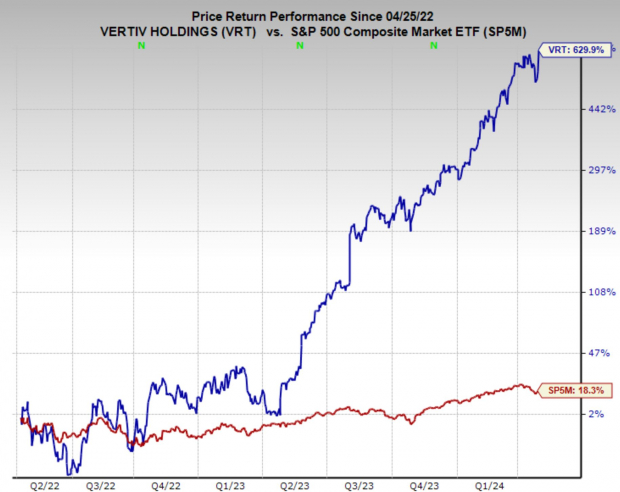

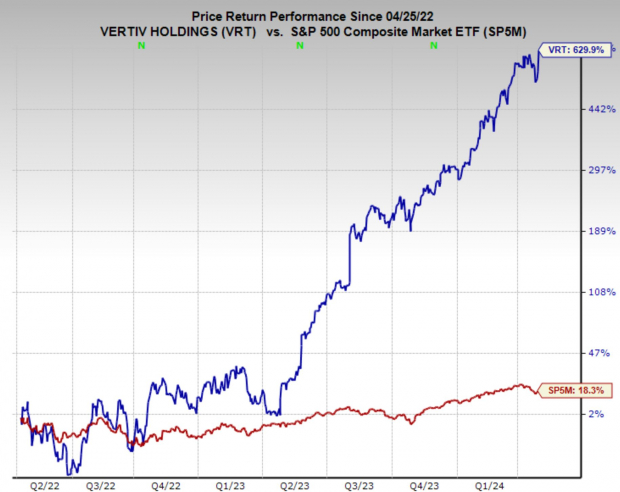

Vertiv Shines Bright: AI Infrastructure Stock Surges The Rise of Vertiv in the AI Landscape Vertiv (VRT), a key player in critical digital infrastructure such as data center and systems management, unveiled robust quarterly earnings today, driving its stock to record highs. As the artificial intelligence sector blooms, Vertiv's stock has been on a stellar trajectory over the past year, reflecting investors' recognition of its pivotal role in the AI landscape. Even with its remarkable ascent, Vertiv remains attractively valued, poised for prolonged growth, fortified by a top Zacks Rank portending possible further market upticks.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Empowering AI with Robust InfrastructureVertiv's recent earnings demonstrate the remarkable boost generative AI has provided to its operations, with no signs of waning. The company occupies a prime position within the AI surge, bolstering shareholder confidence. Vertiv’s pivotal contributions to the AI revolution include:

High-Density Power and Cooling Solutions: Vertiv's advanced data center solutions ensure optimal performance and prevent overheating in response to the escalating power demands of AI workloads. Technical Partnerships: Collaborations with industry leaders like Nvidia allow Vertiv to tailor solutions to meet the unique requirements of cutting-edge AI hardware. End-to-End Expertise: Vertiv offers comprehensive solutions that streamline AI infrastructure deployment and boost performance by managing power delivery and heat rejection effectively. Global Reach and Scalability: With a global presence, Vertiv can cater to the surging demand for data center infrastructure worldwide, adapting to evolving power and cooling needs across different regions.Given its pivotal role in the AI ecosystem, Vertiv emerges as a prime candidate among AI-related stocks for investment.

Impressive Earnings PerformanceVertiv's first-quarter financials for 2024 surpassed sales and earnings estimates, with a notable organic order surge of 60% year-on-year. Net sales soared to $1,639 million, marking an 8% increase from the same period in 2023. The quarter witnessed an operating profit of $203 million, with adjusted operating profit spiking to $249 million, a substantial 42% annual growth.

In a strategic move, Vertiv initiated share buybacks, repurchasing around 9.1 million shares at a favorable average price, which proved timely as stock prices surged subsequently. Upbeat about its performance, Vertiv raised its full-year 2024 guidance, projecting a 12% growth in net sales at the midpoint, coupled with increased operating and adjusted operating profits. The robust demand, especially in AI-led deployments and liquid cooling technologies, positions Vertiv for sustained growth in the evolving digital infrastructure arena.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

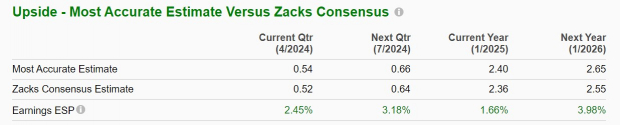

Considering Vertiv as an InvestmentVertiv's integral role in the AI domain, supported by its top Zacks Rank and reasonable valuation, marks it as an enticing investment prospect. With a Zacks Rank #2 (Buy), and optimistic earnings revisions for the next quarter and year, Vertiv exhibits promising growth potential. At a one-year forward earnings multiple of 33.5x, Vertiv's valuation surpasses its median but remains below the industry average, justifying its significance in the AI sector. Moreover, with an estimated annual EPS growth of 26.7% over the next 3-5 years, Vertiv's investment appeal shines brighter.

Exploring Other AI Investment AvenuesRecent market fluctuations have presented buying opportunities in the AI sector, with noteworthy tech and AI-related stocks witnessing dips of 10%-20%. Among the standout names in AI, Nvidia emerges prominently, presenting investors with a compelling avenue for AI-driven growth.

Insightful Analysis of Semiconductor Leaders Insightful Analysis of Semiconductor Leaders