Crypto exchange Kraken has stirred the pot by submitting a motion to dismiss the legal entanglement with the U.S. Securities and Exchange Commission.

The Core Storyline

In the motion, Kraken refutes assertions of actual fraud or injuries to its clientele made by the U.S. Securities and Exchange Commission.

Significance in Context

Kraken’s plight is part of a larger narrative involving other legal skirmishes in the industry, such as those involving Coinbase and Binance.US. This legal saga pivots on one central query: How should the SEC regulate the complex ecosystem of cryptocurrencies and are its current actions equitable?

Deconstructing the Situation

The crux of Kraken’s motion mirrors well-trodden grounds: disputing the SEC’s classification of the named assets as securities, questioning the extension of the “investment contract” definition, and challenging the regulator’s jurisdictional boundaries.

While some aspects of Kraken’s defense step into novel territory, like touching upon the SEC’s contention that the exchange actively promoted the digital assets without delving deeply into the matter, the overarching arguments parallel those seen in Coinbase and Binance.US’s dismissal bids.

With the lack of definitive judgments thus far, the eventuality of the involvement of the Supreme Court of the United States looms large, underscoring the gravity of the ongoing legal wrangle.

The venue for the Coinbase case rests in the Southern District of New York, Binance.US’s case is unfolding in the District of Washington, and Kraken navigates through the Northern District of California. Another contender named Legit.Exchange has also thrown its hat into the ring by taking the SEC to task in the Northern District of Texas, further muddying the legal waters.

The odds of consensus among four disparate district judges seem slim, hinting at a prolonged judicial odyssey. Assuming inevitable appeals from the concerned parties, the intervention of multiple appeals courts is nigh.

While it’s too premature to predict the lawsuits’ denouement, the protracted nature of legal battles and the formidable resources backing the litigants hint at a scenario where at least one of these cases will journey through the appeal process until all avenues are exhausted.

For the erudite legal minds following this newsletter: What unfolding panorama might we visualize? What timeline might these legal battles adhere to before potentially reaching the halls of the Supreme Court, should it reach that climactic juncture?

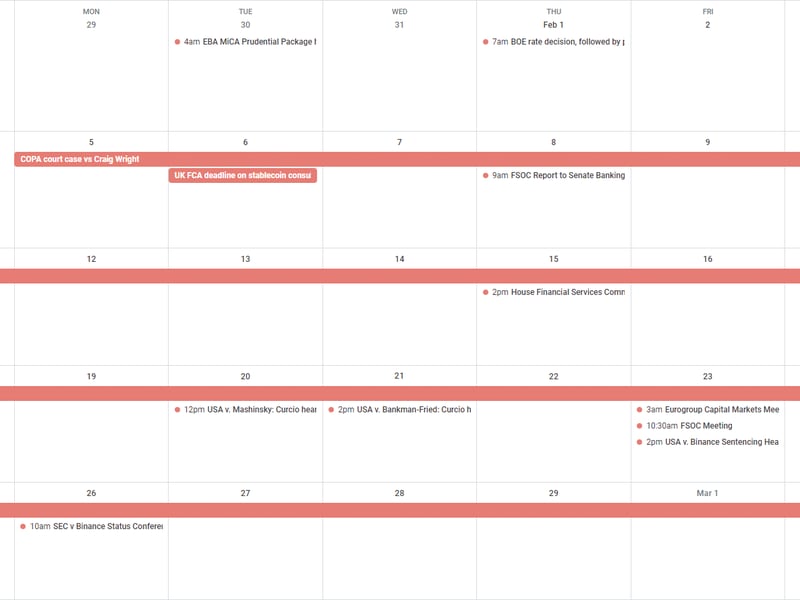

Tuesday

- 17:00 UTC (12:00 p.m. ET): The judge presiding over the U.S. case involving Alex Mashinsky convened a hearing to validate his attorneys’ dual representation of Sam Bankman-Fried.

Wednesday

- 19:00 UTC (2:00 p.m. ET): The judge overseeing the U.S. case against Sam Bankman-Fried conducted a parallel session to confirm the same. Bankman-Fried affirmed that his trial advocates would no longer act on his behalf.

Friday

- 14:30 UTC (10:30 a.m ET): The Financial Stability Oversight Council convened a closed assembly.

- 19:00 UTC (11:00 a.m. PT): The judge presiding over the U.S. case involving Binance approved the suggested plea deal (it’s pertinent to mention that the same judge heads the U.S. case against former Binance CEO Changpeng Zhao, with the sentencing hearing postponed to April).

- (Ars Technica) A Canadian court has decreed that Air Canada must respect a refund policy fabricated by its “AI” chatbot, leading to the withdrawal of the said chatbot by Air Canada.

- (Reddit) Noteworthy is the surge in in-flight Wi-Fi usage, allowing passengers to share images of anomalies like holes in their aircraft wings, exemplified by a recent incident on United flight 354, where the 29-year-old Boeing 757 landed safely in Denver despite the glitch.

- (Bloomberg) A recent lawsuit alleges that Alameda Research received a credit line “worth billions of dollars” from Deltec Bank, utilized to bolster the expansion of tether (USDT).

If you have any suggestions for topics to explore in the next edition or wish to share feedback, feel free to email me at nik@coindesk.com or connect with me on Twitter @nikhileshde.

For more collaborative discussions, join the conversation on Telegram.

Until next time, take care!