Analyst’s Upbeat Forecast

Recently, on May 23, 2024, Bernstein began coverage of Ford Motor (NYSE:F) with a resounding Outperform recommendation. This initiation comes at a significant juncture for the company, as it strives for growth and enhancement in an ever-evolving market.

Price Forecast Indicates Potential Growth

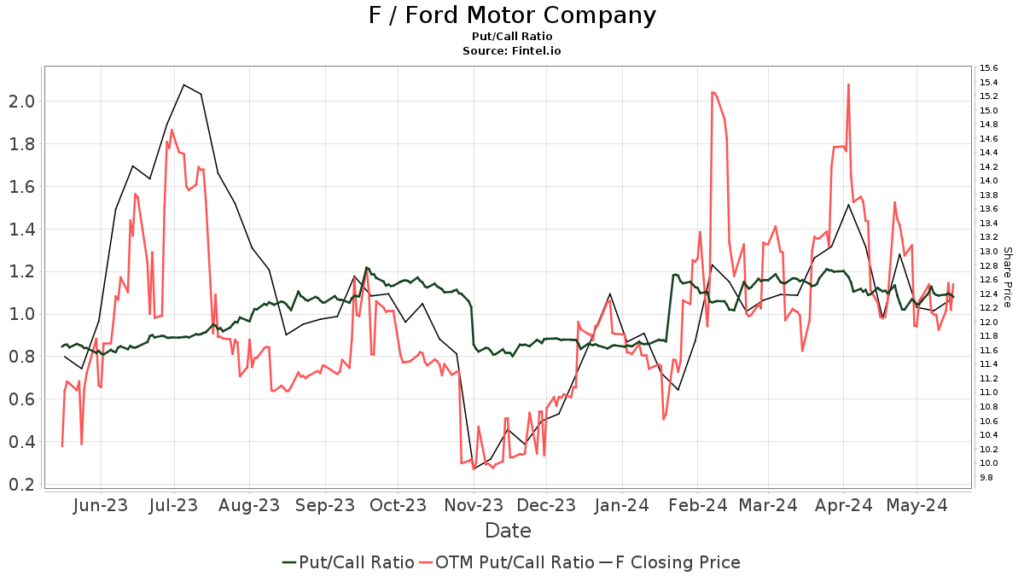

The average one-year price target for Ford Motor is projected to be 13.77, with forecasts ranging from 9.85 to $22.05. This estimation implies a substantial uptick of 14.43% from its latest closing price of 12.03. Analysts are suggesting a promising outlook for the stock, fueling optimism among investors.

Firm Fundamentals Amidst Change

Despite facing a forecasted 9.78% decrease in annual revenue, Ford Motor shows resilience with a projected non-GAAP EPS of 1.82. These figures showcase the company’s adaptive nature as it navigates through fluctuations in the automotive industry.

Insight into Fund Sentiment and Shareholder Behavior

With a notable 1.02% increase in the number of funds holding positions in Ford Motor, the company’s attractiveness to institutional investors is on the rise. The average portfolio weight of all funds dedicated to F has surged by 10.16%, signifying a growing confidence in the stock’s potential.

Stakeholder Allocations and Shifts

Institutional investors such as Newport Trust, Vanguard Total Stock Market Index Fund Investor Shares, Charles Schwab Investment Management, Vanguard 500 Index Fund Investor Shares, and Geode Capital Management have all made strategic adjustments to their holdings in Ford Motor. These shifts reflect varying sentiments and strategies in response to the evolving market dynamics.

Overview of Ford Motor

Based in Dearborn, Michigan, Ford Motor Company is a global corporation renowned for its diverse portfolio of vehicles, financial services through Ford Motor Credit Company, and ambitious pursuits in electrification, mobility solutions, and connected services. With a workforce of around 187,000 individuals worldwide, Ford continues to drive innovation and progress in the automotive sector.

Fintel is a premier investing research platform catering to a wide range of investors and financial professionals. Offering extensive data on various investment aspects, Fintel empowers users with valuable insights and tools to make informed decisions in the market.