Note: Best Buy’s fiscal year of 2024 ended in January 2024

A Downturn in Revenue

Best Buy (NYSE: BBY), a retailer of consumer electronics, is set to unveil its fiscal fourth-quarter results on February 29. Analysts anticipate a decrease in the company’s stock value following the Q4 earnings report, with revenues and earnings likely falling slightly short of estimates. Factors such as inflation and supply chain disruptions in the electronics retailing sector during the fiscal year of 2024 contributed to this outlook. Furthermore, comparisons with the pandemic-induced growth of previous years and inflationary challenges have added to the slowdown. Best Buy foresees a temporary dip in the market before sales rebound and break records in fiscal 2025.

Projected Decline in Sales

In the fourth quarter, Best Buy expects a 3.0% to 7.0% drop in comparable sales. The company also foresees a non-GAAP operating income rate of 4.7% to 5.0% for Q4 FY 2024. Additionally, Best Buy expects revenues between $43.1 billion to $43.7 billion for the full year FY 2024, with an EPS range of $6.00 to $6.30. Comparable sales for the full year are predicted to decline by 6.0% to 7.5% for fiscal year 2024.

Stock Performance

Best Buy’s stock has experienced a 20% decline from $100 in early January 2021 to around $80 currently, compared to a 35% increase for the S&P 500 during the same period. Notably, Best Buy’s stock has consistently underperformed the market over the past three years, with returns of 2% in 2021, -21% in 2022, and -2% in 2023. In contrast, the S&P 500 saw returns of 27% in 2021, -19% in 2022, and 24% in 2023. This trend highlights the challenges faced by individual stocks in outperforming the market, especially in the consumer discretionary sector. The Trefis High Quality (HQ) Portfolio, which comprises 30 stocks, has consistently outperformed the S&P 500 each year over the same period, indicating the challenges faced by companies like Best Buy in a volatile market environment.

Challenges Ahead

Looking forward, Best Buy’s valuation is projected to be $73 per share, which is 8% lower than the current market price. With uncertainties such as high oil prices and elevated interest rates in the macroeconomic landscape, there is a looming question of whether Best Buy will continue to underperform the S&P 500 over the next year or if a recovery is on the horizon.

Outlook on Revenues and Earnings

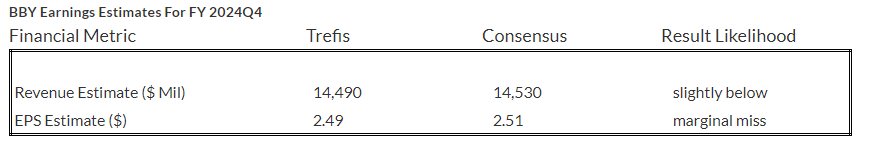

According to Trefis estimates, Best Buy’s Q4 2024 revenues are expected to be around $14.5 billion, slightly below consensus estimates. The company posted $9.76 billion in revenue in Q3, marking an 8% year-on-year decline. The decline in domestic comparable sales points to challenges in key product categories such as computing, appliances, home theater, and mobile phones. International comparable sales also dropped during the quarter. Additionally, Best Buy’s EPS for Q4 2024 is estimated to be $2.49, slightly below consensus estimates. The company’s adjusted operating margin declined in comparison to the previous year, reflecting the challenges in the retail sector.

Valuation and Comparison

Based on EPS estimates and a P/E multiple for fiscal year 2024, Best Buy’s valuation suggests a price of around $73 per share, indicating an 8% decrease from the current market price. Comparisons with peers in the industry reveal insights into Best Buy’s standing and performance metrics relative to similar companies.

| Returns | Feb 2024 MTD [1] | Since start of 2023 [1] | 2017-24 Total [2] |

| BBY Return | 9% | -1% | 85% |

| S&P 500 Return | 5% | 32% | 127% |

| Trefis Reinforced Value Portfolio | 4% | 43% | 633% |

[1] Returns as of 2/28/2024

[2] Cumulative total returns since the end of 2016

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates