Setting the Stage

The tech arena, abuzz with anticipation, as two behemoths—Alphabet and Microsoft—gear up to unveil their quarterly performances, vying for investors’ attention alongside the likes of Tesla and Meta Platforms.

Quarterly Expectations

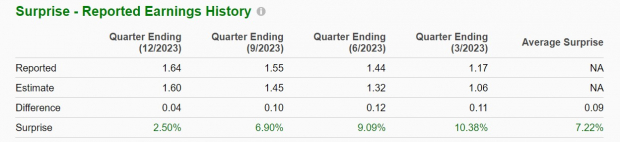

Alphabet’s Q1 projections paint a rosy picture, with an expected earnings surge of 27% to $1.49 per share, accompanied by a 14% hike in sales to a bountiful $66.02 billion, building upon its stellar record of surpassing earnings forecasts for the past four quarters.

Meanwhile, Microsoft’s story is no less compelling, having outshone EPS estimates for six consecutive quarters, with a predicted 14% uptick to $2.81 per share in the current fiscal quarter and a 15% rise in Q3 sales to $60.63 billion.

Performance & Valuation Comparison

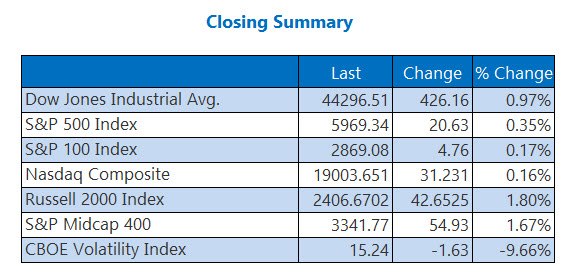

As both Alphabet and Microsoft bask in double-digit stock growth this year, with +13% and +8% respectively, they outshine broader market averages, with both stocks soaring over +40% in the past year, leaving the S&P 500 and the Nasdaq grasping for the coattails of these voracious titans.

Eye on Valuations

In terms of P/E valuations, Alphabet takes the crown, trading at a modest 23X forward earnings multiple, sitting close to the S&P 500 benchmark of 20.9X, while Microsoft stands at a lofty 34.5X. Notably, Alphabet remains a bargain, shadowing its decade-long median of 26.1X, while Microsoft flirts with its price ceiling, perched near its historical high of 37.4X.

Earnings Estimate Revisions

While Alphabet’s earnings forecasts hold steady, with slightly promising updates for FY25 EPS, a shadow looms over Microsoft’s camp, with slight declines in current quarter and FY24 estimates, offset by a stagnant FY25 EPS outlook.

Final Verdict

Standing at the crossroads of investments, Alphabet boasts a Zacks Rank #3 (Hold) against Microsoft’s less favorable Zacks Rank #4 (Sell), a tale spun by the yarn of earnings estimations dancing in Alphabet’s favor, coupled with a more attractive P/E valuation, while Microsoft grapples with premium valuation and dwindling FY24 EPS numbers.