Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett’s strategy of seeking out great businesses at favorable valuations and holding onto them over the years has yielded commendable returns for investors. A decade ago, a $10,000 investment in Berkshire’s Class A shares would now be valued at $33,870, outpacing the $27,810 return from a similar investment in the S&P 500 index.

While blindly emulating investment moves might lead to unsatisfactory outcomes, understanding the rationale behind Buffett’s stock picks can offer valuable insights for savvy investors. Let’s delve into the potential of Amazon (NASDAQ: AMZN) and Snowflake (NYSE: SNOW), two companies in Berkshire’s portfolio that appear poised for promising growth.

Amazon’s Sustainable Growth Trajectory

Berkshire currently holds approximately $1.8 billion worth of Amazon stock, a company that has demonstrated remarkable performance as an investment option. Amazon’s stock prices have surged by an impressive 76% over the past year.

An in-depth analysis of Amazon’s growth drivers reveals its attractiveness as a long-term investment. Despite a significant uptick in its stock value, Amazon is currently trading at a mere 3.2 times sales, presenting a discount compared to the Nasdaq-100 Technology Sector index’s price-to-sales ratio of 7.3. Furthermore, Amazon’s forward earnings multiple of 41 is lower than its five-year average of 57.

Market analysts anticipate a 15% annual growth in Amazon’s earnings over the next five years, surpassing the 10% growth seen in the previous five years. With catalysts like artificial intelligence (AI), digital advertising, and the expanding e-commerce market, Amazon is poised for accelerated growth.

Amazon’s cloud business, Amazon Web Services (AWS), generated nearly $91 billion in revenue in 2023, marking a 13% increase. AWS, with a 31% market share, is a leading cloud service provider worldwide. As AI adoption in the cloud grows, Amazon stands to benefit.

The cloud AI market’s projected revenue surge to nearly $400 billion by 2030 indicates substantial growth potential. Amazon’s strategic focus on developing innovative AI applications is likely to enhance its revenue streams, particularly through AWS.

Furthermore, Amazon’s Rufus generative AI shopping assistant is tailored to enhance the customer shopping experience, potentially boosting its e-commerce operations.

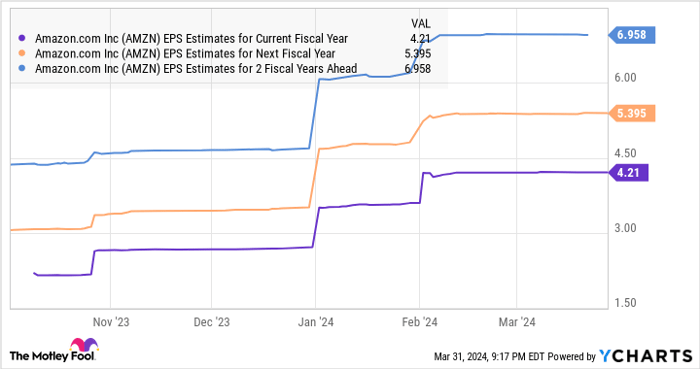

Considering these factors, Amazon’s projected earnings growth over the next few years from $2.90 per share ensures a compelling investment opportunity.

AMZN EPS Estimates for Current Fiscal Year data by YCharts

Amazon’s long-term growth prospects, particularly driven by AI in the cloud, position the stock favorably for sustained growth in the foreseeable future. Investors should consider capitalizing on this momentum before Amazon’s stock ascends further.

Snowflake’s Recuperative Potential

Berkshire has a stake worth $989 million in Snowflake stock. Despite a recent downturn, Snowflake presents an appealing investment opportunity at its current valuation. The company has witnessed a 19% decline in 2024 following lower-than-expected fiscal 2025 guidance.

Although Snowflake’s fiscal 2024 concluded with a robust 38% surge in product revenue to $2.67 billion, its conservative fiscal 2025 product revenue forecast of $3.25 billion, indicating a 22% year-over-year increase, prompted investor concern. This moderated growth projection led to market apprehension post the latest results.

Despite the tempered outlook for the current fiscal year to adjust for potential customer spending pullback, Snowflake’s substantial remaining performance obligations (RPO) surged by 41% last quarter to reach $5.2 billion. RPO reflects the total value of a company’s forthcoming contractual commitments yet to be fulfilled.

The Rise of Snowflake: An Alluring Investment Opportunity

Enhanced Revenue and Market Potential

Snowflake closed the quarter with an impressive net revenue retention rate of 131%. This uptrend signifies that Snowflake’s existing clientele is amplifying their investment in its solutions, reflecting a robust financial performance.

Diversification and Growth Prospects

Noteworthy is Snowflake’s foray into integrating AI tools within its data cloud platform, signaling a strategic move to tap into the thriving AI-as-a-service market. This diversification effort could potentially unlock a new avenue for growth and bolster Snowflake’s market position in the long haul. Furthermore, the current modest price-to-sales ratio of 18, a significant drop from almost 25 at the conclusion of 2023, presents investors with an attractive opportunity to capitalize on a rapidly expanding enterprise at a relatively undervalued stance.

Investment Advice Beyond Amazon

As tempting as it might be to consider Amazon for investment, investing enthusiasts are urged to widen their horizons. The Motley Fool Stock Advisor team has identified 10 prime stocks that have the potential to provide substantial returns in the future – with Amazon not making the list. The guidance provided by Stock Advisor, inclusive of portfolio construction recommendations, consistent updates from analysts, and bimonthly stock picks, has significantly outperformed the S&P 500 since 2002, presenting a compelling case for alternative investment avenues.

Source: The Motley Fool