journey as Nvidia, it would be unwise to underestimate its potential. As it commences the shipment of its AI chips and expands into other facets of the market, such as AI-powered PCs, AMD’s growth prospects appear promising.

Nvidia or AMD: The Superior AI Stock?

Nvidia and AMD find themselves at markedly different stages in their AI expansions, with one firmly entrenched in the chip segment of the market, and the other just hitting its stride.

Consequently, the choice between these company stocks may hinge on whether one is swayed by Nvidia’s validated AI success or is inclined to bet on AMD’s long-term potential in the sector.

Data by YCharts

Regardless of the direction one leans towards, comparing the valuations of these companies is sensible. Nvidia’s forward price-to-earnings and price-to-free-cash-flow ratios are notably lower than those of AMD, albeit neither stock being inexpensive. Nvidia’s lower metrics suggest that it provides greater value than AMD, given its more established role in AI and the promising expansion in China. Consequently, Nvidia emerges as the less risky and superior stock to invest in for AI at present.