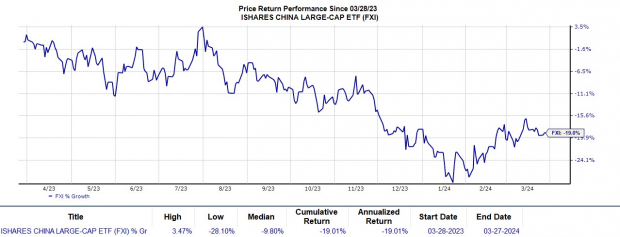

The Landscape of Chinese Equities

Despite the recent tumultuous trajectory of the iShares China Large-Cap ETF FXI, which has experienced a 19% decline over the past year, a select group of Chinese ADRs (American Depository Receipts) appear to be on the brink of a significant recovery.

Market Dynamics and Investment Potential

Amid concerns over a deceleration in China’s economic growth, numerous Chinese companies are currently perceived as oversold. Notably, the resilience of internet-commerce giants in China, alongside other firms benefitting from robust business sectors, indicates potential opportunities for investors.

Opportunities in Internet-Commerce Leaders

The Zacks Internet-Commerce Industry, positioned in the top 26% of over 250 Zacks industries, showcases promising stars like JD.com JD and PDD Holdings PDD, both holding a Zacks Rank #1 (Strong Buy).

JD.com and PDD Holdings Projections

JD.com is anticipated to witness a 5% surge in total sales for fiscal years 2024 and 2025, with estimates surpassing $160 billion. Additionally, JD.com’s earnings are poised for a slight uptick this year, followed by a substantial 12% rise in FY25 to reach $3.53 per share.

PDD Holdings Growth Trajectory

Pinduoduo, under PDD Holdings, is forecasted to experience a 50% sales upswing to $51.89 billion in fiscal 2024 from $34.64 billion in 2023. Looking ahead to FY25, sales are predicted to climb by 35% to $70.2 billion, while EPS is expected to expand by 29% this year and an additional 26% next year to reach $10.66 per share.

Valuation and Potential

Despite being 39% and 24% below their respective 52-week highs, JD.com and PDD are currently trading at P/E multiples well below 20X, offering investors a compelling discount compared to the industry average of 27.4X and the S&P 500’s 22.1X.

Exploring Li Auto’s Prospects

Li Auto, a significant player in China’s smart energy vehicle market, is positioned advantageously in the realm of electrified vehicles and autonomous driving innovations. With a Zacks Rank #2 (Buy) and trading at reasonable multiples, Li Auto’s growth potential indicates a buying opportunity.

Projections for Li Auto

Li Auto’s forward earnings multiple stands at 15.7X, with anticipated EPS growth of 22% in FY24 and a substantial 54% surge in FY25 to $3.05 per share. Coupled with robust top-line growth estimates, Li Auto presents an enticing long-term investment prospect.

Exploring Opportunities with iQIYI

iQIYI, often dubbed as the “Netflix of China” and boasting a Zacks Rank #2 (Buy), offers a favorable risk-reward proposition for investors. Despite lofty comparisons, iQIYI’s stock exhibits a promising outlook, with its Zacks Film and Television Production and Distribution Industry ranking in the top 16 percentile.

Crossing the profitability threshold last year, iQIYI’s stock symbolizes a potential avenue for investors seeking exposure to the Chinese media and entertainment landscape.

Ripe Investment Opportunities in Chinese Equities for 2024

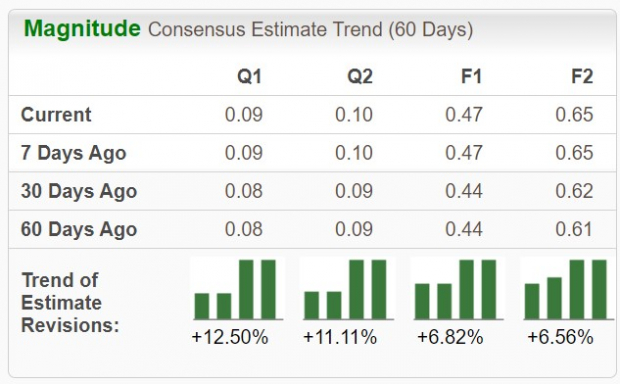

Robust Financial Prospects

Trading at a mere $4 and 8.7X forward earnings, iQiyi presents a tantalizing proposition for investors. With annual earnings predicted to surge by 14% in FY24 and an additional 38% in FY25 to $0.65 per share, the company’s financial trajectory appears promising. Furthermore, iQiyi’s revenue growth remains consistent, with sales forecasted to climb by 7% this year and expected to rise by a further 5% in FY25, reaching $4.91 billion. Notably, earnings estimate revisions have shown a modest uptick over the last 60 days for both FY24 and FY25.

Image Source: Zacks Investment Research

Promising Outlook

Given the enticing forecasts for iQiyi and similar Chinese stocks, the landscape appears ripe for a significant rebound in the near future. These stocks are not just poised for growth but also shaping up to be viable long-term investments beyond the year 2024. Seizing the opportunity to acquire positions now could prove fruitful, especially considering the potential for an uptick in market sentiment surrounding Chinese equities. This could be particularly pivotal if China manages to allay concerns regarding its decelerating economy.