The U.S. government has taken substantial strides to bolster the semiconductor industry, recognizing its vital role across multiple sectors like automotive, smartphones, computers, and artificial intelligence (AI).

An instrumental move was the enactment of the CHIPS and Science Act in 2022, which injected new life into the U.S. semiconductor sector. Through this initiative, the U.S. government has allocated approximately $30 billion in grants and $25 billion in loans to seven companies. As a result, projections indicate that semiconductor manufacturing capacity in the U.S. is poised to triple by 2032, marking a remarkable 203% surge in less than a decade as per a report by the Semiconductor Industry Association and Boston Consulting Group.

The Micron Technology Marvel

On April 25, Micron Technology (NASDAQ: MU) finalized preliminary terms with the U.S. government for a potential funding package of $6.1 billion under the CHIPS Act, alongside proposed loans of up to $7.5 billion. This grants and loans package aims to bolster Micron’s capital expenditure plans amounting to $50 billion for the development of cutting-edge chips in the U.S. until 2030.

This escalated production capacity promises to propel Micron’s growth trajectory significantly, enabling it to capture a larger portion of its market share. Micron, a dominant player in supplying dynamic random access memory chips (DRAM), held a 23% market share last year.

With robust demand for its DRAM chips, particularly stemming from AI applications, Micron is experiencing a surge. The company reported selling out its high-bandwidth memory (HBM) capacity for 2024, with a similar scenario unfolding for 2025. The skyrocketing demand for HBM, anticipated to triple this year and undergo further exponential growth, is projected to boost the memory market’s annual revenue to $338 billion in 2032 from $134 billion in 2023 according to Credence Research.

The Taiwan Semiconductor Manufacturing Company Thrive

Taiwan Semiconductor Manufacturing Company (NYSE: TSM), commonly known as TSMC, is another beneficiary of the CHIPS Act. In recent developments, the U.S. Department of Commerce proposed direct funding of $6.6 billion and an additional $5 billion in loans to support TSMC’s U.S. expansion plans. TSMC has completed one fabrication facility and is in the process of building two more in the U.S. Its latest endeavor includes the construction of a third facility in Arizona, bringing its total U.S. semiconductor investment to $65 billion.

The decision to establish the third plant is driven by a strategic vision to cater to heightened customer demand by leveraging cutting-edge semiconductor technologies domestically. TSMC has earmarked a significant portion (70% to 80%) of its 2024 capital budget, amounting to $28 billion to $32 billion, for advanced process technologies.

Benefiting from its dominant market position of 61% as the world’s leading foundry, TSMC is primed to capitalize on the industry’s overall growth. Industry forecasts project the semiconductor market to potentially reach $1.9 trillion by 2032 from $664 billion in the previous year, foreshadowing a tripling of its value within the decade. This bodes well for TSMC’s future prospects.

The Rise of TSMC: A Semiconductor Powerhouse in the Making

Analyzing TSMC’s Growth Trajectory

In the competitive arena of semiconductor manufacturing, Taiwan Semiconductor Manufacturing Company (TSMC) has been making bold moves. By expanding its manufacturing capacity and securing a larger market share, TSMC has positioned itself for success – a success that promises to be nothing short of meteoric.

Projected Earnings and Stock Performance

Industry analysts foresee TSMC’s earnings escalating at a whopping 21% annually over the next five years. Even if TSMC were to maintain a slightly more conservative 15% growth rate for the following decade, its per share earnings could soar to a commendable $25. This financial prowess translates to a stock price surge that could catapult TSMC’s value to $525 a share, based on current projected earnings.

A Glimpse into the Future

Such a surge would signify a remarkable three-fold increase from its current stock price, implying a golden opportunity for astute investors to ride the wave of revolution in the U.S. semiconductor industry by considering a long-term investment in TSMC.

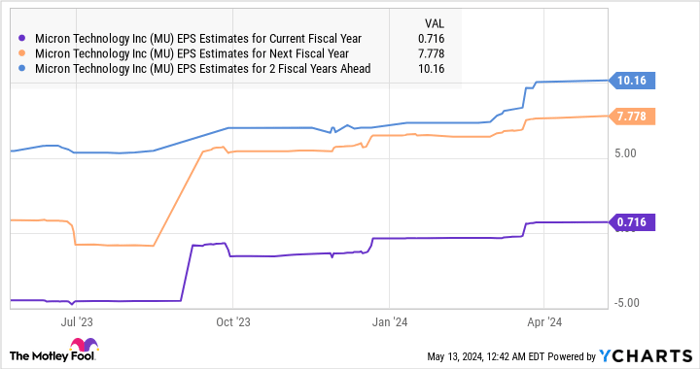

Underdog or Overachiever: The Micron Technology Dilemma

Considering an investment in Micron Technology? Before taking the plunge, contemplate this: the esteemed analyst team at Motley Fool Stock Advisor has brought to light what they believe are the top 10 stocks poised for growth, and Micron Technology fell shy of the cut. The stocks that made the list, however, could potentially yield colossal returns in the near future.

Reflect on the tale of Nvidia, which graced this prominent list back in April 15, 2005. A modest $1,000 investment at the time of recommendation would have snowballed into a staggering $553,880 – a testament to the power of strategic stock picks by credible sources.

Stock Advisor: A Blueprint for Success

The Stock Advisor platform equips investors with a clear roadmap to prosperity, offering valuable insights on constructing a winning portfolio, regular updates from seasoned analysts, and two fresh stock picks each month. Since its inception in 2002, Stock Advisor has outperformed the S&P 500 by a significant margin, multiplying returns in an impressive fashion.

Seeking more guidance on potential growth stocks? Explore the latest curated list of 10 promising stocks on Stock Advisor to uncover hidden gems in the market.

Disclaimer: The author mentioned has no current positions in the stocks discussed. However, it’s important to note that the Motley Fool holds positions in and recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool also endorses Intel and recommends specific options related to Intel stock.

*Stock Advisor returns are accurate as of May 13, 2024.