The Divergence in Performance

Over the past year, Apple and Nvidia have ridden on different waves of fortune. Nvidia, a standout performer among the “Magnificent 7” stocks in 2023, has managed to retain its crown into 2024. On the other hand, Apple, despite its 49% gain last year, struggled to keep up, being the second lowest performer among the elite group this year.

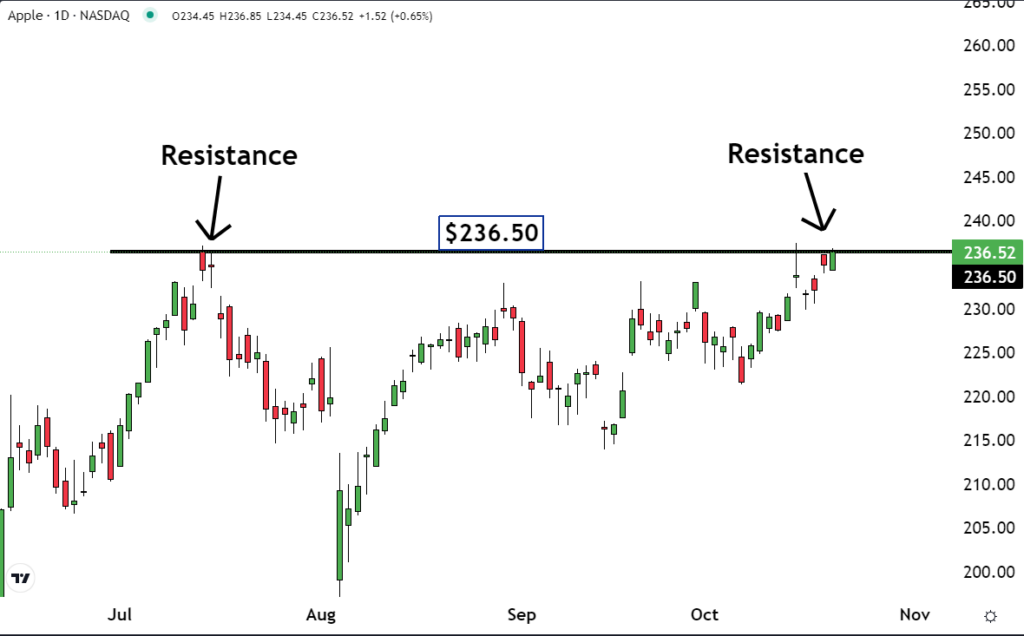

While Apple has shown signs of recovery from its 2024 lows, the stock’s year-to-date performance remains lackluster with a marginal increase of less than 1% at the latest close. Nvidia’s market cap even threatened to surpass Apple at one point, highlighting the shifting tides in the tech industry.

Understanding the Divergence

Stock performance is a reflection of a company’s earnings and growth prospects. Apple faced a challenging year with YoY revenue declines in all four quarters, especially struggling with slowing iPhone sales in key markets like China. On the other hand, Nvidia’s revenue soared by 126% in the last fiscal year, showcasing its remarkable growth trajectory.

The heart of Nvidia’s success lies in its strong foothold in AI spending, with analysts predicting a staggering $119 billion in revenues for the current fiscal year – a significant leap from previous years. In contrast, Apple’s revenue growth is expected to be modest in comparison.

Apple’s AI Lag

Nvidia’s dominance in AI was evident early on, whereas Apple was perceived as lagging in this space. Apple’s focus on AI only seemed to materialize during the fiscal Q1 2025 earnings call, with CEO Tim Cook finally shedding light on the company’s ambitions in generative AI.

Despite late entry, Cook expressed optimism about Apple’s prospects in AI, emphasizing the transformative power of the technology and the company’s unique advantages in this domain.

The Better Buy: Apple or Nvidia?

Gene Munster, managing partner at Deepwater Asset Management, favors Apple over Nvidia in the coming year. While acknowledging Nvidia CEO Jensen Huang’s AI prowess, Munster believes investors are underestimating Apple’s potential in the AI landscape.

Analyst Projections: AAPL vs. NVDA

Analysts exhibit a higher bullish sentiment towards Nvidia, with the stock receiving a consensus “Strong Buy” rating from over 92% of analysts covering it. In contrast, Apple’s rating stands at a “Moderate Buy,” with mixed opinions from analysts.

Interestingly, Nvidia’s current trading performance aligns closely with its mean target price. In comparison, Apple still has room for growth, with its mean target price indicating a potential 6.1% increase from the latest closing price.

Predicting the Future

While some analysts share Munster’s optimism about Apple’s AI prospects, others like JP Morgan’s Samik Chatterjee foresee a groundbreaking phase similar to the 5G iPhone upgrade cycle. Apple’s participation in events like the Worldwide Developers Conference may herald new product offerings that leverage generative AI, potentially boosting hardware sales.

Despite differing perspectives, considering Nvidia’s lofty valuations, investing in Apple might offer more room for growth in the near to medium term.