The Tech Boom and the Millionaire Rush

Recent surges in tech stocks, like the Nasdaq-100 Technology Sector’s impressive 51% rise since last May, have been creating ripples in the investment world. The rise in interest surrounding artificial intelligence (AI) has propelled various stocks to record highs. OpenAI’s ChatGPT launch showcased the technology’s potential to revolutionize multiple industries.

Among the beneficiaries, Advanced Micro Devices (AMD) has stood out with a 61% climb in its stock value over the past year. The company’s strong market share in graphics processing units (GPUs) and substantial investments in AI have endeared it to investors.

Intel: A Phoenix Rising Amidst Challenges

Intel’s journey has been tumultuous, facing setbacks since 2014, including losing market share in central processing units and ending a lucrative partnership with Apple. However, recent strategic shifts in its manufacturing approach are igniting hopes for a revival.

The company’s shift towards internal foundry models to rival giants like Taiwan Semiconductor is a bold move. Intel aims to save billions by 2025 and achieve impressive margins. The recent first-quarter results indicate a positive trajectory, with strong growth in its AI segment and promising gains in revenue and operating income.

Microsoft: Reigning Supreme in the AI Frontier

Microsoft’s meteoric rise, marked by a 35% surge in its stock value over the last year, has solidified its position as a tech giant. The company’s foresight in investing heavily in AI, like its partnership with OpenAI, has given it an edge over competitors like Amazon and Alphabet.

The recent second-quarter earnings reveal robust revenue growth across segments, with AI integration proving to be a game-changer. Microsoft’s history of creating millionaires and its current dominance in AI hint at a bright future.

Investing Insights on Intel

As investors contemplate the stock potential of Intel, it’s crucial to weigh various factors. While the company’s recent moves suggest a promising upward trend, analysts caution against overlooking other stocks with potentially higher returns in the future.

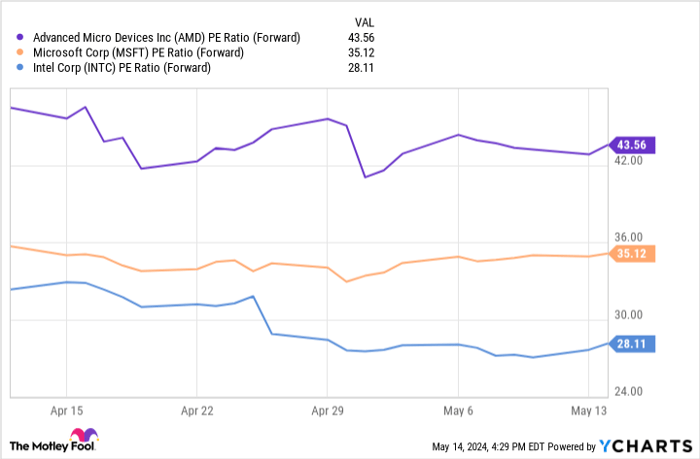

The historical success of companies like Nvidia serves as a reminder of the transformative power of strategic investments. Intel’s trajectory, coupled with its lower forward P/E ratio compared to AMD, may present a compelling opportunity for investors.

*Stock Advisor returns as of May 13, 2024.