Analysts envision a promising 12% upside potential for the iShares Russell Top 200 ETF (Symbol: IWL). Delving into the underlying holdings of the ETF, a comparison of trading prices against the average analyst 12-month forward target price has revealed a weighted average implied analyst target price of $139.49 per unit for IWL.

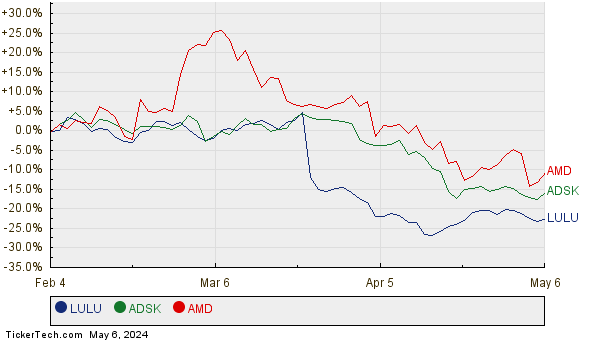

Currently trading around $124.66 per unit, analysts foresee an almost 12% upside for this ETF when pairing the average analyst targets of its underlying holdings. Notable among these holdings are lululemon athletica inc (Symbol: LULU), Autodesk Inc (Symbol: ADSK), and Advanced Micro Devices Inc (Symbol: AMD). LULU holds a significant 32.73% upside, with an average analyst target of $471.40/share despite its recent price of $355.15/share. Similarly, ADSK and AMD boast potentials of 32.71% and 26.68% respectively from their recent prices when looking at their analyst target prices. A historical comparison of their stock performances can be viewed in the chart below.

Further insight can be gained from the summary table below, showcasing the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell Top 200 ETF | IWL | $124.66 | $139.49 | 11.90% |

| lululemon athletica inc | LULU | $355.15 | $471.40 | 32.73% |

| Autodesk Inc | ADSK | $215.19 | $285.58 | 32.71% |

| Advanced Micro Devices Inc | AMD | $150.58 | $190.75 | 26.68% |

Are analysts justified in their targets, or perhaps overly optimistic about the future trajectories of these stocks? The validity of their predictions may rest on the pace of recent company and industry developments. A lofty price target relative to a stock’s current trading value can signal expectation and hope for the future, yet it could also turn sour if based on outdated information. Investors would be wise to conduct thorough research to draw their own conclusions.

Further Resources

See more: