Disney Stock Hits 52-Week Highs

Disney’s (DIS) stock made headlines after reaching 52-week highs, driven by an upgrade from analysts at Barclays.

Cost-cutting initiatives have paid off with Disney reinstating its dividend at the end of last year after postponing its payout during the pandemic.

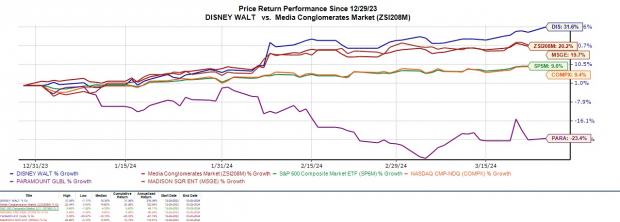

Impressive Performance Amidst Zacks Media Conglomerate Industry

Investor sentiment has been high for Disney shares with DIS spiking +3% today and climbing +31% in 2024, outperforming many of its Zacks Media Conglomerate Industry peers.

Barclays Upgrade and Earnings Performance

Barclays upgraded Disney’s stock to overweight, projecting positive earnings revisions and valuation support after the company’s stellar Q1 earnings performance.

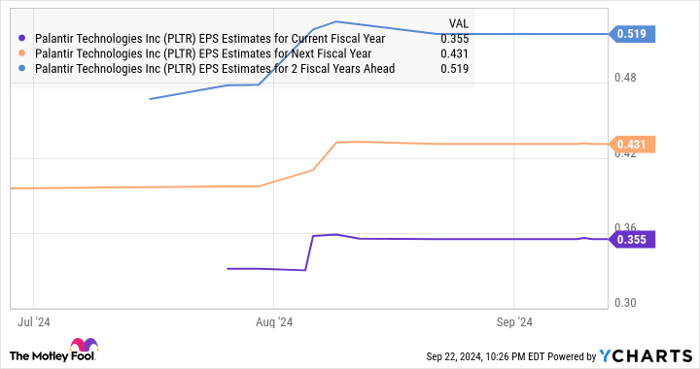

Rising Earnings Estimates and Valuation

Disney is expected to see a 21% bottom-line expansion this year and a further 19% jump in FY25, with rising earnings estimates indicating a positive trajectory.

Cost Cutting and Financial Health

Disney has shown financial prudence with its CEO’s cost-saving initiatives, lowering long-term debt and maintaining a reasonable forward P/E valuation.

Reinstated Dividend with Promising Prospects

Following strong Q1 results, Disney reinstated its dividend at $0.45 per share, signaling confidence in its financial performance and future prospects.

Is it Time to Invest?

The turnaround in Disney’s stock has been impressive, with a current Zacks Rank #3. While rewarding for long-term investors, caution is advised for potential future buying opportunities.