Robust cash flows act as a beacon of financial fortitude, enabling companies to tackle debts, explore expansion avenues, and distribute dividends. Moreover, such companies are akin to well-built ships, capable of navigating the choppy waters of an economic downturn, offering investors a sturdy lifeboat for the long haul.

For those on the lookout for investments bolstered by strong cash flows, three stalwarts – Verizon Communications VZ, Microsoft MSFT, and Visa V – stand tall as formidable cash engines. Let’s delve deeper into each of their financial prowess.

Microsoft Swings to the Tune of Cash Flow Symphony

Part of the illustrious ‘Magnificent 7′, Microsoft stocks have been the torchbearers of the market, soaring by a resounding 60% over the past year, outstripping their peers. Bolstered by optimistic analysts’ forecasts and donning a favorable Zacks Rank #2 (Buy), Microsoft has churned out a substantial $67.5 billion in free cash flow over the most recent trailing twelve-month span, attesting to its operational finesse.

The allure doesn’t end there. Owning MSFT shares serves as a gateway to a passive income stream, with current annual yields at a respectable 0.7%. The company’s roadmap exhibits a promising trajectory, with consensus expectations for the ongoing year pointing towards a 19% surge in earnings over a 15% hike in sales.

Verizon Communications: Communication Excellence through Cash Flow

Verizon has modestly eclipsed the general market performance, amassing an 8% value hike year-to-date, surpassing the S&P 500’s 7% progress. A striking $18.7 billion in free cash flow during the latest trailing twelve-month stretch emphasizes Verizon’s financial acumen. Equally enticing is the attractive 6.7% annual yield on VZ shares, augmented by a subtle 2% five-year annualized dividend growth rate.

Visa: The Cash Flow Maestro

In sync with its peers, Visa, the financial services heavyweight, has posted an impressive $19.1 billion in free cash flow during its latest trailing twelve-month tenure.

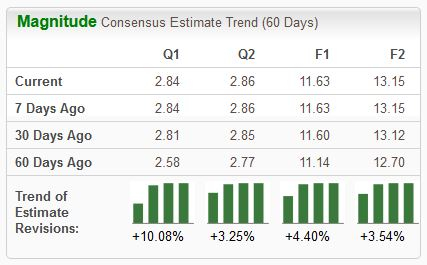

Analysts have painted a rosy picture of Visa’s outlook for the current fiscal year, with the $9.90 Zacks Consensus EPS estimate up by a notable 3.4% over the past year, hinting at a promising 13% year-over-year growth. Visa stocks, up by 8% in the year so far compared to the S&P 500, showcase a stable performance trajectory.

Cash-Generating Titans as Investment Warriors

Stocks of companies endowed with robust cash-generating capabilities make for compelling investments. The surplus cash at hand fuels growth, enriches dividend payments, and effortlessly wipes out debts. Besides, such companies serve as financial bulwarks during economic storms, a fact investors wouldn’t want to overlook.

For champions seeking the crème de la crème of cash-generating investments, Verizon Communications VZ, Microsoft MSFT, and Visa V emerge as prime contenders that seamlessly fit the bill.