Cognizant CTSH has rekindled its longstanding partnership with Pon IT, the IT arm of the esteemed Dutch corporation Pon Holdings.

For over six years, Cognizant has played a pivotal role in transforming Pon IT’s infrastructure, sculpting an agile and automated platform tailored to cater to the varied requirements of Pon Holdings’ diverse business units.

Through this extended collaboration, the focus is on refining and enhancing the cloud-managed services offered to Pon IT, enabling seamless access to shared resources, streamlined operations, and real-time data insights.

The stress on agility, user-friendliness, and integration within the cloud arena underscores Cognizant’s commitment to empowering Pon IT with the necessary tools to navigate the ever-evolving business environment. By embracing automation and collaborative innovation, both entities are poised to unearth new echelons of operational efficiency and propel continuous growth.

Cognizant’s Strategic Partner Ecosystem

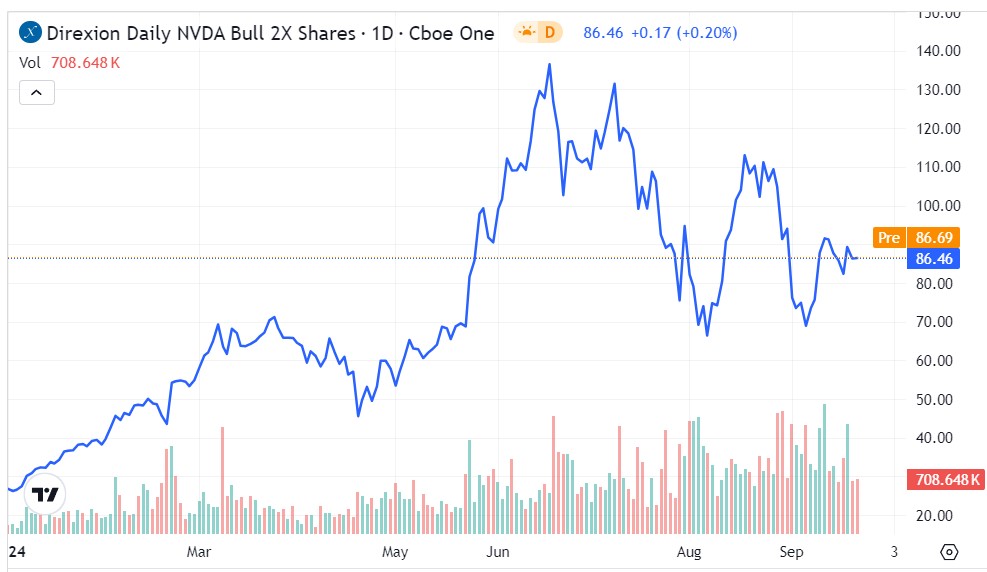

Cognizant’s robust network of partners, featuring industry giants like Alphabet GOOGL, Microsoft MSFT, NVIDIA NVDA, and ServiceNow, has been instrumental in broadening its client base.

The collaborations with Microsoft and NVIDIA have significantly boosted its presence in the healthcare sector.

Cognizant, in conjunction with NVIDIA, is set to revolutionize drug discovery through the utilization of gen AI technology. By integrating NVIDIA’s BioNeMo platform into its operations, Cognizant aims to tackle the complex challenges specific to the life sciences field, especially in drug development.

Simultaneously, Cognizant and Microsoft are teaming up to embed gen AI into healthcare management. This strategic alignment seeks to optimize efficiency for healthcare payers and providers while elevating patient care standards.

The incorporation of gen AI functionalities into Cognizant’s TriZetto platform, powered by Microsoft Azure, holds vast potential for the healthcare industry. Leveraging Azure OpenAI Service and Semantic Kernel, the TriZetto Assistant on Facets enables seamless access to gen AI within the user interface, enhancing processes, fortifying data security, and ensuring regulatory adherence, consequently leading to superior patient outcomes.

Additionally, Cognizant is fortifying its foothold in software development and AI sectors through an expanded partnership with Alphabet’s cloud division, Google Cloud. This collaboration is slated to revolutionize the software delivery life cycle, boosting developer productivity by integrating Gemini for Google Cloud into CTSH’s operations and platforms.

Through this initiative, Cognizant aims to arm its developers with AI-powered tools, enhancing their coding, testing, and deployment capabilities. The partnership also signals a move towards enhancing the skill set of its workforce, with plans to train over 70,000 associates in Google Cloud’s AI offerings within the next year.

Future Trends and Financial Outlook

With the establishment of Gemini Studios and Centers of Excellence across various locations, Cognizant is poised to deliver advanced AI solutions to its corporate clients, further cementing its position as a frontrunner in the tech consulting arena.

In February, this Zacks Rank #3 (Hold) enterprise unveiled its latest Flowsource platform, equipped with cutting-edge gen AI capabilities, set to revolutionize the enterprise software engineering landscape. Cognizant projects that first-quarter 2024 revenues will range between $4.68 billion and $4.76 billion, signifying a decline of 2.7% to 1.2% (a decrease of 3-1.5% on a cc basis).

The Zacks Consensus Estimate for revenues is $4.73 billion, indicating a 1.79% year-over-year decrease. The First Quarter 2024 earnings consensus stands at $1.11 per share, unchanged over the past 30 days.