The Information Technology Sector’s Consistent Market Dominance

Over the last decade, the benchmark S&P 500 delivered an impressive 220% return, compounding annually at 12.3%. Notably, this exceptional performance was largely fueled by a single sector among the various market segments tracked by the index.

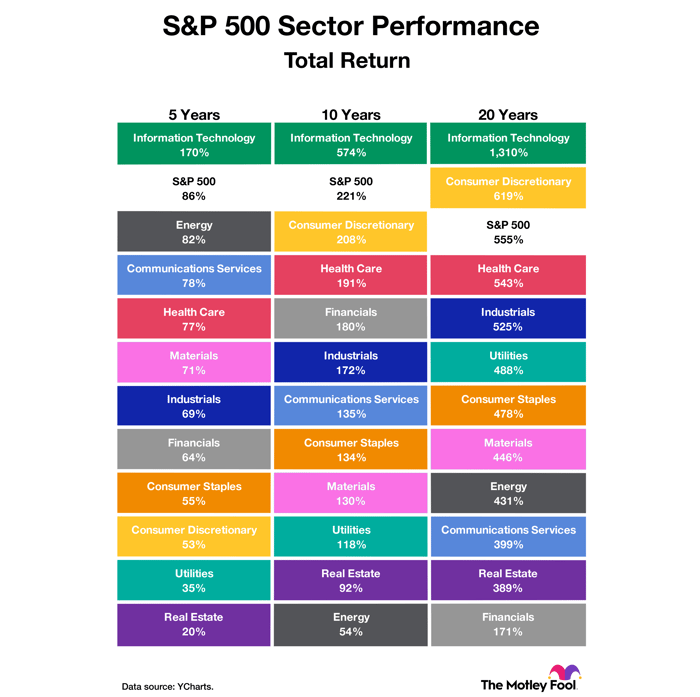

Specifically, the Information Technology sector stands out for not only surpassing the S&P 500 returns in the last ten years but also emerging as the top-performing sector over the past five, ten, and even twenty years.

The Influence of Artificial Intelligence on Technology Stocks

The rise of the internet in the mid-1990s heralded a technological revolution encompassing mobile devices, e-commerce, cloud computing, cybersecurity, and software-as-a-service, shaping subsequent decades. This wave of transformative technologies has propelled the Information Technology sector ahead of other market sectors, as illustrated by its superior performance compared to the broader market benchmarks.

Many experts foresee artificial intelligence (AI) as a groundbreaking force set to reshape various industries fundamentally. Figures like former Microsoft CEO Bill Gates and JPMorgan Chase CEO Jamie Dimon have likened AI’s impact to revolutionary historical inventions like the printing press and the internet.

With AI poised to permeate multiple sectors, technology companies focusing on chips, cloud solutions, and software are in a prime position to benefit. This anticipated trend could potentially sustain the Information Technology sector’s outperformance for years to come.

Vanguard Information Technology ETF: Tracking Tech Giants

The Vanguard Information Technology ETF comprises 313 technology stocks classified into three main categories: software and services firms, technology hardware and equipment providers, and semiconductor manufacturers.

The fund’s top ten holdings, dominated by Microsoft and Nvidia, demonstrate a substantial exposure to companies well-positioned to capitalize on the AI-driven future. Analysts view Microsoft’s generative AI monetization strategies and Nvidia’s unique cloud-based AI-as-a-service offerings as particularly promising.

While Microsoft and Nvidia lead the way, the Vanguard ETF’s diversity allows investors to tap into the potential growth of numerous tech stocks, providing broad exposure to the evolving tech landscape.

Potential Growth Trajectory of Vanguard Information Technology ETF

With a remarkable 1,160% return over the past two decades, compounding annually at 13.5%, the Vanguard Information Technology ETF has demonstrated its growth potential. A conservative assumption of 12% annual returns suggests that monthly investments of $250 could amount to $57,500 in ten years, $247,300 in twenty years, and $873,700 in three decades.

However, this growth potential comes with accompanying risks, as the Vanguard Information Technology ETF has historically exhibited significant volatility, highlighting the importance of thorough investment consideration.

The Resilient Journey of Vanguard World Fund – Vanguard Information Technology ETF

Over the past decade, Vanguard World Fund – Vanguard Information Technology ETF has weathered the financial storms with a beta of 1.15. This figure signifies the ETF’s movement of 115 basis points for every 100-basis-point shift in the S&P 500. Buckle up, because this rollercoaster of volatility is poised to continue into the future.

An Eye on Expenses: Vanguard Information Technology ETF

Another key consideration lies in the expense ratio. The Vanguard Information Technology ETF proudly flaunts a meager expense ratio of 0.1%, translating to a mere $10 annual fee for every $10,000 invested. In contrast, similar funds boast an average expense ratio of 0.98%, as reported by Vanguard.

Investing Wisdom: Decoding the Vanguard World Fund ETF Phenomenon

Before diving into Vanguard World Fund – Vanguard Information Technology ETF, savvy investors should ponder this nugget of insight: the esteemed analyst team at Motley Fool Stock Advisor has spotlighted the 10 best stocks for the future, and surprisingly, this ETF didn’t make the cut. Brace yourselves for the potential windfall that the chosen 10 stocks might deliver down the line.

Stock Advisor goes the extra mile to guide investors towards prosperity, furnishing them with a roadmap for success. The offering includes expert advice on crafting an investment portfolio, frequent updates from analysts, and a duo of fresh stock picks each month. Remarkably, the service has eclipsed the S&P 500’s returns by a staggering margin since 2002*

*Stock Advisor returns data evaluated as of April 22, 2024