Tesla (NASDAQ: TSLA) formerly reigned as the alpha dog in the electric vehicle (EV) realm until an unexpected shift in market dynamics. Surging from the fringes of obscurity, China’s BYD dealt a blow outstripping Tesla in sales for the first time by the close of the fourth quarter last year. The EV terrain, once a serene playing field for Tesla, now echoes with the cacophony of rivals, ranging from sprightly start-ups to seasoned automotive giants vying for a piece of the pie.

A multifaceted conundrum unwinds as consumer interest in EVs wanes, clouded by the looming shadows of inflated interest rates nudging prospective buyers toward conventional gas-guzzling alternatives. Tesla, in a drastic maneuver, slashed prices by an average of 25% in 2023, aimed at reigniting demand but inadvertently scarring its profitability.

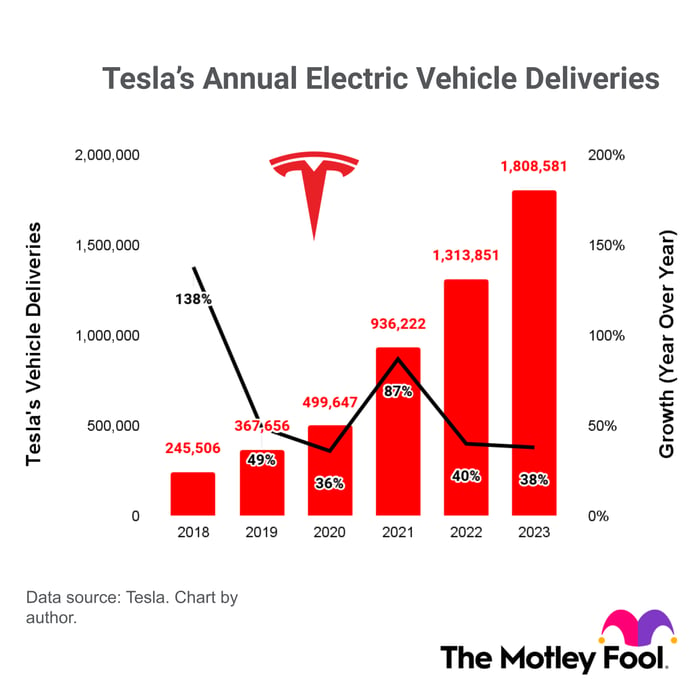

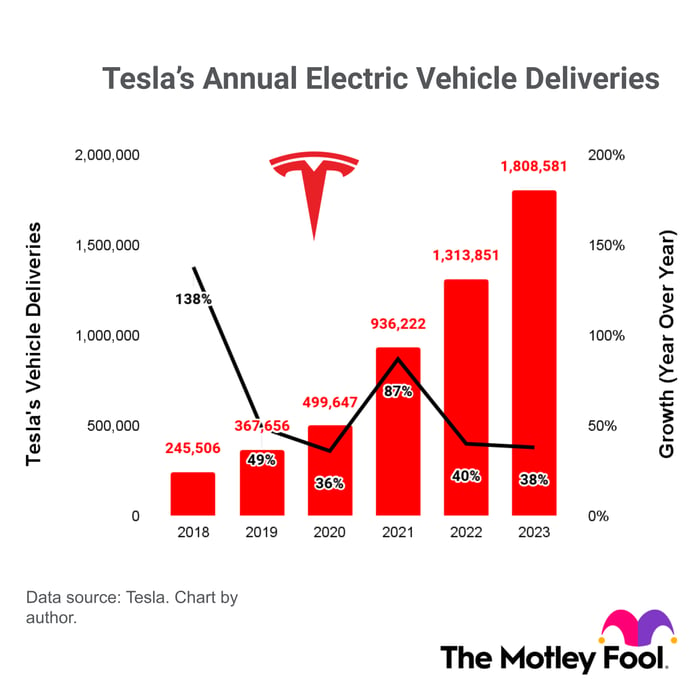

This tumultuous narrative unfurls as Tesla’s stock takes a sharp nosedive of 21% year-to-date, with the bulk of the plummet transpiring post its full-year 2023 performance disclosure. Boasting a haul of 1.8 million vehicles over the year, Tesla’s growth fizzled to a mere 38% uptick from the preceding year, marking its most lackluster rise since 2020. Forecasts for Tesla’s 2024 deliveries remain absent from the equation, yet analyst predictions gesture at 2.2 million vehicles, heralding a further deceleration to a modest 22% growth rate.

Strategies for Resurgence: Tesla’s Gamble on a Cheaper Model

Tesla is poised to embark on the production of a wallet-friendly EV model slated for 2025, potentially tagged with a $25,000 price point. This tactical maneuver aims to lure consumers eyeing a Tesla but deterred by the hefty tags adorning its existing lineup.

However, Tesla’s repertoire transcends mere vehicular manufacturing. Driven by its pioneering self-driving software endeavors, deemed revolutionary enough to reshape its financial tapestry, Tesla has its sights set on the unveiling of a humanoid robot christened Optimus by 2027. Coupled with its burgeoning solar energy and battery storage divisions, Tesla’s artistic canvas is far from monochromatic.

Whilst these ventures may not jettison Tesla stock to stratospheric heights in the imminent horizon, the current 21% slump this year, intertwined with the broader 52% dip from its zenith, could form an opportune entryway for steadfast investors inclined towards a long-haul journey with the stock.

Seeking Investment Avenues:

Embedded within the turbulent flux of the market lies potential treasure troves. Comprehending the insights gleaned by our seasoned analysts, as exemplified by the enduring legacy of the Motley Fool Stock Advisor newsletter, proves a prudent strategy. Unveiling what they deem as the 10 premier stocks for current investor perusal, Tesla emerges among the select few, accompanied by 9 other hidden gems that might elude cursory observation.

*Stock Advisor returns as of February 20, 2024