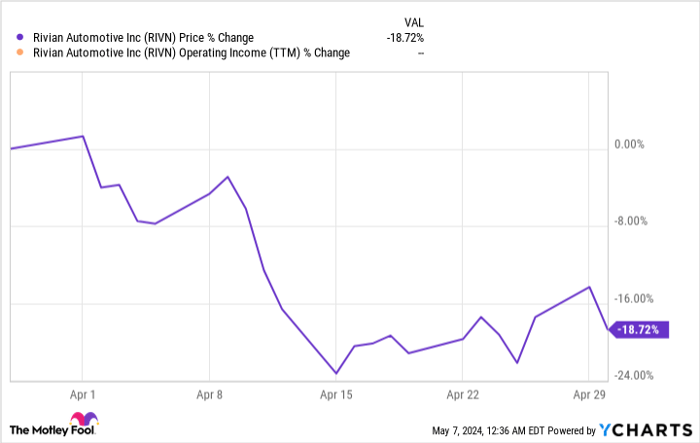

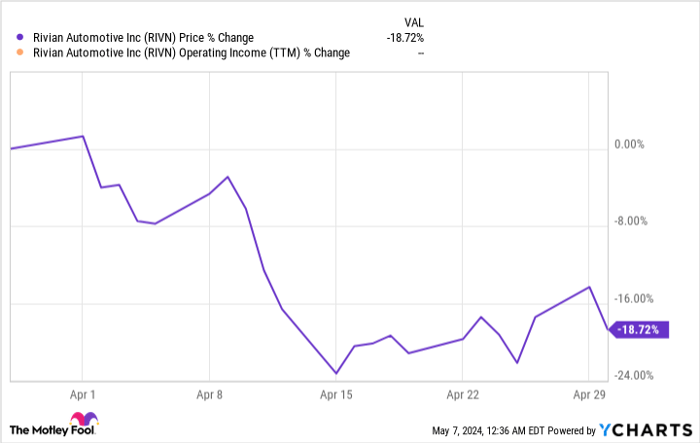

Shares of Rivian, the electric-vehicle (EV) maker traded under NASDAQ: RIVN, faced a tumultuous April, diving 19% amidst relentless pressure mounting on the EV sector.

The downward spiral was triggered by a confluence of events – competitors slashing prices, dwindling hopes of a Federal Reserve rate cut, and lackluster deliveries and financial performance by industry juggernaut Tesla.

According to S&P Global Market Intelligence, Rivian’s stock closed the month with a 19% decrease, predominantly occurring in the initial half of April.

Rivian’s Downhill Journey

April kicked off on a sour note for Rivian after the company’s delivery numbers matched expectations while reiterating its guidance to produce 57,000 vehicles for the year.

Rivian disclosed delivering 13,588 vehicles in the first quarter, leaving investors yearning for an upward revision in the guidance.

Simultaneously, Tesla’s report reflected a 9% slump in first-quarter earnings, exposing vulnerabilities in the broader EV landscape.

The second week of April proved to be the toughest for Rivian, compounded by Ford Motor slashing prices for the F-150 Lightning EV, intensifying the pricing rivalry between Rivian and Ford, two prominent EV pickup manufacturers.

Furthermore, the March Consumer Price Index release on April 10 exhibited a resurgence in inflation, dashing hopes of a Fed interest rate reduction later in the year. High interest rates suppress demand for pricey vehicles, whereas a rate cut was anticipated to alleviate luxury carmakers like Rivian.

On April 17, Rivian disclosed a 1% workforce reduction, a concrete step towards curbing its substantial losses.

Image source: Rivian.

Future Trajectory for Rivian

Investors await a significant update from Rivian post-market on Tuesday through its comprehensive first-quarter earnings report.

A surpassing performance may trigger a stock resurgence, yet daunting uncertainties loom as production growth eases and the EV domain appears to reach a plateau.

Analysts anticipate a 76% surge in revenue to $1.16 billion and a per-share loss of $1.17, contrasting with a $1.25 loss in the same quarter last year. A mere outperformance might not suffice to propel the stock upwards, as investors seek indications of progress towards gross profitability.

Is Investing in Rivian Automotive Prudent?

Prior to considering Rivian Automotive shares, contemplate this:

The Motley Fool Stock Advisor analysts recently recognized the 10 best stocks for investors to clinch superior gains, excluding Rivian Automotive from the list. The highlighted stocks hold the potential for monumental returns over the forthcoming years.

Recall when Nvidia debuted on this list in April 15, 2005… Investing $1,000 at the suggestion would yield a staggering $544,015!

Stock Advisor equips investors with a seamless pathway to success, offering portfolio construction tips, regular analyst updates, and bi-monthly stock recommendations. Since 2002, the Stock Advisor service has significantly outperformed the S&P 500.

*Stock Advisor returns as of May 6, 2024