Upon initial inspection, Stellantis (STLA), the automotive powerhouse behind brands like Chrysler, Fiat, and Dodge, seems to be locked in a fierce battle against the inevitable tide. The prevailing wisdom in the industry touts electric vehicles as the undisputed future. Yet, this narrative might not be playing out as anticipated, presenting a potential for those eyeing STLA stock.

While Stellantis witnessed a more than 4% decline in its shares recently, there is a glimmer of hope amidst the turmoil. As noted by Barchart contributor Tony Daltorio, legacy automakers have notably outperformed this year, with STLA stock showing resilience despite the recent dip.

In stark contrast, pure-play electric vehicle manufacturers like Tesla (TSLA) have faced significant challenges, with Tesla plummeting over 31% since the year’s commencement. Similarly, Rivian Automotive (RIVN) saw a staggering drop of almost 57% during the same period. The primary obstacle these pure-play companies encounter is their lack of diversification, leaving them vulnerable to market fluctuations.

On the contrary, legacy automakers have the advantage of fallback options such as internal-combustion engines. Additionally, the increasing popularity of hybrid vehicles, blending traditional and electric technologies, has provided the legacy players with flexibility that pure EV companies lack.

Thus, betting on STLA stock amidst this market uncertainty might not be as far-fetched as it seems. The discerning eyes of options traders have already caught wind of this potential opportunity.

STLA Stock Displays Strong Unusual Stock Options Volume Indicator

At the close of the recent session on April 12, STLA stock ranked among the top 10 in Barchart’s unusual stock options volume indicator. This indicator sheds light on unconventional trades in the derivatives market, offering insights into institutional investment behavior.

STLA stock witnessed a total volume of 55,779 contracts against an open interest of 233,089 contracts. Notably, the spike in volume represented a significant 563.64% deviation from the average volume over the past month, with call options dominating at 53,632 contracts compared to 2,147 put contracts.

The stark put/call volume ratio of 0.04X indicates robust bullish sentiment, as investors overwhelmingly favor call options over puts. Moreover, a closer look at Barchart’s options flow screener reveals a prevailing bullish sentiment in substantial transactions, amplifying the overall market impact.

While recent volatility in Stellantis shares has affected the Barchart Opinion indicator, currently rating STLA stock as a 56% overall buy, the underlying bullish sentiment remains strong.

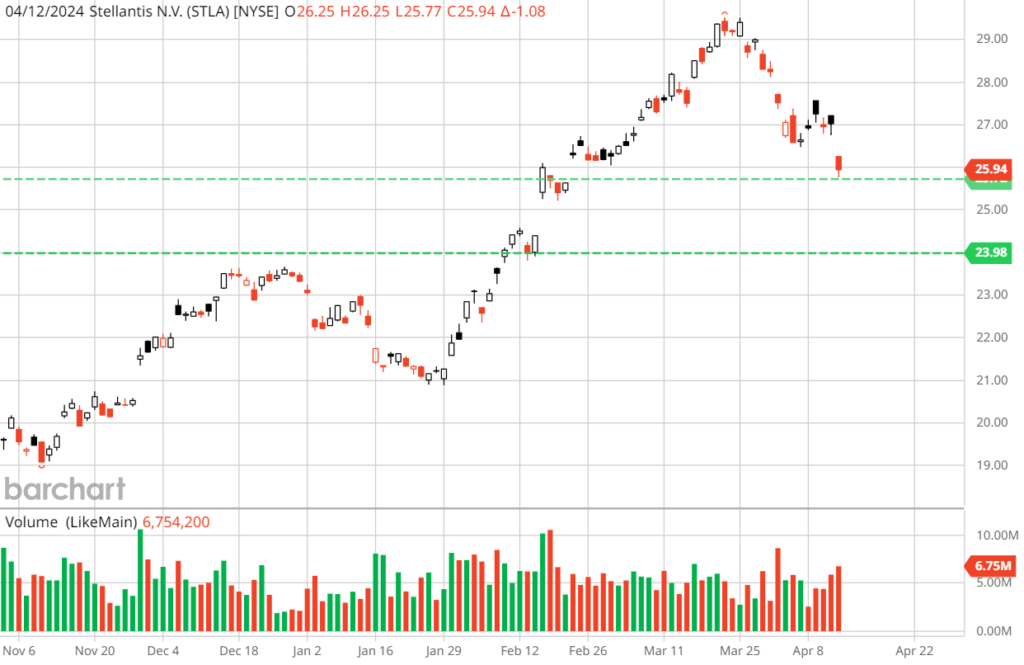

Despite potential short-term downside risks, technical analysis and STLA’s Trader’s Cheat Sheet hint at critical support levels at $24 and $25.72, representing pivotal points for traders. With EVs facing production constraints, Stellantis stands to benefit from extended viability in a rapidly evolving market landscape, making STLA stock an appealing speculative prospect.

Uncovering Great Value Amidst Uncertainty

Another compelling aspect to consider with STLA stock is its value proposition. The current trading price of shares at 0.41X last year’s revenue contrasts sharply with the industry average sales multiple of 1.29X. While undervaluation may not always signify a sound investment, the prevailing narrative surrounding the pace of EV adoption and potential policy shifts post-2024 elections presents intriguing possibilities for entities like STLA stock.

While certainty in the market is elusive, it’s prime time to reassess the preconceived notions about the traditional automotive sector. Keep a keen eye on STLA stock, as it holds the promise of captivating developments in the coming months.