Investing involves finding the perfect balance between risk and reward, growth and stability. When considering where to invest a set amount, growth stocks often emerge as the potential market-beaters. In this arena, Roku (NASDAQ: ROKU) shines as a fiercely misunderstood growth stock, vying for a spot in your portfolio.

Revolutionizing the Streaming Industry

Roku has secured a promising long-term position within the rapidly expanding media streaming industry, a pillar of modern media consumption.

From its roots as the division of Netflix (NASDAQ: NFLX) that produced the initial set-top boxes for video streaming, Roku has persisted as a market-leading force. According to Pixalate, devices running Roku’s streaming software captured 51% of the global connected TV (CTV) market in the third quarter of 2023.

After a period of sluggish growth, Roku is now back to raking in robust revenues. With fourth-quarter sales soaring 14% year over year to $984 million and $176 million of free cash flow, Roku’s financial standing exhibits sound health.

Moreover, Roku has continually garnered new users, even during the tumultuous times of economic uncertainty. The company added 10 million net new active user accounts in the past year, reaching a total of 80 million. The platform’s streaming hours also surged by 21% during the same period, signaling not only growth but heightened user engagement.

Playing the Long Game

Despite these impressive financial figures, Roku’s stock plummeted by 24% following Thursday’s earnings release, driven by market volatility and investor sentiment. Yet, this plunge offers a potential under-the-radar opportunity for investors.

For long-term investors, Roku’s strategic alignment with industry trends is evident. The soaring digital media consumption trend positions Roku advantageously. CEO Anthony Wood often underscores the eventual shift of all media viewing and advertising to digital platforms, a transformation Roku is poised to capitalize on.

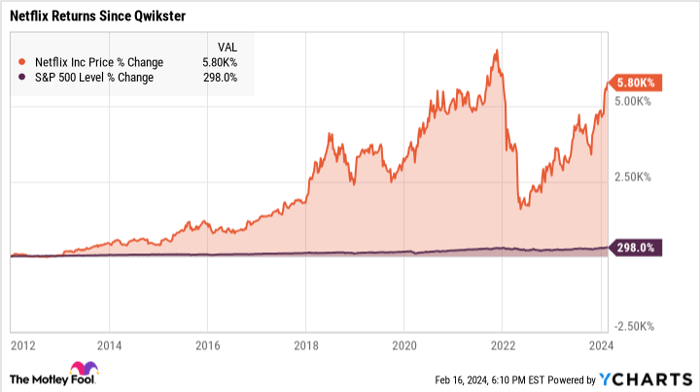

The recent price drop echoes Netflix’s stock plunge in 2011, when the company committed to transforming its streaming service into a substantive business, divesting from its old DVD-mailer model. Roku’s stock slump after a solid earnings report and favorable guidance denotes no significant shift in strategy.

In my view, Roku’s stock bore a 24% haircut without merit. Such instances present a tantalizing opportunity to purchase shares in a robust company at a markdown. If you’re contemplating investing in a growth stock, Roku presents a compelling case.

Embracing Roku for Long-Term Growth

With a sturdy foundation, a clear trajectory for growth, and a market presence reflecting resilience and adaptability, Roku stands out as a growth stock poised to generate substantial returns over time. While the road ahead may present challenges, there remains nothing inherently amiss with Roku’s business.

As for me, I intend to bolster my investment in Roku as soon as I can tear myself away from writing about it.

Before you dive into Roku, consider: The Motley Fool Stock Advisor team recently enumerated what they believe are the 10 best stocks for investors to buy now, and Roku didn’t make the cut. The 10 selected stocks hold the potential for remarkable returns in the years to come.

Stock Advisor furnishes investors with a user-friendly roadmap to success, complete with portfolio construction guidance, regular analyst updates, and two fresh stock picks every month. Since 2002, Stock Advisor has tripled the returns of the S&P 500*.

*Stock Advisor returns as of February 12, 2024

Anders Bylund has positions in Netflix and Roku. The Motley Fool has positions in and recommends Netflix and Roku. The Motley Fool has a disclosure policy.