The Nasdaq-100 Technology Sector index has dazzled investors, boasting a remarkable 50% surge in the past year. This upward trajectory has been fueled by the rampant growth of artificial intelligence (AI), propelling key components of the index into a red-hot rally.

Take, for example, shares of Nasdaq-100 cornerstone Nvidia (NASDAQ: NVDA), which have skyrocketed by an astounding 221% in the last year. Nvidia’s meteoric rise finds its roots in the company’s dominant stance in the AI chip market, where it commands a market share of over 95%, according to industry estimates.

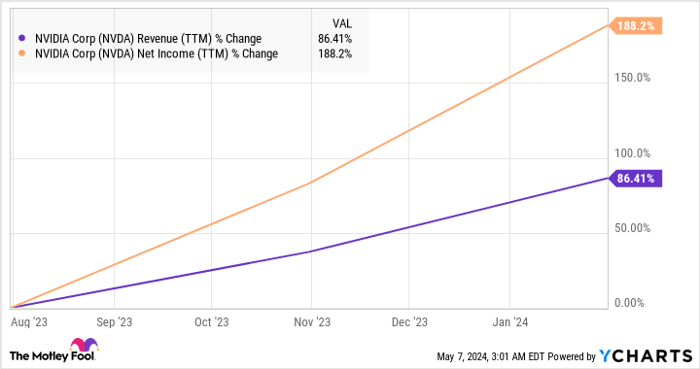

NVDA Revenue (TTM) data by YCharts.

Market analysts forecast a robust 38% annual increase in Nvidia’s earnings over the next five years. Should the company’s fiscal 2024 earnings of $12.96 per share be taken as a point of reference, the bottom line could potentially swell to nearly $65 per share in five years, as per analyst projections.

Even if Nvidia garners a price-to-earnings ratio of 30 in five years—mirroring the Nasdaq-100’s earnings multiple—its stock price may catapult to $1,950, marking a 112% uptick from current levels.

However, Nvidia is not the sole contender reaping bountiful rewards from the AI boom. Two other Nasdaq stocks are leveraging the AI wave and hold the potential for outperforming Nvidia in the ensuing five years.

Exploring the AI Vanguard: Super Micro Computer

Super Micro Computer (NASDAQ: SMCI) outshone Nvidia in the past year, witnessing an impressive surge of 505%. Renowned for its AI server solutions, Supermicro stands poised to continue surpassing Nvidia’s growth in the coming half-decade, owing to the rapid expansion within its operational sphere.

Data center operators deploy Supermicro’s servers to house chips from industry giants like Nvidia and others, curbing their operational expenditure. Supermicro’s modular server solutions aim to curtail electricity and cooling expenses in data centers.

For instance, Super Micro rolled out liquid-cooled server solutions for deploying Nvidia’s immensely popular H100 chips in May last year, asserting a 40% reduction in electricity costs within data centers. Additionally, the company claims that its liquid-cooled H100 servers could cut cooling expenses by 86% compared to existing data centers.

In light of the remarkable electricity consumption by AI data centers, the demand for Supermicro’s servers is spiraling upward. This accounts for the remarkable revenue and earnings surge witnessed by the company in the previous quarter. Super Micro’s fiscal 2024 third-quarter revenue (for the three months ending March 31) soared threefold year over year to $3.85 billion, with earnings skyrocketing fourfold to $6.65 per share.

Forecasts indicate that Supermicro’s annual earnings are projected to escalate by 62% over the next five years. Given the anticipated 30% annual growth rate within the AI server market over the ensuing decade, Supermicro appears to be sprinting ahead of the market it serves, thereby justifying analysts’ expectations of sustained earnings growth. Assuming a 60% annual earnings growth rate over the next five years, the company’s earnings could potentially spike to $124 per share.

Applying the Nasdaq-100’s earnings multiple of 30 to the projected earnings suggests a $3,720 stock price in five years, marking a staggering 348% surge from current levels. Even in scenarios where growth tempers, Supermicro still displays a strong growth trajectory compared to Nvidia. Therefore, for investors eyeing an AI stock, Supermicro emerges as a formidable alternative to Nvidia, poised to potentially outshine the latter over the next half-decade.

Meta Platforms: Building Momentum in AI Integration

Meta Platforms (NASDAQ: META) is another tech behemoth capitalizing on the AI surge. The social media juggernaut has been seamlessly embedding AI tools across its platforms and harnessing the technology to bolster advertisers’ returns on investment.

CEO Mark Zuckerberg recently elaborated on Meta’s AI endeavors during the company’s first-quarter earnings conference call. He highlighted the broad integration of the company’s generative AI assistant, Meta AI, which has already piqued the interest of “tens of millions of people” and is set to expand across more countries and languages in the near future.

Meta AI is finding its way into WhatsApp, Facebook, Messenger, and Instagram. From empowering creators to craft high-quality visuals to aiding businesses in recommending products to customers, Meta Platforms is positioning itself to monetize its AI offerings over the long haul. According to Zuckerberg:

On the upside, once our new AI services reach scale, we have a strong track record of monetizing them effectively. There are several ways to build a massive business here, including scaling business messaging, introducing ads or paid content into AI interactions, and enabling people to pay to use bigger AI models and access more compute. And on top of those, AI is already helping us improve app engagement which naturally leads to seeing more ads, and improving ads directly to deliver more value.

The silver lining for investors lies in Meta’s AI initiatives injecting vigor into the company’s growth trajectory. Revenue witnessed a 27% year-over-year surge in the first quarter of 2024, reaching $36.4 billion. Simultaneously, earnings soared by an impressive 114% year over year to $4.71 per share. As Meta commences capitalizing on a broader array of its AI offerings, sustaining a healthy earnings growth rate appears promising in the long haul.

Exploring the Potential Growth of Meta Platforms in the AI Market

Meta Platforms: A Promising Future

The AI market is abuzz with excitement surrounding Meta Platforms and its innovative offerings in the artificial intelligence realm. Analysts have pegged the company’s potential earnings growth rate at a significant 28% annually over the next five years, a substantial leap compared to the 11% growth rate achieved in the past five years.

Based on the current earnings per share of $14.87 in 2023, analysts predict a potential surge to $51 per share over the next five years. This impressive growth trajectory hints at a prosperous future for Meta Platforms in the AI sector.

The Path to Stock Price Ascension

Should this growth materialize as anticipated, projections indicate a lucrative future for investors. By applying the Nasdaq-100’s earnings multiple of 30, a potential stock price of $1,530 after five years looms on the horizon – a remarkable 229% increase from current levels. With the stock currently trading at 27 times earnings, investors may find themselves on the cusp of a rewarding investment opportunity.

Should You Invest in Nvidia?

Contemplating investment options in the tech sector, an intriguing question emerges – should you consider investing in Nvidia? While the renowned Motley Fool Stock Advisor team does not currently recommend Nvidia among the 10 best stocks to buy, it serves as a stark reminder of past successes.

Reflecting on Nvidia’s inclusion on the list back in April 15, 2005, a hypothetical investment of $1,000 at that time would have ballooned to an impressive $550,688 by now. This remarkable growth underscores the potential rewards that shrewd investments can yield in the tech landscape.

Guiding investors towards success, the Stock Advisor offers a comprehensive blueprint for building a robust portfolio with regular updates and carefully curated stock selections. The service’s track record speaks volumes, having outperformed the S&P 500 by more than fourfold since its inception in 2002.

*Stock Advisor returns as of May 6, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.