If you’ve made a point of steering clear of China’s e-commerce behemoth Alibaba Group of late, that’s certainly understandable. The country’s economy is seemingly on the defensive, and the company is attempting to restructure itself with limited success so far. It would also be naïve to forget Beijing’s 2020 regulatory crackdown on many of the nation’s major technology names, the echoes of which may still be ringing.

These are all reasons Alibaba shares haven’t budged since 2022 following their steep sell-off from 2020’s peak.

Investors, however, are better served by looking to the future rather than remaining fixated on the past. And Alibaba’s future actually looks quite promising.

A New Path Ahead for Alibaba

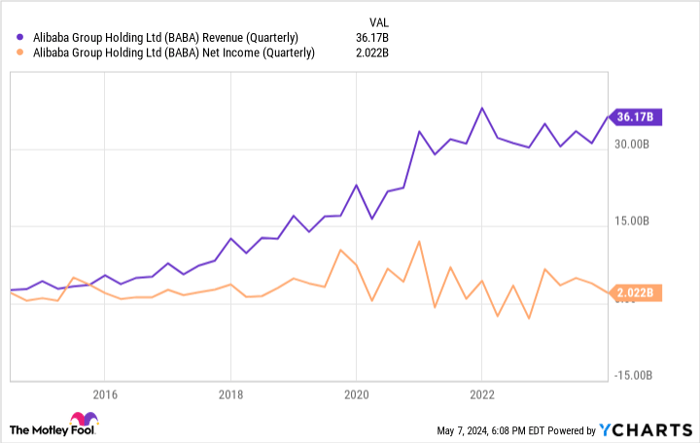

Some may disagree with that assessment. Its fourth-quarter revenue fell short of estimates, after all, only improving 5% year over year while adjusted net income slumped 4%.

Then, this past March, the company canceled its plans to spin off its majority stake in logistics subsidiary Cainiao, reminding investors of November’s cancellation of the planned spinoff of Alibaba’s cloud computing arm. These decisions could point to a lack of buyer interest in either business, meaning Alibaba is forced to figure out how to handle them on its own, and this may be easier said than done.

However, many of the headwinds holding Alibaba back are finally abating.

Take the overall health of China’s economy as an example. The country’s GDP grew 5.3% during Q1 2024, readily topping estimates. Moreover, UBS just raised its full-year GDP growth outlook for China from 4.6% to 4.9%, citing a recovery of its exports, in addition to a clear uptick in service-industry activity. The IMF recently upped its 2024 economic growth expectations for China as well.

And the country’s economic growth is benefiting its consumers. March’s retail spending improved 3.1% year over year, adding to the prior year’s tough comparison of 10.6% growth. In fact, after several strong months, China’s overall retail spending now stands at record levels, boding well for Alibaba’s online malls like Taobao and Tmall.

A Promising Turnaround Effort

But Alibaba itself still has much to figure out.

Chief among its internal challenges is figuring out what it wants to do — and what it can do — with its cloud computing division. Alibaba wanted out of that business despite its profitability, but just a few months ago, CEO Eddie Wu said, “I see very strong potential for greater synergy between Alibaba Cloud and the Taobao and Tmall Group, especially driven by AI.”

This may ultimately be the right move. The artificial intelligence market is set to grow at an annualized pace of 19% through 2032, according to Precedence Research, while the overall cloud computing market will likely grow at an average pace of 17% over the same time frame.

In the meantime, the company’s rethinking its Cainiao logistics unit, turning it into something more supportive of its e-commerce operation. For example, the company unveiled Cainiao Small Parcel last month, a service specifically meant to target Taobao and Tmall’s underserved third-party sellers that offer small-sized goods.

And speaking of e-commerce, for the first time in years, the Taobao website is undergoing an overhaul that should improve its shopping as well as its selling experience. This revamp includes tweaks like clearly marked discounts in shoppers’ digital shopping carts along with plans to better integrate its mobile shopping app and browser-based shopping.

This is only a small sampling of what’s currently in the works to turn the business around.

Revisiting the Potential

Not everyone sees the potential in these efforts, given Alibaba stock’s persistent weakness over the past several years. However, plenty of stocks underperform right up until they suddenly don’t, and this can catch investors off guard. There may not be a clear catalyst for a stock’s rally, but in many cases, the reasons for the rekindled strength only become obvious after the fact.

IBM comes to mind as an example. Most investors assumed it would simply fade into obscurity after the legacy tech company failed to break into more marketable industries like cloud computing or cybersecurity. But shares of IBM are up 35% in the past year, specifically because the company’s quietly been capitalizing on a hybrid cloud computing opportunity. General Electric is another example. Shares of the industrial icon are up 240% in the past two years as the company has successfully broken up its conglomerate into separate entities.

While there’s no guarantee Alibaba stock will be higher a year from now, from a risk-versus-reward perspective, long-term investors should view this growth stock’s deep discount as an opportunity rather than a red flag. Analysts expect its top line to grow in the upper-single-digit range over the next few years too.

Alibaba reports its full-year fiscal 2024 numbers on May 14.

Consider the Future

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $550,688!*.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends Alibaba Group and International Business Machines. The Motley Fool has a disclosure policy.