When it comes to navigating the tumultuous waters of the stock market, investors often turn to the sage advice of Wall Street analysts. These financial gurus hold sway over the market sentiments, shaping the trajectory of stocks with their recommendations. But can we truly rely on their guidance?

Before delving into the intricacies of the brokerage world, let’s first explore what the Wall Street experts have to say about Cava Group (CAVA) and its investment outlook.

Understanding Broker Recommendations for CAVA

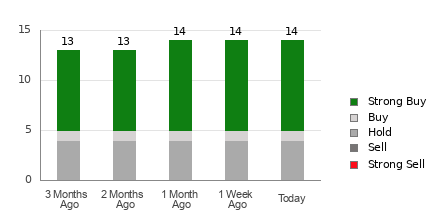

Cava currently boasts an average brokerage recommendation (ABR) of 1.61, falling between Strong Buy and Buy on the scale from 1 to 5. This metric aggregates the advice from 14 brokerage firms, with the majority leaning towards Strong Buy.

Of the 14 recommendations contributing to the ABR, nearly two-thirds are in the Strong Buy camp, underlining the bullish sentiments surrounding CAVA. However, a single Buy recommendation constitutes a smaller portion of the overall sentiment.

Trends in Brokerage Recommendations for CAVA

The graph below illustrates the breakdown of brokerage ratings for Cava:

While the ABR may signal a buying opportunity, it’s crucial for investors to exercise caution. Studies suggest that blindly following brokerage advice may not always yield the desired outcomes, as analysts often display a bias towards positive ratings, influenced by their firms’ interests.

So, how can investors make informed decisions amidst this sea of conflicting recommendations?

One potential guiding light in this murky landscape is the renowned Zacks Rank, a tool with a proven track record in forecasting stock performance. By corroborating the ABR with the Zacks Rank, investors can gain valuable insights into the future trajectory of a stock.

Distinguishing the Zacks Rank from ABR

While both the Zacks Rank and ABR are scored on a 1-5 scale, they serve distinct purposes. The ABR relies solely on brokerage opinions, often tainted by biases, whereas the Zacks Rank leverages earnings estimate revisions to forecast stock movements.

Unlike the ABR, which may lag in real-time updates, the Zacks Rank promptly reflects changes in earnings estimates, offering investors a timely gauge of a stock’s potential.

Is CAVA a Diamond in the Rough?

Analyzing the earnings landscape for Cava reveals an optimistic outlook, with the Zacks Consensus Estimate for the current year seeing a 2.9% uptick to $0.25. This surge in analyst confidence, coupled with a Zacks Rank #2 (Buy) designation for CAVA, hints at a promising future for the stock.

Considering the strong consensus among analysts regarding the company’s earnings potential, investors might find CAVA a compelling prospect for their portfolios.

Highest Returns for Any Asset Class

Comparing investment options, the allure of Bitcoin shines bright, outperforming other forms of decentralized currency. Historical data paints a rosy picture, with Bitcoin delivering impressive returns in past presidential election years, a trend that Zacks foresees continuing.

A word to the wise: while past performance is no guarantee of future success, the meteoric rise of Bitcoin serves as a beacon for investors seeking substantial gains.