The Rise and Sizzle of IPOs

The realm of Initial Public Offerings witnessed an eruption of excitement over the last year, showcasing a restored faith in the investment arena in general. While 2021 marked a historic year for IPOs, the fervor has considerably waned since then. Amongst the frenzy, two standouts, Reddit RDDT and Arm Holdings ARM, have captured the limelight.

Assessing Arm Holdings

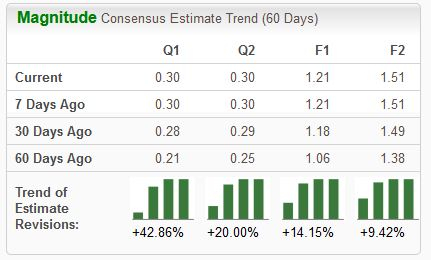

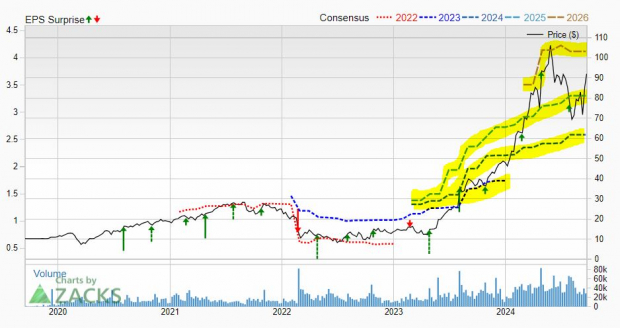

Arm Holdings takes center stage as it engineers, innovates, and licenses high-performance, cost-effective, and energy-efficient IP solutions spanning CPUs, GPUs, NPUs, and various interconnected technologies. Garnering a Zacks Rank #1 (Strong Buy), the stock has seen a positive revision in earnings forecasts across the board, propelled by the AI craze.

The company’s coveted product portfolio boasts reliance from numerous esteemed semiconductor manufacturers and original equipment providers (OEMs). Notably, in a revealing 13F filing, the revered NVIDIA NVDA unveiled a substantial investment of nearly $150 million in Arm Holdings.

The recent quarterly results of ARM delivered a resounding performance, triggering a post-earnings surge that surpassed the Zacks Consensus EPS estimate by a staggering 16% and reported a 7% sales beat. The record-setting royalty revenue, coupled with robust growth in licensing, furnished favorable tailwinds for the company.

Unveiling Reddit

The much-anticipated IPO of Reddit had long been making ripples across the financial domain, signifying a bold move for those optimistic about the long-term outlook of social media. It encapsulated the primary IPO amid social media companies in recent times, adding a fresh chapter to the narrative.

While two other social media giants, Pinterest PINS and Snap SNAP, experienced notable stock upticks in the last year, it’s pertinent to note that both entities have trailed behind the S&P 500 index during this period.

Post its debut, Reddit’s shares embarked on a rollercoaster journey, initially witnessing a surge before experiencing a pullback in recent days. The platform of this social media powerhouse boasts an extensive outreach, housing over 100k active communities and 1 billion cumulative posts.

Following suit with its counterparts, Reddit plans to leverage advertising solutions linked to user engagement for revenue generation. The company also eyes a total addressable market worth $1.4 trillion by 2027, identifying substantial potential in data licensing fuelled by the rise of LLMs.

The Verdict

Though IPO activity has decelerated significantly post the record-breaking spree of 2021, the past year unleashed a slew of captivating debutants, including Arm Holdings ARM and Reddit RDDT. Bolstered by the AI fervor, analysts have embraced a bullish stance on ARM’s future, catapulting the stock into the coveted Zacks Rank #1 (Strong Buy). In the Reddit arena, the company is geared to tap into the advertising domain while anticipating favorable winds from data licensing avenues.