Making its way onto the Zacks Rank #1 (Strong Buy) list last week, Ford Motor’s F stock lands the Bull of the Day.

Improved Probability & P/E Discount

Ford had worked diligently to improve its profitability prior to the pandemic and this came to fruition once supply chain disruptions subsided with the company seeing multi-year EPS peaks of $2.01 per share last year. While a modest slowdown in the resurgence of Ford’s bottom line is expected, over the last 60 days, earnings estimate revisions are nicely up for both FY24 and FY25.

P/S Discount

In terms of price to sales, Ford’s stock checks the valuation box as well with a P/S ratio of 0.31X which is roughly on par with General Motors’ 0.29X and firmly beneath the optimum level of less than 2X. With the industry average at 1.5X sales its noteworthy that Ford’s top line is expected to slightly increase this year to $166.3 billion compared to $165.99 billion in 2023.

EV Surge

Making Ford’s perceived discounts more lucrative is that its EV sales surged 27% last quarter to record highs with a total of 25,927 all-electric vehicles delivered. Driven by increasing demand for its Mustang Mack-E, F-150 Lightening, and E-Transit, this impressively defied expectations. To that point, many analysts are expecting a significant slowdown in the broader EV market with Tesla’s TSLA slowing sales growth making headlines.

Bottom line

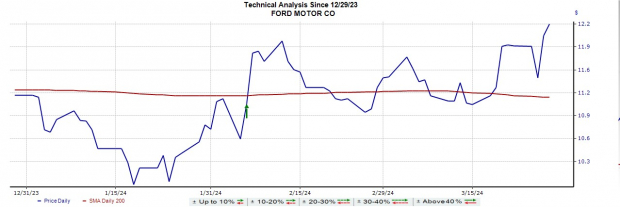

The recent surge in Ford’s stock may just be getting started considering its very attractive valuation and compelling EV expansion. Certainly, now appears to be an ideal time to buy as keeping Ford’s stock in the portfolio may be very rewarding this year.