If you fancy dabbling in individual stocks and exchange-traded funds (ETFs), chances are you’ve crossed paths with Vanguard, an investment powerhouse of global proportions.

Vanguard boasts ETFs with mere 0.1% annual fees across all 11 S&P 500 sectors. This year, the Vanguard Communication Services ETF (NYSEMKT: VOX) stands out, flaunting an impressive 13.6% surge in recent times.

Discover the reasons behind the fund’s stellar performance and why it might just be the right buy for you.

Image source: Getty Images.

Technological Tumult: Reshaping the Communications Sector

Amid the various sectors in the market, communications stands as arguably the one most rattled by technological upheavals in recent decades. The surge in mobile phone ubiquity has thrust phone carriers and internet providers like Verizon, AT&T, and T-Mobile into the spotlight.

The shift from traditional cable TV to the streaming realm has rendered Netflix nearly double the worth of Comcast. Enterprises like Roku have revolutionized the TV domain by prioritizing the integration of diverse streaming and media applications over traditional channels or stations.

The advent of cloud-based advertising has catapulted The Trade Desk into an incredibly vital marketing ally.

The grandest evolution has seen the transition from print to digital and social media, from newspapers to smartphones, and from voluminous physical documents and fax machines to centralized data centers and cloud infrastructures.

These themes have upheaved the communications domain, infusing it with abundant growth opportunities.

Gargantuan Growth on the Cheap

Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) and Meta Platforms (NASDAQ: META) together make up a staggering 45% of the Vanguard Communication Services ETF. But this wasn’t always the case.

ETFs rebalance their weightings to accommodate shifts in market capitalization. This adjustment has created a more top-heavy communications sector where giants like Alphabet and Meta Platforms hold significant sway, leaving smaller companies doubling their value and still fetching a mere 1 or 2 percentage points.

What renders the communications sector enticing is its blend of burgeoning, fast-growing firms with established pillars — many of which offer substantial dividends. Surprisingly, the Vanguard Communications Services ETF boasts a 22.1 price-to-earnings ratio and a 1% yield, significantly lower than the Vanguard Information Technology ETF’s 40.4 P/E ratio.

Despite hovering near all-time peaks, Alphabet and Meta Platforms trade at bargain prices, each below 24 forward P/E ratios. This places them as the two most inexpensively valued “Magnificent Seven” stocks based on this metric.

GOOGL PE Ratio (Forward) data by YCharts

Combine the reasonable valuation of the top two growth holdings with the value orientation of cell carriers, cable operators, telecom companies, and other entities, and you get a sector that artfully blends growth, value, and income unlike any other.

An Equilibrated ETF Beckons

The Vanguard Communications Services ETF has leaped an eye-popping 62.6% since 2023 began, majorly propelled by sweeping gains from Alphabet, Meta Platforms, and Netflix. Such rapid growth in a short span could potentially set the stage for volatility or even an ETF sell-off. Nevertheless, valuations stay attractive, with earnings growth ringing exceptional.

The likes of artificial intelligence, virtual reality, augmented reality, and the metaverse linger in their infancy but promise to stir cascading reverberations across the communications realm for eons.

Overall, the Vanguard Communications Services ETF persists as the simplest gateway to plunge into the forthcoming evolution of information dissemination and media consumption.

2>An ETF Opportunity to Seize Now

Before diving into Vanguard World Fund – Vanguard Communication Services ETF stock, ponder this:

The Motley Fool Stock Advisor team has just pinpointed what they reckon are the 10 best stocks for investors to snap up right now… and Vanguard World Fund – Vanguard Communication Services indeed nabs a spot on that prestigious list.

The Incredible Potential of Stock Picks Unveiled

A Journey Through Unparalleled Wealth Creation Opportunities

Imagine a world where a simple investment of $1,000 could blossom into a staggering $697,878. This utopian financial realm may sound like a far-fetched dream, yet Stock Advisor guides investors along this magical path to wealth creation.

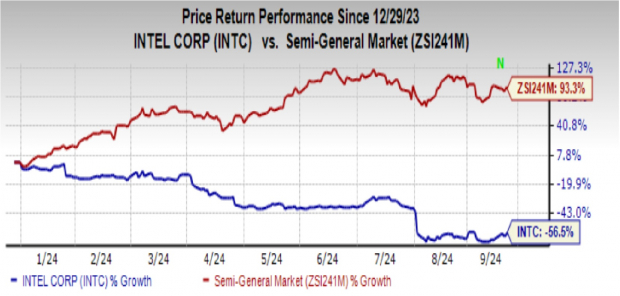

The Nvidia Phenomenon: From Obscurity to Remarkable Riches

Travel back to April 15, 2005—a time where Nvidia was a mere whisper in the cacophony of stock market chatter. Fast forward to today, and if you had heeded the advice on that fateful day and invested $1,000, your coffers would now overflow with close to seven hundred thousand dollars. A story of rags to riches, of ordinary dollars metamorphosing into extraordinary treasures.

Stock Advisor – The Beacon of Financial Enlightenment

Within the tumultuous seas of the stock market, Stock Advisor stands as a guiding light for investors—an illuminating blueprint for success. It offers a compass to navigate the choppy waters of stock selection, providing regular updates from seasoned analysts and unveiling two new stock picks each month. This beacon has outshone the S&P 500 since 2002, more than quadrupling its returns, setting it miles apart in the galaxy of investment guidance.

Discover the 10 Stocks Holding the Key to your Financial Future »

*Stock Advisor returns as of May 28, 2024