The Rise of Taiwan Semiconductor

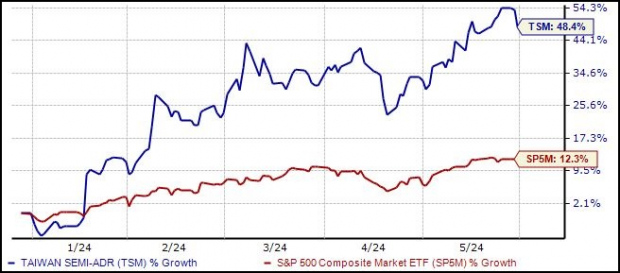

Taiwan Semiconductor, symbolized by the TSM ticker, recently ascended to greater heights with better-than-expected financial results. Surpassing the Zacks Consensus EPS estimate by nearly 7% and showcasing a 2.7% sales increase, TSM experienced a 5% rise in earnings and a remarkable 13% surge in revenue year-over-year. This financial feat, paired with surging demand, catapulted TSM shares upward, boasting a 50% boost in 2024 alone, outshining the S&P 500’s performance.

The company’s decision to elevate its dividend by 10%, elevating the quarterly payout to $0.45/share, cements its dedication to generously rewarding its shareholders. Positioned as a top pick among income-driven investors seeking exposure to the technology and semiconductor sectors, Taiwan Semiconductor’s commitment to enhancing shareholder value heralds a promising future.

Advanced Drainage Systems: Navigating the Waters of Success

Advanced Drainage Systems (WMS) has been charting a course to success in 2024, amassing a 22% gain relative to the S&P 500’s 12% upsurge. The company’s stellar financial performance, consistently exceeding the Zacks Consensus EPS estimate by an average of 30% over its last four releases, underpins this upward trajectory.

By announcing a 14% increase in its quarterly dividend, bumping the payout to $0.16/share, WMS exemplifies its shareholder-friendly ethos. With a commendable five-year annualized dividend growth rate of 12%, Advanced Drainage Systems is poised for sustained expansion. Forecasts suggest a 5.6% growth in earnings and 5% higher sales in FY25, while an anticipated FY26 unveils a projected 17% earnings surge accompanied by a 7% sales upswing.

Northrop Grumman: A Defense Strategy for Resilience

Northrop Grumman, a stalwart in the defense sector, recently fortified its position by unveiling a significant 10% dividend boost, amplifying the quarterly payout to $2.06 per share. While NOC shares have faced a minor downturn of approximately 4% year-to-date, lagging behind the broader market, positive earnings estimate revisions for the current fiscal year indicate a potential uptrend in the making.

Despite enduring a relative setback compared to the S&P 500 over the past two years, Northrop Grumman’s resilience shines through. Continued bullish earnings estimate revisions could pave the way for a remarkable turnaround in the fortunes of NOC shares.

The Value of Dividends Amidst Market Swells

Dividends aren’t just monetary rewards; they act as lifeboats during market downturns, offering investors an alternate avenue for returns. By reinvesting dividends, investors can maximize their gains and weather the storm of market volatility. The recent dividend boosts from Advanced Drainage Systems, Taiwan Semiconductor, and Northrop Grumman underscore a commitment to shareholder value and financial fortitude in uncertain times.