In the tumultuous realm of electric vehicles (EVs), the winds of change are blowing fiercely. The once-glorious landscape, which saw Tesla (TSLA) stumble in its recent quarterly deliveries, now finds itself grappling with a far graver predicament – the looming shadow of a demand downturn.

As the EV industry navigates treacherous waters, the plight is starkly evident, even behemoths like Tesla are faltering. However, the true test lies in the fate of emerging players, with many on the brink of collapse or facing the grim specter of imminent bankruptcy.

Not long ago, VinFast (VFS), the Vietnamese EV upstart, captured the limelight in the U.S. through a high-flying SPAC merger. In a meteoric rise, its stock ascended to lofty heights, touching $93 and bestowing upon the company a market cap surpassing $200 billion – a staggering figure outshining the combined valuations of Ford (F) and General Motors (GM).

Fast forward to 2024, and VFS now languishes as a mere penny stock, trading perilously close to its all-time lows. The year ahead paints a murky forecast for this once-celebrated EV torchbearer amid the unforgiving industry headwinds.

Analysts Bet Big on VinFast

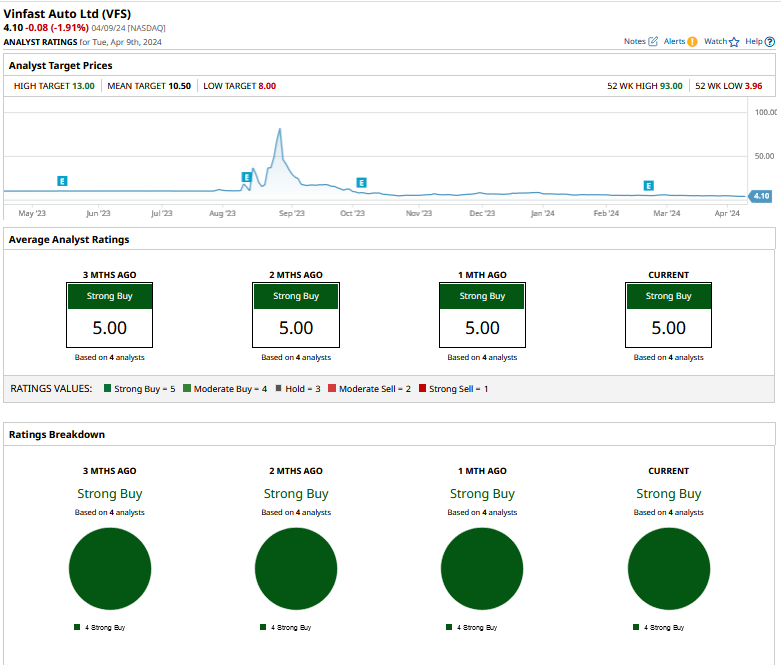

A compelling narrative emerges from the analyst circles around VinFast, all echoing a unanimous sentiment – a resounding “Strong Buy” ringing through the corridors of Wall Street. With a mean target price of $10.50, a whopping 156% surge beckons from current levels. Even the most conservative projection, pegged at $8, hints at a stock that could potentially double in value.

Despite the skewed optimism in analyst projections, the market’s lackluster response to VFS suggests a stark disconnect between perceived potential and ground realities.

Unveiling the Decline of VinFast Stock

The descent has been swift and brutal for VinFast, mirroring the broader EV market turmoil. In 2024 alone, the stock has shed over 51% of its value, a staggering plunge echoing the dismal performances of industry peers such as Rivian (RIVN) and Lucid (LCID) which have wilted by 55% and 36%, respectively.

The EV universe finds itself ensnared in a quagmire of excess capacity, stifling demand, and bruising price wars. This lethal concoction has wreaked havoc on profit margins, exacerbating losses, and fueling a cash burn crisis among burgeoning players.

The Financial Inferno Ravaging VinFast

VinFast’s financial woes paint a grim picture, with a staggering $3.3 billion and $2.2 billion torching through its coffers in 2023 and 2022, respectively. With a paltry $168 million in cash reserves at the close of 2023, VFS heavily leans on lifelines from its parent firm, Vingroup, portraying a precarious reliance on external support.

Mirroring a kindred tale is Lucid Group, propped up by Saudi Arabia’s Public Investment Fund (PIF), yet grappling with a cash hemorrhage despite the deep pockets of its benefactor.

Deciphering VinFast’s Enigma

Peering into VinFast’s narrative unveils a tapestry woven with intertwined threads of promise and peril. A notable concern arises from the overdependence on Green and Smart Mobility (GSM) for sales, a risky gambit with potentially dire consequences.

Moreover, VinFast’s products, exemplified by the lackluster reviews for its VF8 model, emanate a contrasting aura to the allure of rivals such as Rivian and Lucid offering superior market appeal.

Despite the somber narrative, VinFast’s foray into the SUV market and strategic diversification across price segments hint at a glimmer of hope. The positioning of production hubs, such as the upcoming North Carolina plant, and expansion into untapped markets like India and Indonesia, reflect a deft maneuver in a fiercely competitive industry landscape.

Coupled with a forward-thinking approach to market access, leveraging Vietnam’s locational advantage vis-a-vis Chinese EV entrants, VinFast promotes a narrative of resilience amidst adversity.

Yet, the daunting specter of an overvalued stock, juxtaposed with a lack of discernible competitive edge in an oversaturated market, paints a cautionary tale. Hence, while tempting fate with VinFast, it might be prudent to sidestep the allure and seek refuge in more sound investment avenues.