Investor Interest in Alibaba

Alibaba Group Holding Limited (BABA) has recently been under the financial microscope, catching the eye of investors scouring Zacks.com for insights. With a backdrop of a -0.9% return over the past month while the Zacks S&P 500 composite glided +4.1%, Alibaba’s presence in the Zacks Internet – Commerce industry where it belongs, gaining 4.8% during the same period, beckons a closer examination.

The Power of Earnings Estimates

Media speculation may sway the market temporarily, but nothing steers the ship like a company’s earnings projections. Here at Zacks, we hold a strong conviction that a company’s stock value hinges on its anticipated future earnings. Analysts tweaking earnings estimates indicate a stock’s fair value, sparking investment interest should estimates rise. Consequently, there exists a notable correlation between earnings forecast revisions and short-term stock movements.

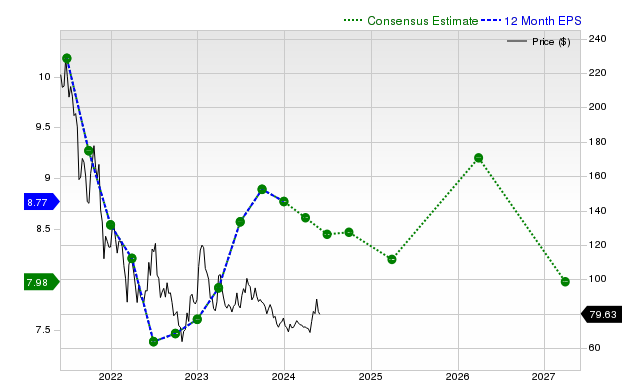

Alibaba’s Q1 projected earnings sit at $2.24 per share, showcasing a -6.7% variance from the previous year. Meanwhile, the current fiscal year anticipates earnings of $8.20 per share, signaling a -4.9% change. Looking ahead, the subsequent fiscal year might see Alibaba reporting earnings of $9.20, reflecting a potential +12.2% deviation.

The Zacks Rank #3 (Hold) bestowed upon Alibaba serves as a nod to the recent amendments in consensus estimates affirming potential future trends.

Forecasted Revenue Growth

While earnings growth stands as a pillar of a company’s financial landscape, revenue expansion forms its cornerstone. Without an uptick in revenue, sustained earnings growth remains improbable. Alibaba’s prospects look optimistic, with sales estimates for the current quarter at $34.95 billion, signalling an +8.2% year-over-year increase. Estimations for the current and subsequent fiscal years indicate +6.2% and +7.4% growth, reaching $138.63 billion and $148.86 billion, respectively.

Reviewing Historical Performance and Valuation

Alibaba’s last reported revenue totaled $30.73 billion, marking a +1.4% uptick from the previous year, with EPS at $1.40. The earnings surprise stands at +12.9%, indicating a track record of outperforming market projections.

An assessment of a stock’s valuation snapshot aids in strategic investment decisions. Alibaba’s A-grade valuation reflects an undervalued position compared to its peers, highlighting a promising outlook.

Concluding Thoughts

Delving into Alibaba’s performance metrics, coupled with data-driven insights from Zacks.com, may unveil the potential beneath the market chatter. Despite the Zacks Rank #3 signaling balanced performance vis-a-vis the general market, Alibaba’s strong valuation metrics underpin a compelling investment perspective that investors shouldn’t overlook.