When Rivian made a thunderous entry onto the electric vehicle (EV) scene with its monumental IPO in November 2021, hopes were high, reminiscent of a rocket ready to launch into the financial stratosphere. However, the reality has been far from a smooth trajectory for this newcomer in the EV industry. As competition stiffens, challenges mount, and the terrain remains rocky, Rivian finds itself grappling to establish a firm footing in the market.

On the flip side, standing tall amidst the storm is Tesla, an old hand that has weathered its fair share of challenges and emerged as a beacon of success in the EV sector. With a track record of profitability and a sturdy business model, Tesla shines bright like a North Star beckoning investors seeking long-term growth and stability.

A Tale of Financial Fortunes: Rivian vs. Tesla

One glance at the financial sheets tells a compelling story. Rivian, despite commendable strides in production, is yet to turn a profit. The company’s expenses continue to outpace revenue, forcing it to rely heavily on cash reserves, a well that dries up a little more each passing day. With its cash pile dwindling at an alarming rate, Rivian teeters on the brink of a financial precipice, left to ponder the stark realities of survival beyond the short term.

Contrast this with Tesla, a titanic figure in the EV firmament. Despite a slight dent in profit margins in 2023, Tesla boasts an enviable business model that churns out an impressive $8,200 per vehicle sold. Even with temporary setbacks, Tesla set income and production records in 2023, showcasing its resilience and power to thrive in a challenging environment.

And as the specter of sluggish growth looms over the EV industry in 2024, Tesla’s robust financial position stands it in good stead. With a colossal $29.1 billion in cash reserves, Tesla stands ready to weather the storm, poised to expand and innovate while competitors scrape for sustenance in the arid financial landscape.

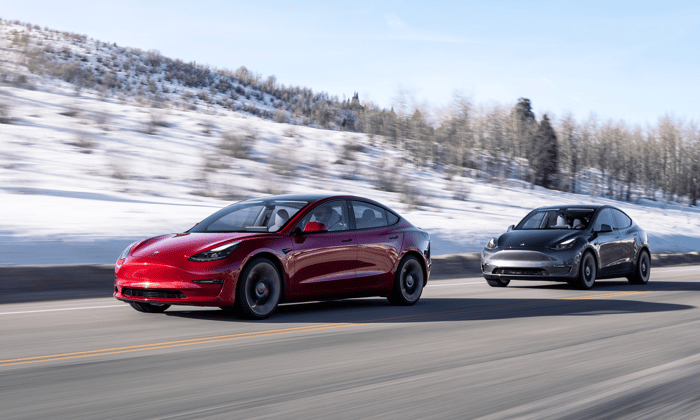

Image source: Tesla.

The Evolution of the EV Market: A Shift in Winds

Investors have reaped a golden harvest with Tesla’s meteoric rise, reaping returns that glitter like diamonds in the stock market sky. However, the landscape of the EV market has transformed since Tesla first embarked on its journey. In Tesla’s nascent days, it navigated through uncharted waters, with minimal competition and a fertile plain ripe for the taking.

Fast forward to today, and the battleground is vastly different. Rivian, like a fledgling bird learning to fly, faces a sky crowded with start-ups and legacy automakers bearing the torch of experience. The once-flourishing EV market now matures, its growth slowing to a steady pace, demanding prudence and profitability from its denizens.

While non-profitability in an industry like EV manufacturing is par for the course, the stakes are higher now. Rivian stands at a crossroads, encircled by behemoths with deep pockets and decades of manufacturing expertise. Survival in this terrain demands not just a finger on the pulse but a pulse on profit, a trait that Tesla honed over years of struggle and triumph.

The Verdict: Tesla’s Shine Amidst Stormy Seas

Is Rivian’s fate doomed to the shadows of uncertainty? Perhaps not entirely. The company shows glimpses of progress, unveiling new models and treading cautiously in the face of adversity. Yet, the road to redemption for Rivian is laden with thorns, a journey fraught with risks and uncertainties.

For investors seeking a beacon in the electric storm, Tesla stands tall and resolute. With financial fortitude to weather short-term turbulence and build for the future, Tesla beckons investors with a promise of stability and prosperity amidst an industry in flux.

As the curtain falls on Rivian’s saga and Tesla’s epic continues, the tale of electric dreams unfolds, painting a picture of audacity and acumen in a market teeming with possibilities.