Unveiling the Meteoric Ascent of Nvidia Stock

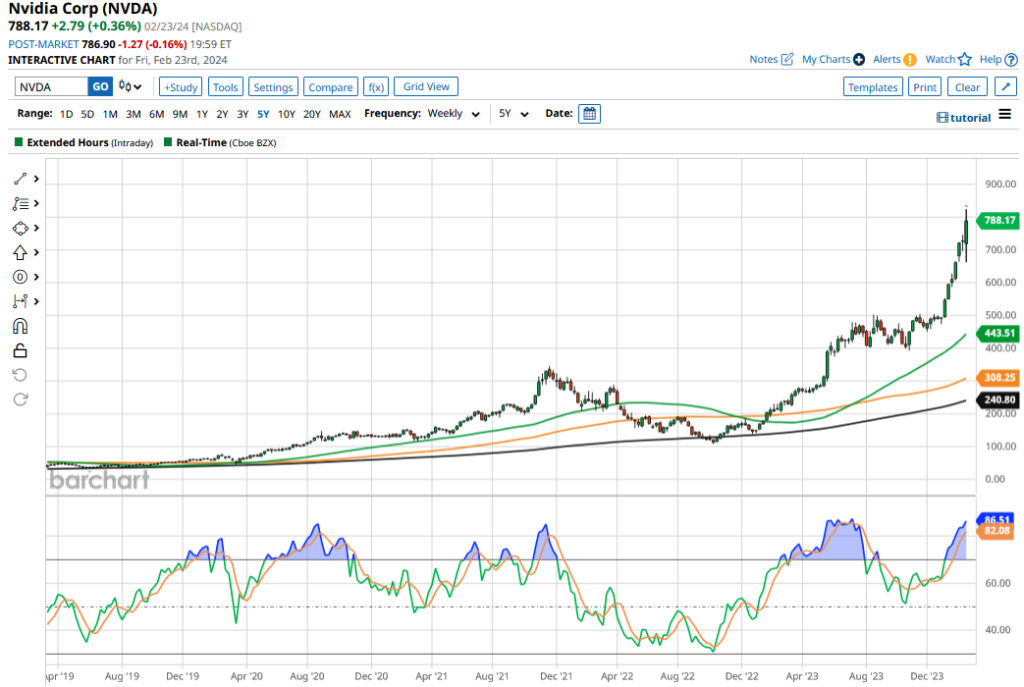

Following a stellar earnings report, Nvidia (NVDA) scaled the summit of $2 trillion market cap last week, albeit momentarily. The trajectory of Nvidia stock propelled it past $800, marking it as the crème de la crème of the “Magnificent 7” stocks.

Penetrating the Pinnacle of Market Capitalization

Nvidia’s meteoric rise in the stock market can be attributed to the AI-driven surge over the past year. With a 61% surge this year and a breathtaking 240% jump in 2023, Nvidia’s shares have ascended to unparalleled heights. The remarkable rally has positioned Nvidia above its 2021 trading levels, pre-split.

The Financial Fortitude Behind Nvidia’s Soaring Shares

Nvidia’s ascendancy stems from its dominance as the leading supplier of AI chips. While some may find the surge in Nvidia stock perplexing, its robust financial performance underpins its share price rally. The company’s forward-looking revenue forecasts of $24 billion in fiscal Q1 2025, with analysts projecting revenues exceeding $100 billion in the current fiscal year and $130 billion in the next, reflect its exponential growth trajectory.

The Inexorable Ascent of Nvidia Stock

Despite expectations for Nvidia stock to retract, the stock has defied gravity, scaling new peaks almost daily. Surprisingly, Nvidia’s valuation, though significantly elevated from its 2022 troughs, remains relatively modest based on certain metrics. With a forward price-to-earnings multiple of 32.1x, Nvidia stands out among its peers, garnering a “Strong Buy” consensus from Wall Street analysts.

Prospecting Nvidia’s Ascendancy to Market Apex

Nvidia’s stratospheric target price of $1,400, posited by Rosenblatt Securities, forecasts a market capitalization of $3.5 trillion, surpassing reigning titan Microsoft. Amidst incredulity just years ago about Nvidia’s potential to clinch the top spot in the market hierarchy, that reality now looms palpable on the horizon.

Tracing the Evolution of Market Dominance

Historically, market leaders have metamorphosed with evolving financial landscapes and shifting market sentiments. From Microsoft’s reign in the early 2000s to Apple dethroning ExxonMobil in 2011, market supremacy continually shuffles hands. Notably, Apple’s recent relinquishment of its $3 trillion market cap to Microsoft underscores the fluid nature of market leadership.

Evaluating Market Sentiments

While fervent optimism enshrouds Nvidia post-earnings, a segment of the market, including valuation doyen Ashwath Damodaran, contends that Nvidia’s valuation has overreached. Notably, Damodaran identifies Nvidia as a standout amidst the “Magnificent 7” in terms of overvaluation. Despite diverging viewpoints, Nvidia’s growth narrative posits it as a compelling long-term investment proposition.