Alphabet’s AI Innovations

Alphabet, Google’s parent company, is diving deep into the artificial intelligence (AI) realm, gearing up for a nuanced battle. Critics foresee a potential loss in online search and advertising to AI tools like OpenAI’s ChatGPT. But Alphabet is no idle spectator.

Renaming its Bard tool to Google Gemini, Alphabet has ushered in a savvy subscription-based Advanced version with analytical and mock-creative capabilities akin to ChatGPT. Venturing beyond, Alphabet integrates the Gemini AI model into widely used online platforms such as Gmail and Google Docs, unlike ChatGPT limited to Microsoft’s dominion over Office 365 and Bing.

With vast reservoirs of valuable user data, Alphabet clinches an unparalleled competitive advantage in the AI landscape, poised to turn challenges into golden opportunities. In sync with economic health resurgence, Alphabet stands ready to bounce back in the digital advertising realm, set to soar with restrained marketing budgets finally unleashed.

Amazon’s Dual Thrust

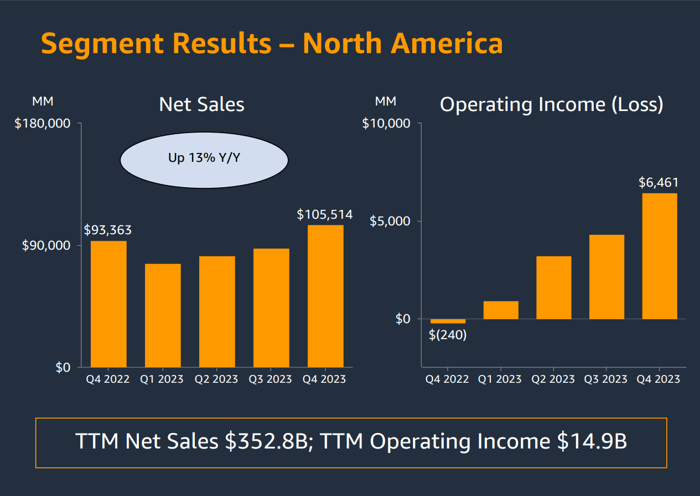

Amazon, the e-commerce and cloud computing powerhouse, rides the awakening economic wave, leveraging a distinct angle from Alphabet. Basking in the recovery of its e-commerce domain, Amazon boasts robust sales upticks and profit surges, unfurling magnanimous cash flows in the wake of a dark inflation era.

And the showstopper? Amazon Web Services (AWS), this cash cow delivers a double-digit revenue growth bolstered by a 38% leap in operating profits, all thanks to AI services. A multi-tiered approach embracing the generative AI frenzy, AWS paves the path to hefty profits. Coupled with the e-commerce resurgence, Amazon’s stock stands poised to sway markets buoyed by a 3.8% market index share.

Netflix’s Growth Trajectory

Netflix, though a smaller entity with a modest 0.5% S&P 500 index impact, occupies a significant position, bedding in for a climb up the ranks. A long-term growth asset navigating through a critical strategy shift, Netflix witnessed co-founder Reed Hastings passing on the reins to trusted conduits Ted Sarandos and Greg Peters.

Marching towards sustainable revenue streams, Netflix pivots from the subscriber acquisition frenzy, eyeing profitability on the horizon. Despite its smaller index weightage, Netflix’s playbook in this epic bull rally promises an intriguing plotline to keep an eye on.

The Resurgence of Netflix: A Bullish Forecast for Investors

Revamped Strategies Fuel Growth

The streaming giant, Netflix, is on a path to greater wealth with a shift towards bolstering free cash flows. Recent changes in their business plan introduce innovative ideas, including a lower-priced subscription tier supported by ads, and a crackdown on password-sharing. Moreover, Netflix is venturing into the realm of video games, offering free titles to subscribers, heralding a fresh revenue stream soon.

Investor Confidence on the Rise

Initially met with skepticism, the updated business approach caused Netflix’s stock to plummet in 2022. However, continuous positive updates on the impact of ad-based subscriptions and password-sharing policies are assuaging investor concerns. The company’s stock has surged by 65% over the past year, reflecting a significant uptrend despite being undervalued. Netflix’s enhanced profitability and long-term ambitions position it as a lucrative investment.

Future Profitability Prospects

As Netflix sets its sights on a more profitable future, investors remain cautious. Akin to the skepticism faced during the shift to media streaming in 2011-2012, convincing shareholders of the merit behind the new profit-driven strategy is paramount for Netflix in 2024 and 2025. The company’s success in rebuilding investor trust is crucial not only for its own growth but also as a key player in contributing to the S&P 500’s bullish trajectory.