Got a hundred bucks you know you won’t be needing anytime soon? Want to do something constructive with it, and don’t mind a little volatility? There’s certainly no shortage of interesting growth stocks to consider. The ultimate growth stock to buy with $100 right now, however, is Google parent Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL).

A painfully predictable pick? You bet. In fact, Alphabet is such a commonly suggested stock that it’s almost become a cliche.

The Clarity of Business Models

You might be surprised how many investors will take on a stake in a company without fully understanding what that company does. Groupon comes to mind. While most people understand the business model now, they didn’t realize then that charging local businesses to offer — and honor — generous coupons was costing those paying clients more than it was worth to them.

That’s not the case with Alphabet. It’s clear what the company does. It’s first and foremost in the web advertising business, using the massive amount of web traffic that often starts with its search engine Google. GlobalStats’ StatCounter indicates that Google consistently handles more than 90% of the world’s web queries, with billions of people collectively making billions of searches every single day using its portal to the internet. It’s the world’s single busiest website, in fact, while its YouTube is the world’s second-busiest. There’s no ambiguity about how either platform makes its money. If you’re visiting either one, you’re going to see an ad sooner rather than later.

This clarity is important for shareholders, helping them evaluate potential challenges and distinguish between temporary setbacks and enduring obstacles.

Steady Growth Trajectory

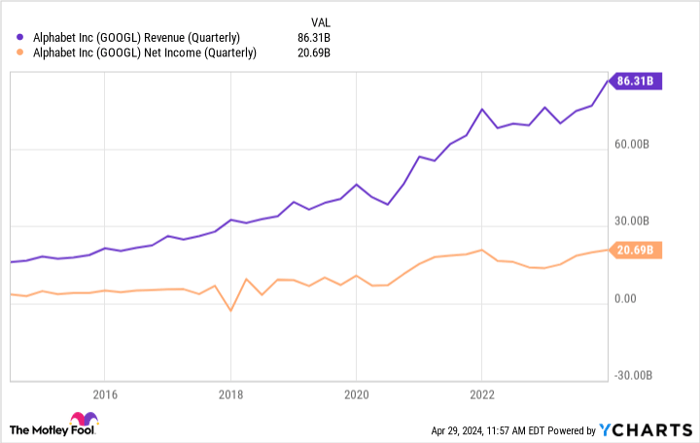

Alphabet’s growth might hit bumps, but it consistently bounces back to high growth rates. The recent years have shown this trend.

Like many internet-centric companies, Alphabet faced challenges early in the COVID-19 pandemic as advertisers cut back spending. However, the business saw a strong resurgence as online activity surged. Later into 2022 and last year, it faced another slowdown due to economic conditions and inflation. Despite concerns that its prime days might be behind, Alphabet’s ad revenue accelerated by nearly 14% year over year for the quarter ending in March, boosting its operating income significantly. YouTube’s revenue also grew by 21%, aligning with the company’s long-term performance.

Durable Market Position

Alphabet stock’s appeal as a growth investment stems from its enduring nature. While many industries come and go, the internet is a permanent fixture, ensuring ongoing demand for search services like Google. Google has become synonymous with web searches globally. This reliability also extends to online advertising, a cost-effective medium unlikely to lose relevance. For instance, YouTube now surpasses industry giants like Netflix and Walt Disney in U.S. viewership, solidifying its position as a formidable advertising platform.

Alphabet’s revenue diversification showcases the sustainability of its revenue streams, with YouTube contributing significantly to the company’s total earnings.

Alphabet: A Stock for the Long Haul

While higher-growth options exist, Alphabet’s growth is now constrained by its substantial size. Investors should maintain realistic expectations based on its historical performance. Nonetheless, Alphabet offers the advantage of a long-term investment that requires minimal monitoring. It’s a reliable choice for investors seeking stability without the need for constant market scrutiny.

The Unforeseen Fortunes of Investment: Unraveling the Gordian Knot of Alphabet Stocks

Many investors are enticed by the allure of quick rewards from short-term speculations. However, the siren call of immediate gains often blinds them to the long-term potential that lies within certain investments.

Analyze Before You Leap

Before diving headfirst into the world of Alphabet stocks, it’s wise to take a step back and consider the bigger picture.

The analysts at Motley Fool Stock Advisor recently pinpointed what they deem as the 10 best stocks for investors at this moment, and interestingly, Alphabet did not make the cut. While this might deter some, it’s crucial to remember that the overlooked 10 stocks have the potential to yield monumental returns in the foreseeable future.

Reflect on the past; recall when Nvidia secured a spot on this prestigious list back on April 15, 2005. Those who heeded the recommendation and invested $1,000 at the time would now be sitting on a hefty sum of $544,015. A truly staggering figure that highlights the transformative power of strategic investment decisions.

The Power of Stock Advisor

Stock Advisor is not just a mere platform but a beacon of enlightenment for investors, offering a clear roadmap to success. It provides invaluable guidance on constructing a robust portfolio, regular insights from seasoned analysts, and monthly suggestions for promising stock picks.

It’s worth noting that since its inception in 2002, the Stock Advisor service has outperformed the S&P 500 by a jaw-dropping margin, more than quadrupling the return of the renowned index. Such consistent excellence over the years underscores the reliability and efficacy of their strategies.

When contemplating investment opportunities, it’s essential to look beyond the immediate horizon and envision the long-term repercussions of your choices. The tale of Alphabet stocks serves as a poignant reminder that lucrative prospects are often obscured within the maze of market fluctuations.

So, to invest or not to invest in Alphabet? The answer lies not in fleeting trends but in a well-thought-out strategy that considers the cyclical nature of the market and the enduring potential of a stalwart like Alphabet.

As the wheels of fortune continue to turn, it’s imperative for investors to navigate the tumultuous waters of the stock market with prudence, foresight, and a firm grasp on the underlying principles of investment.