A Bull Market Defying Odds

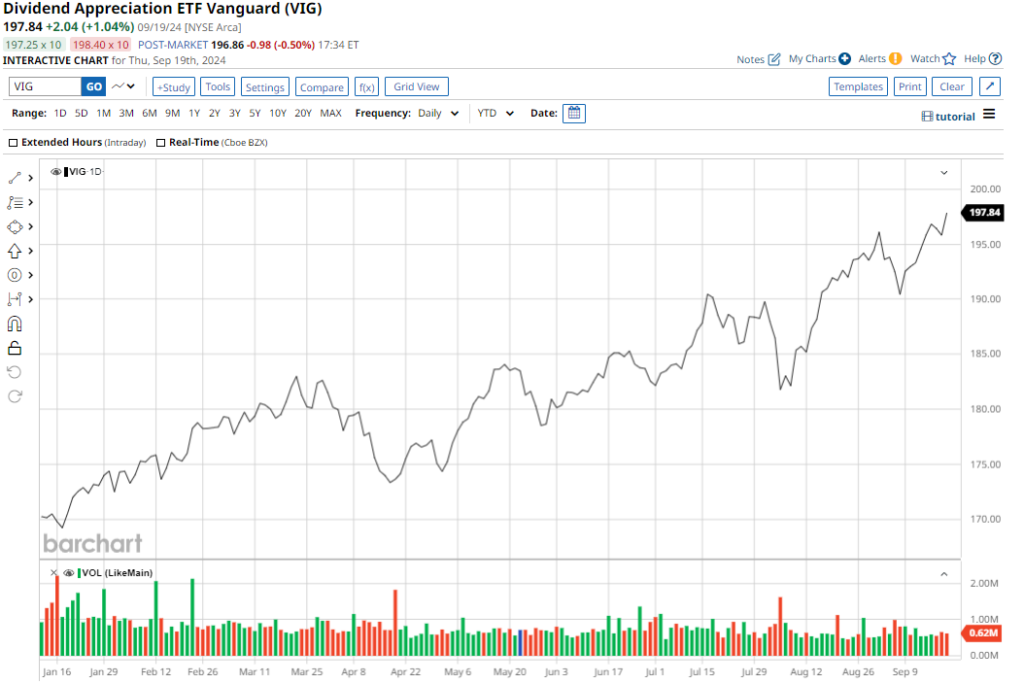

- The S&P 500 swiftly rebounded from a 5.5% setback, surging to an all-time high, affirming the uptrend that commenced in mid-October 2022.

- Currently enduring for 581 days with a 49% ascent, this bull market is fueled by anticipations of a Fed rate decrease and robust corporate earnings.

- European markets are gaining allure due to lower P/E ratios, superior dividend yields, and the likelihood of the ECB cutting interest rates before the Fed.

Following a brief dip of 5.5% from late March to mid-April, the S&P 500 swiftly recuperated, hitting another record high.

The new high reached by the S&P 500 acts as a stamp of approval for the upward trajectory kickstarted in mid-October 2022. Per market conventions, a bull market signifies a surge exceeding 20% post a decline of over 20%.

This ongoing bull market has now persisted for 581 days with a 49% advance. Although this may sound impressive, historical analyses reveal that the average bull market extends for about 1,010 days, with a spike of 114%.

Currently, 80% of S&P 500 constituents are surpassing their respective 200-day moving averages, showcasing a robustness not witnessed since September 2021.

The market’s momentum is primarily steered by two pivotal factors: expectations of a forthcoming Fed rate reduction and corporations outperforming market anticipations in terms of earnings. Unless met with significant corrections, the principal uptrend is anticipated to persist.

Moreover, Bank of America’s global survey of fund managers indicates that investor optimism has hit its peak since November 2021.

Long-term statistics emphasize that the stock market proves to be the premier investment avenue. Over the past century, the U.S. stock market notched an annual return (post inflation) of 6.6%, outshining other assets such as bonds (3.6%), bills (2.7%), and gold (1%). This equates to amplified returns and augmented purchasing power over time.

For context, a dollar invested in stocks in 1802 would have burgeoned to $705,000 by 2012. Conversely, the same dollar placed in bonds would have swelled to $1,780, while in gold, it would have dwindled to less than $5.

Analyzing Investor Sentiment

Bullish sentiment, characterized by the expectancy of stock prices ascending over the ensuing six months, remained stagnant at 40.9%, hovering above the historic average of 37.5%.

Bearish sentiment, signifying the anticipation of stock prices plummeting over the upcoming six months, dwindled to 23.3%, persisting beneath the traditional average of 31%.

Evaluating European Equities

Despite the buoyant outlook for U.S. markets, an escalating number of investors are turning towards European stocks. Several reasons contributing to this shift include:

- European stocks boasting lower price-to-earnings (P/E) ratios in comparison to those on Wall Street.

- More than double the dividend yields in Europe versus the U.S.

- The European Central Bank (ECB) poised to initiate interest rate reductions prior to the Federal Reserve (Fed), and with greater intensity. A departure from historical norms, as typically the ECB trails behind the Fed, awaiting the U.S.’s initial move.

***

Act expeditiously and harness market opportunities. Snag your OFFER HERE now!

Disclaimer: This article is penned solely for informative purposes; it does not constitute an urging, offer, counsel, or suggestion to invest, hence is not designed to incentivize asset purchases in any manner. It is crucial to underscore that all forms of assets are evaluated from several perspectives and encompass substantial risks, thus any investment decisions and associated risks lie solely with the investor.