The financial waters are rife with predators, and it seems that some well-heeled whales have set their sights on Philip Morris Intl.

Unveiling the intricate tapestry of options history for Philip Morris Intl (PM), we unearthed a total of 9 trades.

Delving deeper, it becomes abundantly clear that 22% of the investors harbored bullish expectations, while a staggering 77% adopted a bearish stance.

From our vantage point, we spotted 2 puts totaling $54,670 and 7 calls with a collective value of $1,004,440.

Insights into Expected Price Movements

Analyzing the trading activity, it appears that the heavy hitters are eyeing a price range spanning from $60.0 to $110.0 for Philip Morris Intl over the past three months.

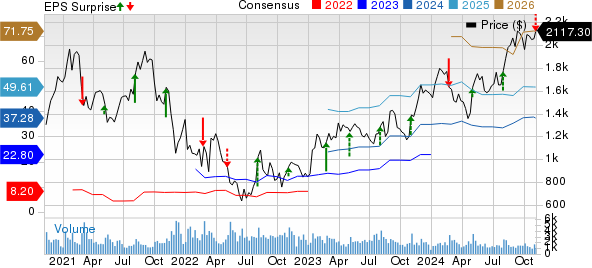

Unveiling Volume & Open Interest Trends

Scrutinizing the volume and open interest offers invaluable clues for stock research, casting light on liquidity and interest levels for Philip Morris Intl’s options within a $60.0 to $110.0 strike price range over the last month.

Philip Morris Intl Options Activity Over the Past 30 Days

Unearthing Significant Options Trades

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PM | CALL | SWEEP | BEARISH | 01/16/26 | $90.00 | $446.5K | 1.9K | 400 |

| PM | CALL | SWEEP | BEARISH | 01/16/26 | $90.00 | $339.0K | 1.9K | 400 |

| PM | CALL | TRADE | BEARISH | 01/16/26 | $100.00 | $67.0K | 830 | 100 |

| PM | CALL | SWEEP | BEARISH | 01/17/25 | $100.00 | $57.0K | 1.2K | 151 |

| PM | CALL | TRADE | BULLISH | 01/16/26 | $110.00 | $35.0K | 383 | 100 |

Exploring Philip Morris Intl

Philip Morris International, a global tobacco behemoth, boasts a product lineup dominated by cigarettes and reduced-risk offerings like heat-not-burn, vapor, and oral nicotine products marketed outside the U.S. The company’s diversification efforts included the 2022 acquisition of Swedish Match and the 2021 integration of Vectura, a provider of cutting-edge inhaled drug delivery solutions.

After meticulously parsing the options trades surrounding Philip Morris Intl, it behooves us to delve deeper into the company’s market position and operational performance.

Philip Morris Intl’s Current Standing

- Trading at a volume of 4,609,697, PM’s price has ascended by 0.28%, now resting at $94.67.

- RSI indicators hint at potential overbought conditions for the stock.

- Earnings announcement is anticipated in 42 days.

Options present a riskier avenue compared to straightforward stock trading but offer enhanced profit potential. Seasoned options aficionados tackle this risk through continuous education, strategic trade entries and exits, multi-indicator analysis, and vigilant market monitoring.

If you desire real-time insights into the latest options maneuvers involving Philip Morris Intl, steer towards Benzinga Pro for immediate alerts.