Stability Amidst Uncertainty

Tesla (TSLA) has found a balance, perched just above the 50-day moving average, signaling potential stability in its stock price.

The Broken Wing Butterfly Strategy

Enter the broken wing butterfly options trade, a strategic play that defines a profitable realm between $160 and $175 for Tesla.

Let’s delve into the mechanics of this strategy – a butterfly spread with a unique twist, where long put options are asymmetrically placed with respect to the short put strike.

This maneuver, akin to a “skipped strike” in a butterfly configuration, gears towards a subtly bullish outlook.

A paramount aspect of this trade setup is to ensure a net credit position, effectively eliminating upside risk.

Anatomy of the TSLA Broken Wing Butterfly

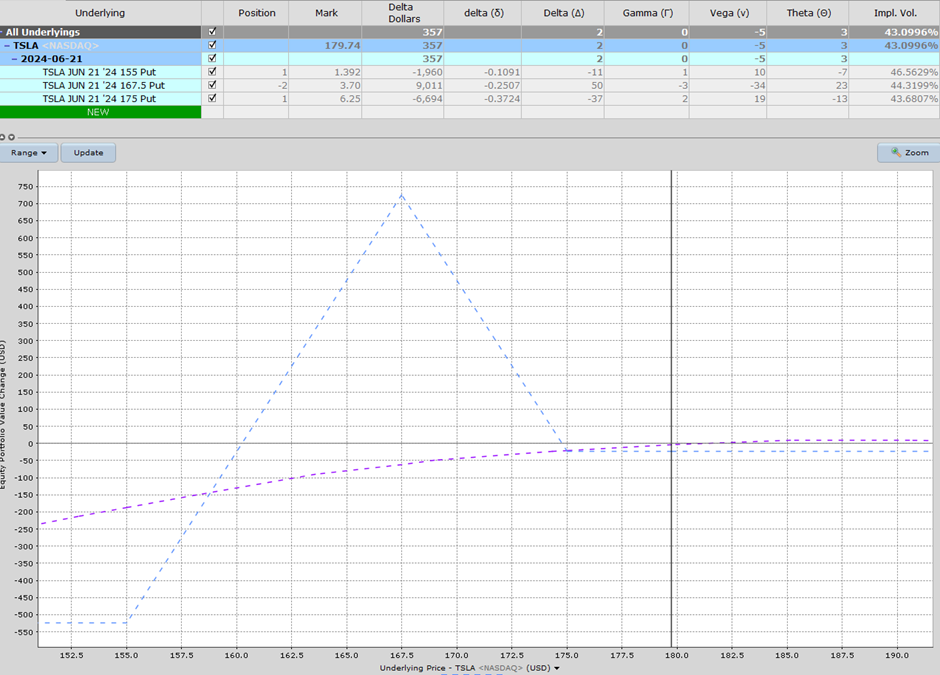

For a June 21 expiry trade on TSLA, traders might consider buying the $155 put, selling two $167.50 puts, and finally buying the $175 put.

As of the previous session’s close, here’s a breakdown of the trade:

Buy 1 June 21, $155 put @ 1.40

Sell 2 June 21, $167.50 put @ 3.65

Buy 1 June 21, $175 put @ 6.20

Note the strategic placement of puts, creating a net debit of $30 – defining the maximum upside risk.

One must be mindful of a swift downward movement early in the trade, representing the primary risk.

The Road to Profitability

The vision for this trade dance lies in Tesla’s slow descent towards the $167.50 mark by expiration, encapsulating the prime profit zone of $160 to $175.

This trade commences with a slight bullish tilt, as depicted by an initial delta of 2, eventually transmuting into a negative delta if Tesla lingers above $167.50 near maturity.

Prudent risk management entails setting a stop loss pegged at 10% of the capital at risk or a breach below $160 in Tesla’s price.

Charting the Journey

An illustration lays bare the delicate balance of risks and rewards in the broken wing butterfly strategy, with an early price retreat posing the primary threat.

Looking ahead, a peek into the trade’s future – revealing promising horizons between $163 and $190.

Conclusion

This strategic spectacle is poised to unfold gradually, barring any sudden plunges in Tesla’s stock price.

Dabble in this tactic not just with Tesla but other stocks too, albeit starting cautiously until the intricacies are firmly grasped.

Mitigating Risks and Looking Ahead

Always blueprint a plan to navigate adverse trade movements, possibly a 10% stop loss in this instance. Be wary of assignment risks if Tesla lingers below $167.50 close to expiry.

Remember, options harbor risk, with potential for a total investment loss. Educational enlightenment underscores this article, steering clear of explicit trade recommendations.