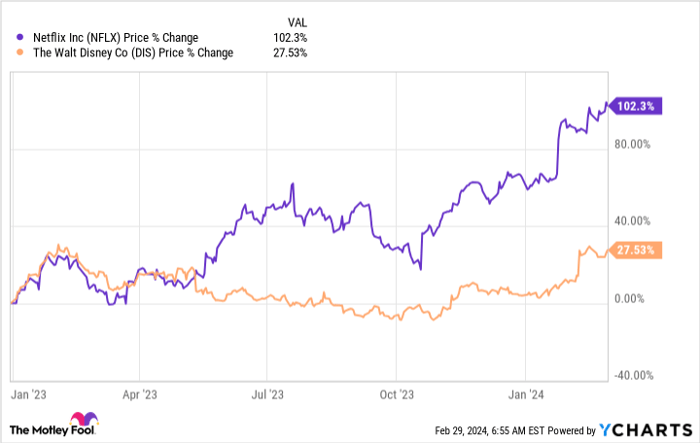

For years, I held a wary eye towards Netflix (NASDAQ: NFLX), questioning its investment potential. However, as 2023 approached, a shift occurred in my mindset. The realization struck me that it was time to part ways with my long-standing underperformer, Walt Disney (NYSE: DIS), and venture into the world of streaming. Little did I know, this delay would cost me as Netflix surged ahead, leaving Disney in the dust.

Amidst the turbulence in the traditional media industry, Netflix emerged as a beacon of stability. The factors that finally nudged me towards embracing Netflix as an investment opportunity, even after its stock price had doubled in the past year, were compelling.

Data by YCharts.

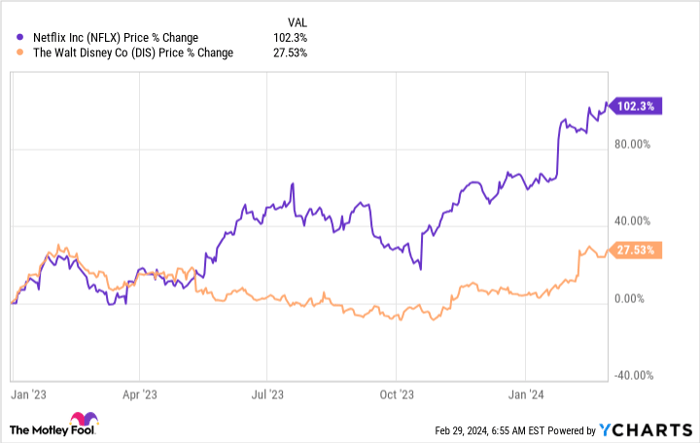

The Profitable Metamorphosis of Netflix

My earlier reluctance to invest in Netflix stemmed from its historical lack of profitability. Although the company reported GAAP net income, its free cash flow figures painted a different picture. However, the narrative underwent a momentous change in 2023. Netflix’s transformation into a highly profitable entity across all metrics has been remarkable, exceeding even the loftiest of expectations.

Data by YCharts.

The market’s recognition of Netflix’s newfound profitability has been swift, propelling its stock price to lofty heights since the beginning of 2023. While the current valuation trades at a premium, the trajectory of growth has been unmistakable.

A Future Ripe with Prosperous Expansion

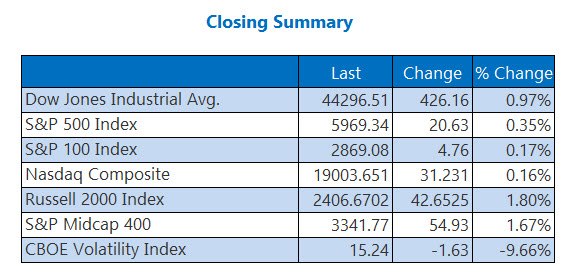

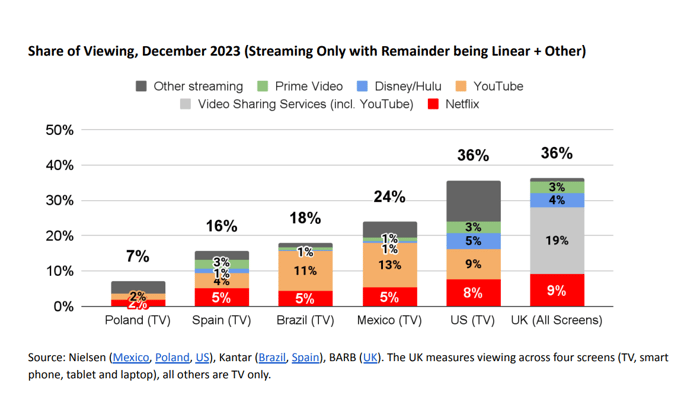

Netflix’s global subscriber base continues to expand rapidly, unfettered by traditional geographic boundaries. Its strategic investments in diverse content have positioned the company as a frontrunner in the industry. With over 260 million subscribers and a mere single-digit share of global screen time, Netflix’s growth potential is staggering.

Chart source: Netflix.

Furthermore, with a focus on enhancing profit margins and a burgeoning advertising business model, Netflix aims to emulate traditional cable services, albeit with a personalized touch. The steady influx of new subscribers is a testament to Netflix’s ability to maintain a robust revenue growth rate for the foreseeable future.

Despite short-term projections hinting at plateauing free cash flow in 2024 due to production constraints in the U.S., Netflix remains financially robust. Notably, the company’s commitment to shareholder value was evident through $6 billion in stock repurchases last year.

In conclusion, Netflix’s narrative has evolved significantly, marking a transition from a bear market to a flourishing, profitable entity in the media landscape. With unwavering optimism, I plan to further increase my investment in Netflix as the year progresses.

Before considering an investment in Netflix, it’s crucial to weigh the various factors at play. While the journey for Netflix has been promising, it’s wise to explore all avenues before diving in headfirst.

The path to success in the stock market is riddled with uncertainties, but the Motley Fool Stock Advisor team has honed in on the top 10 stocks poised for explosive growth in the near future. Understanding the dynamics at play and leveraging the expertise of seasoned analysts can greatly enhance investment decisions.

*Stock Advisor returns as of February 26, 2024

Nick Rossolillo and his clients have positions in Netflix. The Motley Fool has positions in and recommends Netflix and Walt Disney. The Motley Fool has a disclosure policy.