The Spectacular Journey of Nvidia Stock

With analysts buzzing about the artificial intelligence (AI) trend, Nvidia (NVDA) has emerged as a colossal force in the tech stock realm. Renowned for crafting cutting-edge chips fueling AI marvels like ChatGPT, this semiconductor juggernaut has notched an astronomical revenue surge from $26.9 billion in fiscal 2023 to a staggering $60.9 billion in fiscal 2024, thanks to an unprecedented demand for specialized chips.

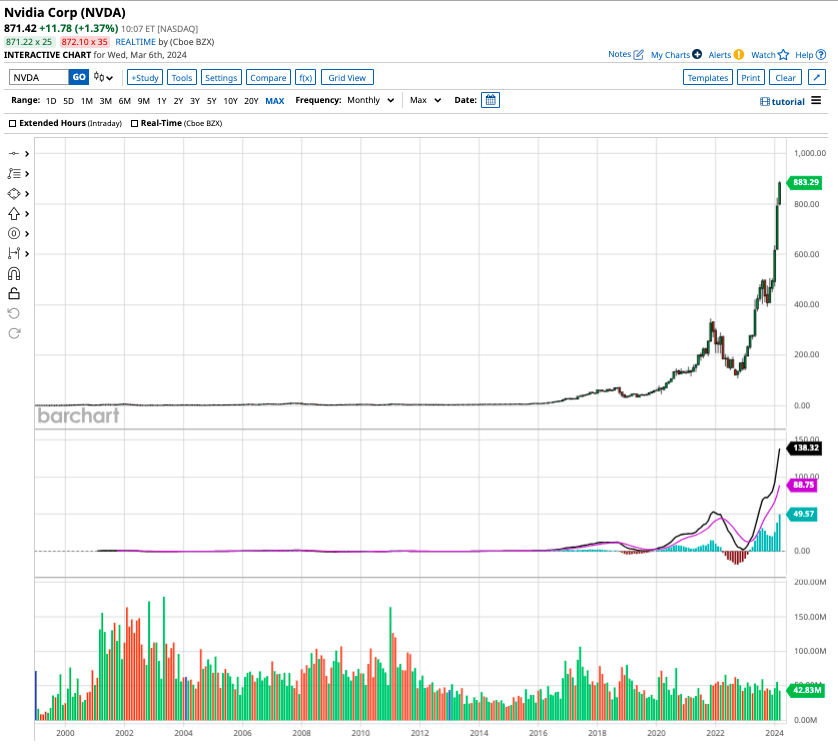

The Meteoric Ascent of NVDA Stock

Shooting up by an eye-watering 517% since the dawn of 2023, NVDA stock has witnessed a jaw-dropping 19,710% surge in the last decade, solidifying its perch as the U.S.’s third-largest firm with a formidable market cap of $2.1 trillion. However, the stock’s sky-high valuation – trading at 20.7 times forward sales and 39 times forward earnings – has spurred concerns about a potential significant correction. Nevertheless, with analysts forecasting a remarkable 33.2% annual surge in adjusted earnings per share for the next five years, this tech titan continues to beckon investors.

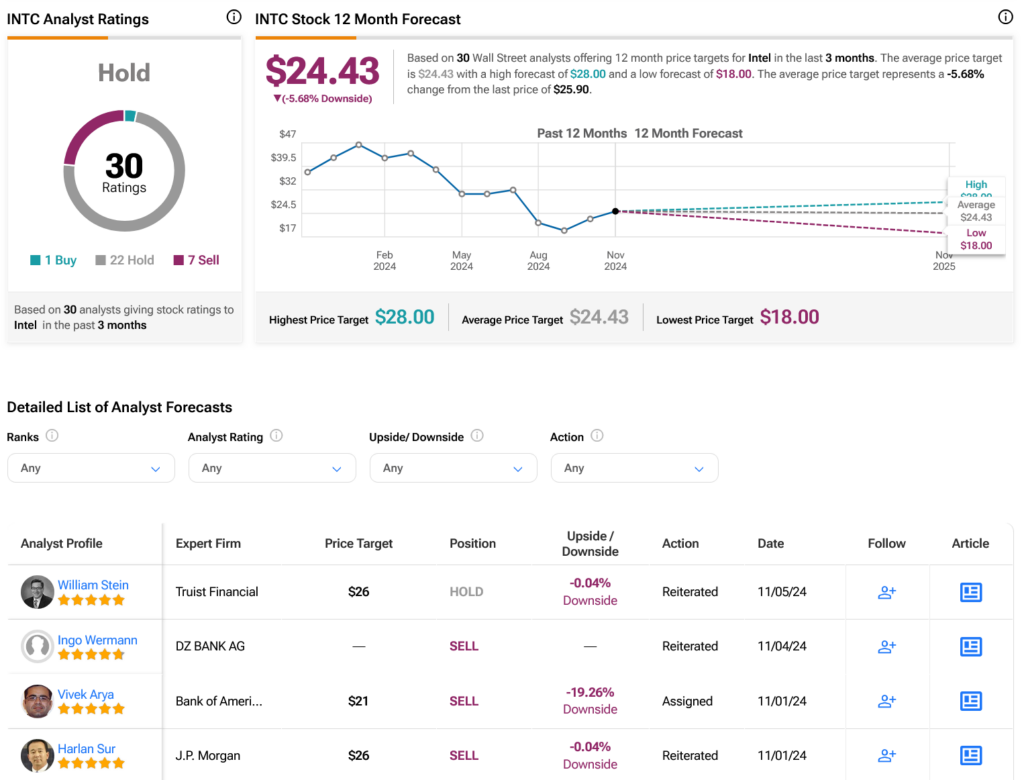

Insights into Nvidia Stock’s Target Price

Of the 39 analysts following Nvidia, a resounding consensus of 34 “strong buy” recommendations underscores bullish sentiment, with a further two favoring a “moderate buy” stance and three opting for “hold.” The average target price for NVDA stock stands at $838.93, representing a modest 7% discount off the current trading price.

Exploring Top ETFs for Nvidia Enthusiasts

For investors seeking to ride the Nvidia wave with reduced risk and enhanced diversification, investing in Exchange-Traded Funds (ETFs) offers an appealing avenue. Here are three top ETFs perfectly poised for Nvidia stock enthusiasts.

1. VanEck Semiconductor ETF (SMH)

Tracking the performance of the largest 25 semiconductor stocks in the U.S., the VanEck Semiconductor ETF (SMH) serves as a gateway to the world of modern computing essentials. Boasting over $17 billion in assets under management, the SMH ETF has notched an impressive 1,000% return for shareholders in the past decade, with Nvidia occupying the top spot at 26.2% allocation.

2. Global X Robotics & Artificial Intelligence ETF (BOTZ)

Positioned to capitalize on the rapid AI, robotics, and automation adoption, the Global X Robotics & Artificial Intelligence ETF (BOTZ) has garnered a solid 128% return for shareholders since its inception in 2016. With a management fee of 0.68%, this ETF emphasizes lucrative investments within the realm of AI and robotics, with Nvidia commanding a hefty 21.5% share of the fund.

3. iShares Robotics and Artificial Intelligence ETF (IRBO)

For investors eyeing an equal-weighted ETF approach, the iShares Robotics and Artificial Intelligence ETF (IRBO) stands out. Despite managing a more modest $700 million in assets, the IRBO ETF has delivered a respectable 54% return to shareholders since its 2018 launch. With Nvidia holding a minimal 1.5% stake, the ETF’s focus extends to an array of noteworthy constituents beyond the tech giant.