Short-term reversals may momentarily dim our view of enduring bull markets, but a broader perspective reveals a different story.

The prevailing bull market, despite recent alterations in leadership, continues to thrive, underpinned by remarkable market breadth.

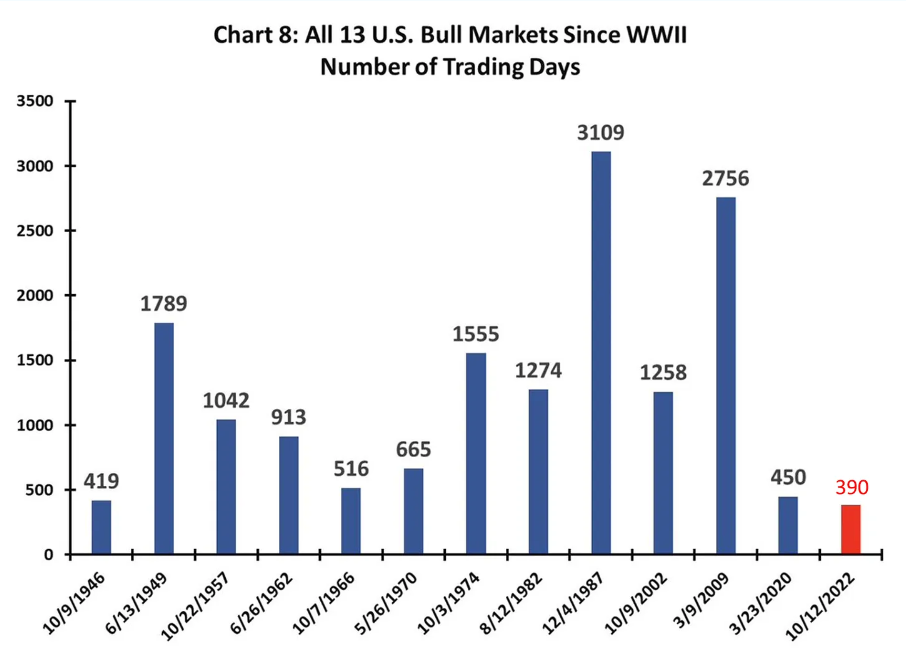

Should the current bull market terminate today, it would rank as one of the briefest since the postwar period, standing fourth to last out of 13 in total returns since inception (40.7%).

While the bull market that emerged from the aftermath of the 1946 scenario exhibited the weakest growth (+11%), the 2020 post-pandemic market soared with the most substantial gains (+94.5%).

The illustration below, depicting various bull markets since World War 2, starkly contrasts the current market trajectory against predecessors, emphasizing the divergent market landscape we navigate.

Anticipating Sector Shifts

The narrative of mega-cap growth stocks dominating the market in 2023 has shifted, with a noticeable surge in communication services at the onset of the new year.

Real estate sectors grapple with challenges, while the ascension of a leading middle sector victor remains undecided – indicative of market uncertainties regarding dominant sectors.

Navigating Market Breadth

The growth versus value ratio, climbing steadily since September 2020, endeavored to surpass previous peaks set in 2021 and 2023.

Marking a breakout towards the end of the prior year, 2024 ushers in a period of consolidation above a critical support level – often signaling a bullish continuation of the prevailing long-term trend.

An inclination towards growth stocks outperforming in the long haul is foreseeable, yet a transient dip could forewarn a tilt in favor of value stocks.

Despite speculations of an imminent bearish turn, a decline in market breadth is a requisite precursor. Presently, 58% of S&P 500 stocks maintain positions above their 200-day moving average, with new lows trailing the levels witnessed in 2023 – underscoring the absence of a definitive bear market phase.

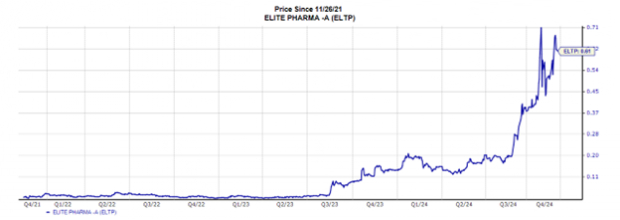

Illustrating the concepts discussed, the graphical representation conveys a nuanced understanding of market movements and potential shifts.

***