The Rise of AI Stocks in 2024

Investors in 2024 are still enamored with artificial intelligence (AI) stocks, as they ride the wave of an anticipated AI megatrend forecasted to attract substantial investments in the upcoming decade. While Big Tech corporations like Nvidia, Microsoft, and Alphabet dominate the headlines, there are lesser-known AI stocks set to potentially shower shareholders with riches in both the current year and beyond.

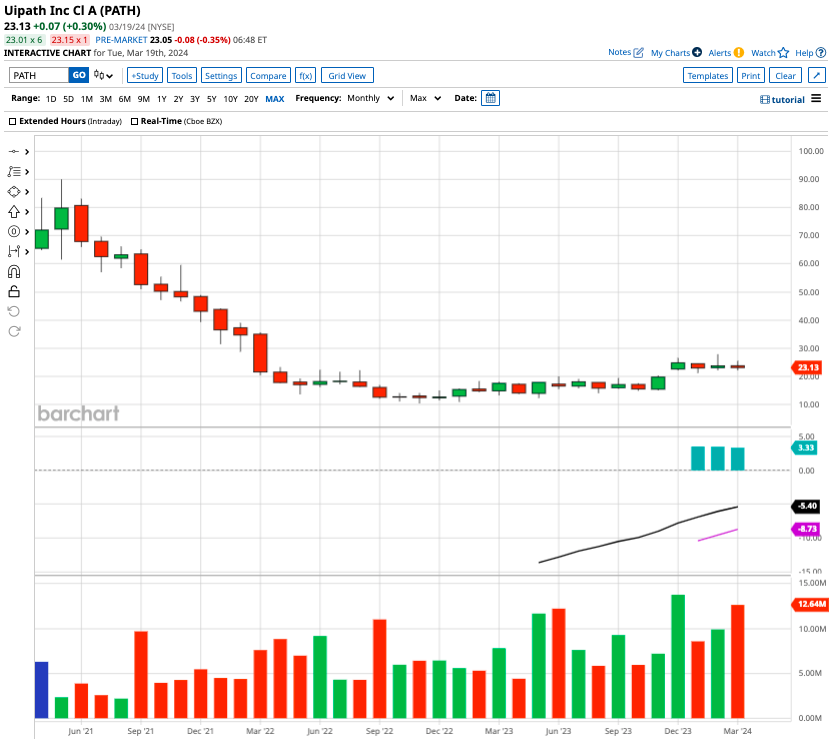

The Bull Case for UiPath Stock

UiPath, with a market cap of $13 billion, offers an enterprise platform that automates numerous business processes across sectors such as healthcare, telecom, finance, and banking. Despite trading nearly 74.5% below its all-time highs, optimism surrounding AI stocks has propelled UiPath’s stock price up by 35% in the last half-year.

UiPath specializes in automating various processes, including accounts payable, claims processing, and finance and accounting. Leading the market in robotics process automation (RPA), UiPath is integrating AI capabilities throughout its RPA stages, positioning it to benefit from the projected expansion of the RPA market to $30 billion by 2030.

Unlike many other AI growth stocks, UiPath boasts consistent profitability, reporting stellar numbers such as adjusted earnings of $0.22 per share in fiscal Q4 of 2024, exceeding estimates, and exhibiting a revenue increase of 31% year over year. Projections indicate that UiPath could potentially soar to over $14 billion in revenue by fiscal 2030 if it maintains its current market share.

Is Unity Software Stock a Good Buy Right Now?

Valued at $10 billion, Unity Software has seen a steep decline of 87% from its record highs in March 2021. Specializing in video gaming software, Unity provides solutions to create, run, and monetize interactive content across various devices, including smartphones, tablets, consoles, and augmented or virtual reality platforms.

Unity’s financials present a mixed picture, with higher-than-expected revenue in Q4 of 2023 but a wider-than-desired Q4 loss per share, disappointing analysts anticipating a slimmer loss. The company has managed to trim its cost base over the last 12 months to offset slowing top-line growth, resulting in a reduced net loss in 2023 compared to the previous year.

Analysts remain cautious about Unity Software’s outlook, predicting a 16.8% decline in sales to $1.82 billion in 2024 despite an improved adjusted EBITDA margin of 30% in Q4 of 2023, representing a significant jump from 5% in the same period of the prior year.

Comparative Analysis and Recommendations

While Unity Software may seem to offer more potential for growth than UiPath at current levels, cautious optimism is advised, primarily due to Unity’s recent earnings miss. Unity’s shares have dipped approximately 20% following the earnings report, signaling potential challenges ahead for the stock.