The Legacy of Ford Motor

With roots tracing back to its founding in 1903 by industry pioneer Henry Ford, Ford Motor has etched a formidable reputation as one of Detroit’s “Big Three” automakers. The multinational giant’s portfolio includes iconic brands such as Lincoln, Mustang, F-Series trucks, and Explorer SUVs.

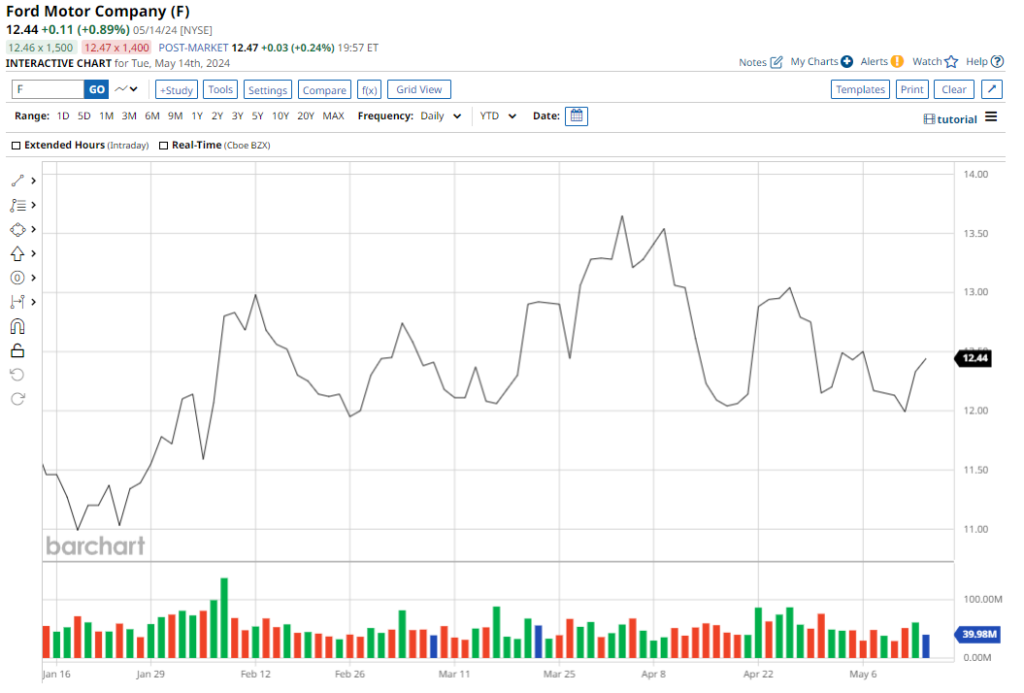

Despite its historical significance, Ford’s stock performance has been lackluster, trailing the market’s upward trajectory. The company boasts a market cap of $49.66 billion, showcasing a modest YTD growth of under 1%.

Resilient Dividends Amidst Adversity

While Ford’s stock struggles to compete with broader market valuations, its dividend yield shines as a beacon of hope for income-seeking investors. Currently offering a generous 4.82% forward dividend yield, Ford’s returns outstrip industry averages, outpacing competitors like General Motors and Honda Motors.

With a sustainable payout ratio of 31.75%, Ford’s dividend payments remain secure, leaving ample room for future increments and solidifying its appeal in the eyes of income-focused investors.

Ford’s Financial Landscape

Even amidst financial turbulence, Ford maintains a robust balance sheet, closing the first quarter with a cash reserve of $34.46 billion. However, the company grapples with a significant debt burden of $149.42 billion, primarily stemming from its financing arm, Ford Credit.

While Ford Credit’s debt load appears daunting, it is mitigated by corresponding assets, bolstering the company’s financial stability and lending support to its operational endeavors.

Driving Diversification in Turbulent Times

Ford’s diversified business model acts as a bulwark against industry headwinds, with distinct segments catering to varied consumer preferences. From traditional gasoline vehicles under Ford Blue to forward-looking electric offerings led by Ford Model E, the company’s product portfolio remains well-positioned amidst evolving market demands.

Furthermore, Ford Pro’s focus on commercial and government clientele, alongside the vital role played by Ford Credit in fueling sales, underscores the company’s strategic prowess in navigating the shifting automotive landscape.

Assessing Ford’s Investment Appeal

Analysts exhibit a mixed sentiment towards Ford’s stock, labeling it a “Hold” with a mean target price of $13.96, signifying potential upside from current levels. Amidst varying analyst opinions, Ford’s stock emerges as a compelling value proposition, trading at attractive multiples relative to industry peers and historical averages.