In 2023, the artificial intelligence (AI) market witnessed an explosion, drawing businesses from various sectors into the arena. Initially perceived as a fleeting trend, the sustained gains seen by numerous companies in the AI landscape indicate a more enduring technological upheaval.

The AI market amassed nearly $200 billion in revenues last year and is on track to approach $2 trillion by 2030. With the industry’s expenditure surging, investing in AI remains a timely opportunity.

Microsoft (NASDAQ: MSFT) and Advanced Micro Devices (NASDAQ: AMD) emerge as two enticing choices, with one excelling in AI software services and the other playing a vital role in chip manufacturing.

Here, we delve into these tech titans to ascertain the superior investment prospect in the realm of AI.

Microsoft’s AI Prowess

Following Microsoft’s earnings report for the third quarter of 2024, its shares surged by 5% during extended trading on April 25. The quarter recorded a 17% year-over-year revenue escalation to $62 billion, surpassing Wall Street’s projections by $1 billion.

Notably, the most substantial growth materialized in Microsoft’s Intelligent Cloud segment, incorporating earnings from its AI-centric cloud platform, Azure, which exhibited a 21% year-over-year revenue expansion, underscoring the potential lucrativeness of Microsoft’s AI initiatives.

Microsoft’s early investment in AI, with a $1 billion infusion into ChatGPT developer OpenAI in 2019, has since burgeoned to around $13 billion. This investment grants Microsoft access to cutting-edge AI models in the industry.

The synergistic integration of OpenAI’s technology across Microsoft’s product suite, encompassing new applications in its Office suite, cloud platform Azure, and search engine Bing, signifies Microsoft’s formidable position in the AI domain.

Advanced Micro Devices’ AI Ascendancy

AMD’s stock soared by 83% over the past year, underpinned largely by its future AI prospects rather than concrete outcomes.

While AMD was slightly tardy to the AI fiesta, its competitor Nvidia gained an early lead. Nonetheless, AMD is set to unveil its first-quarter 2024 earnings on April 30, potentially showcasing the fruition of its AI investments.

In the preceding year, AMD redirected its business towards the industry by launching its AI graphics processing unit (GPU), MI300X, to rival Nvidia’s offerings. Noteworthy clients such as Microsoft, Oracle, and Dell have already adopted AMD’s latest chips.

All eyes are on AMD’s data center segment’s growth in Q1 2024. Analysts at Zacks forecast a 76% year-over-year revenue surge to $2.28 billion for AMD’s data center division in the quarter. A successful meeting of these expectations could spark a rally in AMD’s stock value.

Verdict: Microsoft vs. AMD

Both Microsoft and AMD have made significant strides in AI and are poised to play pivotal roles in the industry’s evolution over the next decade. Moreover, these companies benefit mutually, with Microsoft incorporating AMD’s chips in its network infrastructure.

Yet, Microsoft emerges as the more dependable investment choice, owing to the potency of its services and its second-largest market share in cloud computing. Boasting billions of users on its Office and Azure platforms, Microsoft appears primed to be at the forefront of commercial and public AI adoption.

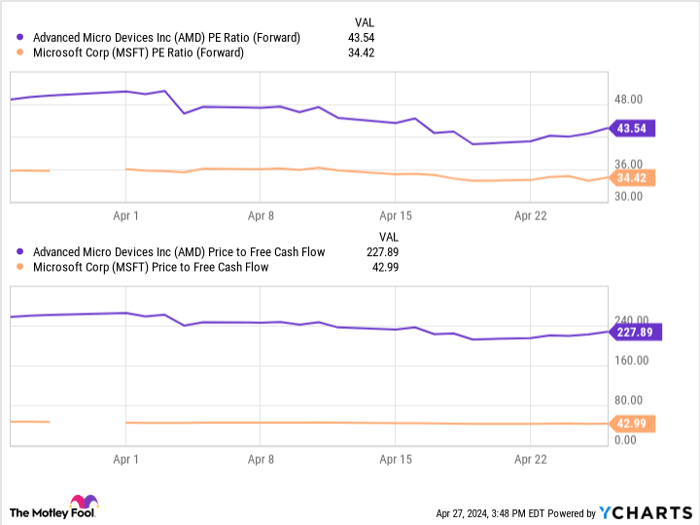

Furthermore, a comparative analysis reveals that Microsoft’s stock presents a more compelling value proposition than AMD’s. Microsoft’s forward price-to-earnings (P/E) ratio and price-to-free cash flow are notably lower than AMD’s counterparts, indicating that Microsoft offers better value for investors.

Microsoft’s stock, operational at 34 times earnings, though not a bargain, trumps AMD’s 43. Similarly, Microsoft’s free cash flow reached $70 billion last year, dwarfing AMD’s slightly over $1 billion, illustrating Microsoft’s superior capacity to sustain AI investments and compete effectively with its peers.

With Microsoft’s stellar quarterly outcomes, rapid cloud expansion, and substantial financial resources, the company justifies its higher valuation. In my perspective, Microsoft currently outshines AMD as an AI-focused investment.

Where to Allocate $1,000 Today

When expert analysts offer insights, it behooves investors to pay heed. Notably, the two-decade legacy of the Motley Fool Stock Advisor newsletter, surpassing market returns by over triple, underscores the merit of their recommendations.*

The recent divulgence of the 10 best stocks for current investors includes Microsoft among the top picks, uncovering hidden gems potentially overlooked by the general populace.

*Stock Advisor returns as per April 30, 2024