Earnings Season Highlights

The Q1 earnings season continues to show steady improvement and resilience, with earnings growth slightly accelerating and estimates for the upcoming periods on the rise. While positive surprises are not as high as in previous periods, the growth trajectory is promising.

- Total earnings for the 310 S&P 500 members that have reported Q1 results show a 5.0% increase from the same period last year, with a 4.5% rise in revenues. A noteworthy 78.1% have surpassed EPS estimates, and 59.4% have exceeded revenue expectations.

The Technology sector remains a significant contributor to growth in the 2024 Q1 period. If not for the robust Tech sector earnings, the remaining index’s earnings would have declined by 2.6% rather than the observed 4.8% increase.

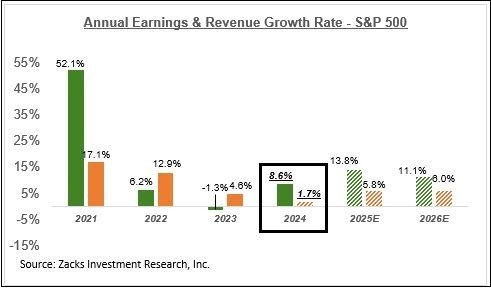

- Projections for total S&P 500 earnings indicate an 8.6% growth for this year, following a modest decline last year. Excluding the substantial Tech sector contribution, which is expected to see a 16.0% earnings growth in 2024, the rest of the index’s earnings would grow by 5.9%.

Recent weeks have shown an optimistic trend in revisions, with estimates seeing a slight uptick for both the current period (2024 Q2) and full-year 2024 estimates.

While some sectors like Tech and Retail have already experienced positive estimate revisions, half of the 16 Zacks sectors now have higher aggregate earnings estimates compared to the year’s beginning.

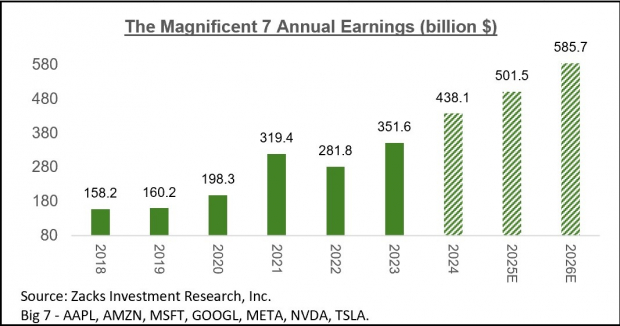

In recent discussions, the Energy sector’s favorable revisions trend was highlighted. This week delves into the evolving earnings outlook for the ‘Magnificent 7’ stocks.

Earnings Trends Evolution

The aggregate earnings for this group reflect an annual basis performance, demonstrating an upward trend over the years.

Image Source: Zacks Investment Research

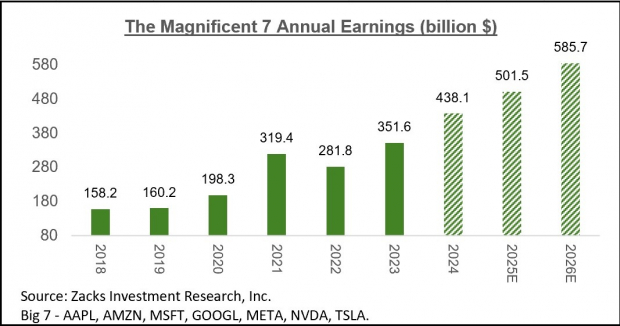

The current expected earnings for 2024 show a positive trajectory, with an increase compared to the previous week’s figures.

While Tesla and Apple have experienced negative revisions, the remaining five members of the group show positive trends that offset the former. Among these, Nvidia stands out for its stellar performance.

Image Source: Zacks Investment Research

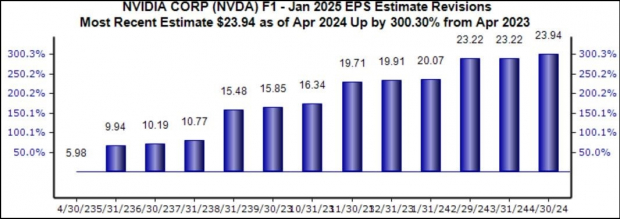

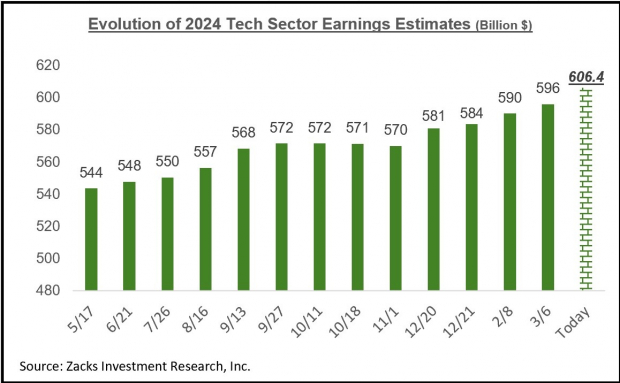

A comprehensive look at the sector’s full-year earnings estimate evolution reveals a positive growth trajectory over the past year.

Image Source: Zacks Investment Research

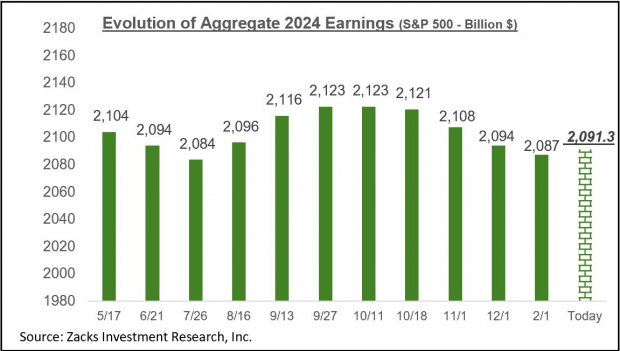

Additionally, the S&P 500 aggregate earnings estimates for full-year 2024 have shown clear developments over time.

Image Source: Zacks Investment Research

The overall earnings picture for the S&P 500 index paints a positive trajectory in annual earnings performance.

Image Source: Zacks Investment Research

Anticipated earnings growth for this year primarily hinges on margin improvements, with expectations to return to the 2022 levels. The Tech sector is forecasted to drive most of these gains, solidifying its pivotal role in the market.

The current shift towards positive estimates and growth prospects bodes well for investors eyeing strong potential gains in the market.