The Powerhouses of AI

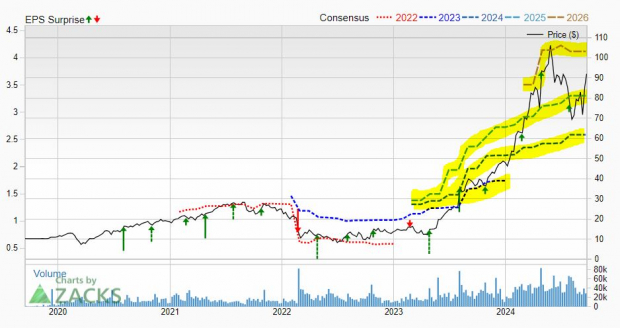

As the shadows of 2024 fall on the roaring success of the artificial intelligence (AI) market, the dominance of AI stocks prevails. Nvidia (NVDA) shines like a newly polished gem, with a dazzling 17% surge since February 21 alone. The juggernaut that is Nvidia continues to impress with robust quarterly reports, cementing its reputation as the market darling.

The AI Titans

While Nvidia remains in the spotlight, other tech giants like Microsoft (MSFT) and Alphabet (GOOGL) have been quietly fortifying their foundations. Microsoft’s stock has astoundingly surged by 963% over the last decade, while Alphabet flaunts a 352% increase, setting a firm foundation for their AI endeavors.

Embracing AI into their core has been a game-changer, unlocking a myriad of growth prospects for both Microsoft and Alphabet in the days to come. These two tech behemoths stand out as prime contenders for investment in the AI arena.

Microsoft’s AI Ascendancy

Microsoft’s meteoric rise in the AI realm traces back to its strategic investment in OpenAI back in 2019, positioning itself as an early AI enthusiast. Integrating AI across its flagship products, Microsoft’s cloud computing platform, Azure, has been gearing up to rival the likes of Amazon’s AWS. Azure’s current 24% market share inches closer to AWS’s 31%, signifying an impending clash of titans.

The recent prowess displayed by Microsoft in the cloud segment mirrors its unyielding commitment to AI. Azure AI witnessed a remarkable 30% year-over-year growth, contributing significantly to Microsoft’s hefty revenue of $62 billion. The Intelligent Cloud segment basked in the glory, commanding 42% of the total revenue.

Forecasts paint a rosy picture for Microsoft’s future, with anticipated growth in various segments such as Productivity and Business Processes, Intelligent Cloud, and the resilient Personal Computing segment. In the wake of Microsoft’s acquisition of Activision Blizzard, the door to the gaming realm swings wide open, fueled by an $81 billion cash reservoir ready to fuel further AI expansion.

Analysts foresee a profitable journey ahead for Microsoft, projecting robust earnings growth in fiscal 2024 and beyond. With earnings growth expected to soar, Microsoft appears poised for a prosperous AI-powered future.

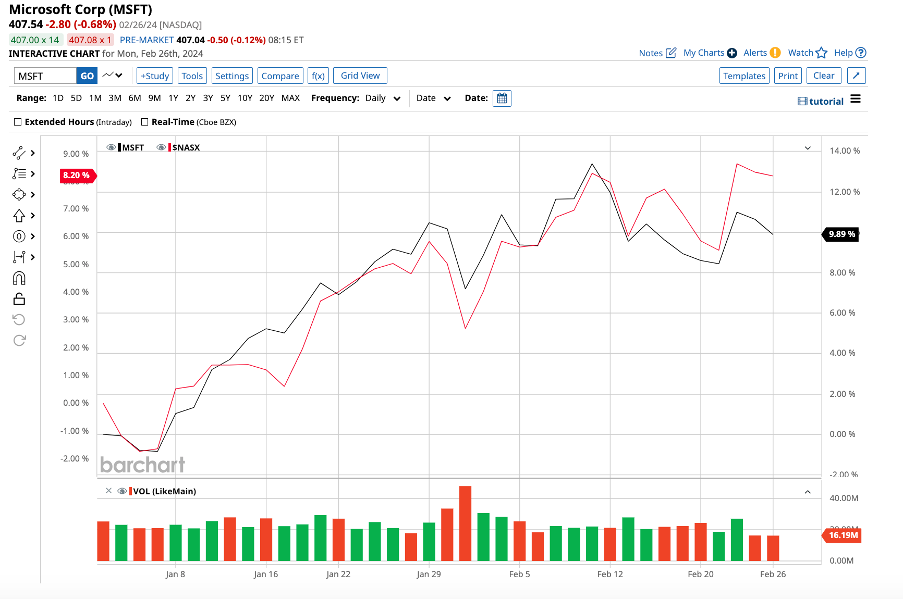

Wall Street’s Verdict on MSFT Stock

On the bustling streets of Wall Street, Microsoft stands tall as a “strong buy.” A gathering of 36 esteemed analysts deems Microsoft as a stock worthy of attention, with 32 labeling it a “strong buy,” while the rest express favorable sentiments with “moderate buy” and “hold” ratings.

The future holds promise for MSFT stock, with an average target price of $438.97, reflecting a potential upside of 7.8%. The loftiest estimate of $600 paints a picture of a staggering 47% growth in the span of just one year.

The Wild Ride of Alphabet (GOOGL) Stock Amidst Gemini AI Controversy

The Gemini AI Saga Unfolds

Alphabet stock experienced a sharp decline attributed to recent mishaps related to Gemini AI technology, resulting in it being marginally down year-to-date while the Nasdaq thrives at over 8% upswing. Despite the plummet on February 26, Wedbush analyst Daniel Ives believes that the market’s reaction may have been exaggerated.

Gemini AI Relaunch on the Horizon

According to Reuters, Alphabet is making plans to relaunch its Gemini AI tool in the near future. The temporary setback caused by the AI-related challenges at Gemini is seen as fixable, allowing Alphabet the opportunity to leverage its diverse portfolio and market position in the AI landscape.

Alphabet’s Steadfast AI Game Plan

Having integrated AI into its products since 2017, Alphabet has steadily upped the ante post-Microsoft’s substantial OpenAI investment. While Microsoft appears to dominate in cloud computing, Google Search retains a dominant 91.5% market share in the search engine realm.

Financial Fortitude and Growth Numbers

Alphabet’s revenue from Google Search surged by 12.6% in the fourth quarter of 2023, hitting $42.0 billion. Google Cloud, ranked third in the market, saw a revenue spike of 26% to $33 billion for the full year, driven by AI-powered services and search functionalities.

With a robust cash balance of $110.9 billion and long-term debt at $13.2 billion, Alphabet looks well-poised to surge ahead in the AI universe. Generating $69.5 billion in free cash flow for the quarter, the company is geared for continued success.

Wall Street’s Fervor for GOOGL Stock

Wall Street maintains a bullish stance on GOOGL stock, with a “strong buy” consensus among the 44 analysts covering the stock. The average price target of $160.97 reflects a potential 16% upside over the next year, with a high estimate of $180 suggesting a hefty 29.5% increase.

The Final Verdict on AI Giants

As the competition between Microsoft and Alphabet intensifies in the AI domain, these tech juggernauts continue to lead the industry. Despite Microsoft trading at 34 times forward earnings compared to Alphabet’s 20, both companies present alluring high-risk, high-reward investment opportunities in the AI sphere.

The amalgamation of legacy portfolios with AI prowess, seasoned leadership, and industry expertise has fueled their meteoric growth trajectory, setting the stage for even greater heights ahead. Undoubtedly, Microsoft and Alphabet stand out as prime AI stocks for long-term investment, potentially surpassing their high targets and soaring to new heights in the coming years.