Value Investing Unveiled

Embracing value investing is akin to seizing a phenomenal sale on stocks that are being overlooked by the masses. The premise is simple: by snapping up undervalued stocks, one anticipates that the market will eventually catch on, driving these stocks to their rightful, lucrative positions.

Who doesn’t relish a good bargain, laced with the promise of future gains?

Furthermore, the value proposition significantly amplifies when we introduce the Zacks Rank into the mix. By incorporating this metric, investors can pinpoint stocks that analysts are currently upbeat about, unravelling a treasure trove of potential.

The Resilient JD.com

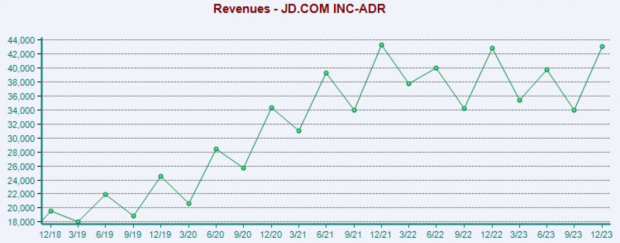

Peering into the realm of e-commerce, JD.com emerges as a stalwart online direct sales company in China. Bolstered by the esteemed Zacks Rank #1 (Strong Buy), JD.com is basking in escalating earnings forecasts across various timeframes.

Trading at a modest 7.8X forward 12-month earnings multiple, the stock stands at a mere fraction of its five-year median and historical highs. Notably, its forward 12-month price-to-sales ratio comfortably hovers below the 0.5X five-year median.

Adding to its allure, JD.com has consistently outperformed the Zacks Consensus EPS estimate in its last ten quarterly reports, a feat worthy of commendation.

KB Home: Building the Future

In the domain of home construction, KB Home shines as a prominent player in the United States. Analysts have embraced a bullish sentiment, driving the stock to a Zacks Rank #1 (Strong Buy) status.

Trading at an enticing 7.3X forward 12-month earnings multiple, KB Home sits slightly below its five-year median and 2020 highs. The forward 12-month price-to-sales ratio is equally appealing, currently positioned beneath the 0.8X five-year high.

AllianceBernstein: Navigating Investment Horizons

Firmly rooted in diversified investment management services, AllianceBernstein, holding a Zacks Rank #2 (Buy), caters primarily to pension funds, endowments, and individual investors.

The positive trajectory in earnings forecasts for the current fiscal year, exemplifying 14% year-over-year growth based on the $3.05 Zacks Consensus EPS estimate, underscores AllianceBernstein’s potential.

Intrinsic Value Unveiled

Embarking on a journey to unearth undervalued stocks signifies more than just a quest for bargains; it embodies a profound strategy that anticipates the eventual realization of these discounts by the broader market, culminating in substantial returns.

Pairing this approach with the perceptive Zacks Rank, tailored towards scrutinizing earnings estimate modifications, offers a blueprint to identify mispriced stocks poised for imminent growth.

The trio of stocks, JD.com, KB Home, and AllianceBernstein, beckons to value-focused investors, accentuated further by their ‘A’ and ‘B’ Style Scores for Value.